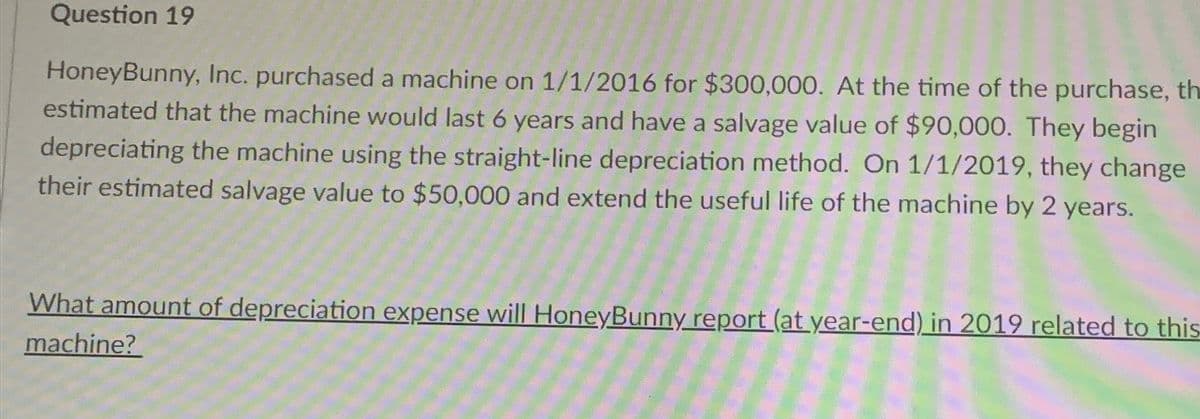

Question 19 HoneyBunny, Inc. purchased a machine on 1/1/2016 for $300,000. At the time of the purchase, th estimated that the machine would last 6 years and have a salvage value of $90,000. They begin depreciating the machine using the straight-line depreciation method. On 1/1/2019, they change their estimated salvage value to $50,000 and extend the useful life of the machine by 2 years. What amount of depreciation expense will HoneyBunny report (at year-end) in 2019 related to this machine?

Question 19 HoneyBunny, Inc. purchased a machine on 1/1/2016 for $300,000. At the time of the purchase, th estimated that the machine would last 6 years and have a salvage value of $90,000. They begin depreciating the machine using the straight-line depreciation method. On 1/1/2019, they change their estimated salvage value to $50,000 and extend the useful life of the machine by 2 years. What amount of depreciation expense will HoneyBunny report (at year-end) in 2019 related to this machine?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.5E: Change in Estimate Assume that Bloomer Company purchased a new machine on January 1, 2016, for...

Related questions

Question

Transcribed Image Text:Question 19

HoneyBunny, Inc. purchased a machine on 1/1/2016 for $300,000. At the time of the purchase, th

estimated that the machine would last 6 years and have a salvage value of $90,000. They begin

depreciating the machine using the straight-line depreciation method. On 1/1/2019, they change

their estimated salvage value to $50,000 and extend the useful life of the machine by 2 years.

What amount of depreciation expense will HoneyBunny report (at year-end) in 2019 related to this

machine?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College