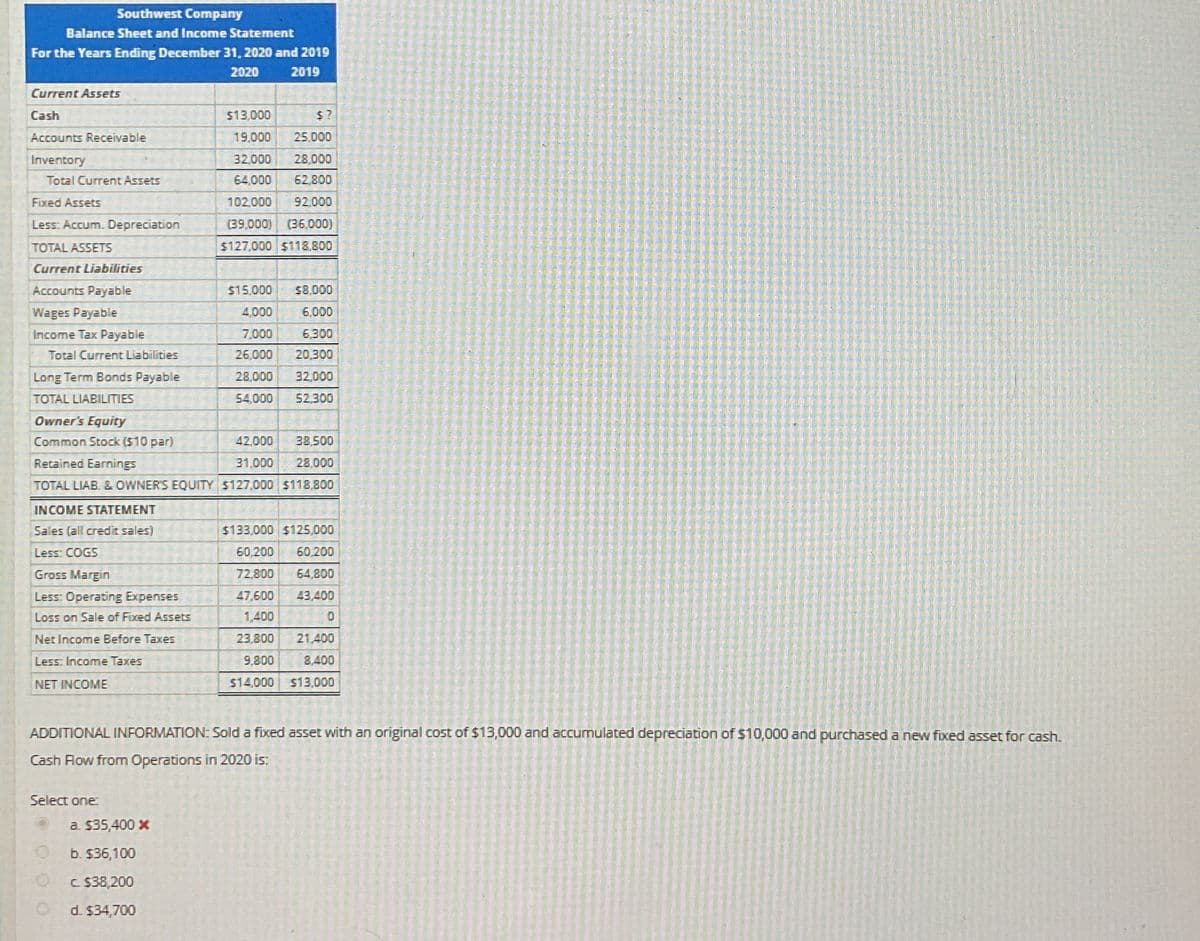

Southwest Company Balance Sheet and Income Statement For the Years Ending December 31, 2020 and 2019 2020 2019 Current Assets Cash $13,000 $? Accounts Receivable 19.000 25.000 Inventory 32,000 28,000 Total Current Assets 64,000 62,800 Fixed Assets 102,000 92,000 Less: Accum. Depreciation (39,000) (36,000) TOTAL ASSETS $127,000 $118.800 Current Liabilities Accounts Payable Wages Payable Income Tax Payable Total Current Liabilities Long Term Bonds Payable TOTAL LIABILITIES Owner's Equity $15,000 $8.000 4,000 6.000 7,000 6.300 26,000 20.300 28,000 32,000 54,000 52.300 Common Stock ($10 par) 42,000 38.500 31,000 28,000 Retained Earnings TOTAL LIAB. & OWNER'S EQUITY $127,000 $118.800 INCOME STATEMENT Sales (all credit sales) $133,000 $125,000 Less: COGS 60.200 60,200 Gross Margin 72,800 64,800 Less: Operating Expenses 47,600 43,400 Loss on Sale of Fixed Assets 1,400 0 Net Income Before Taxes 23,800 21,400 Less: Income Taxes 9,800 8.400 NET INCOME $14,000 $13,000 ADDITIONAL INFORMATION: Sold a fixed asset with an original cost of $13,000 and accumulated depreciation of $10,000 and purchased a new fixed asset for cash. Cash Flow from Operations in 2020 is: Select one: a. $35,400 x b. $36,100 c. $38,200 d. $34,700

Southwest Company Balance Sheet and Income Statement For the Years Ending December 31, 2020 and 2019 2020 2019 Current Assets Cash $13,000 $? Accounts Receivable 19.000 25.000 Inventory 32,000 28,000 Total Current Assets 64,000 62,800 Fixed Assets 102,000 92,000 Less: Accum. Depreciation (39,000) (36,000) TOTAL ASSETS $127,000 $118.800 Current Liabilities Accounts Payable Wages Payable Income Tax Payable Total Current Liabilities Long Term Bonds Payable TOTAL LIABILITIES Owner's Equity $15,000 $8.000 4,000 6.000 7,000 6.300 26,000 20.300 28,000 32,000 54,000 52.300 Common Stock ($10 par) 42,000 38.500 31,000 28,000 Retained Earnings TOTAL LIAB. & OWNER'S EQUITY $127,000 $118.800 INCOME STATEMENT Sales (all credit sales) $133,000 $125,000 Less: COGS 60.200 60,200 Gross Margin 72,800 64,800 Less: Operating Expenses 47,600 43,400 Loss on Sale of Fixed Assets 1,400 0 Net Income Before Taxes 23,800 21,400 Less: Income Taxes 9,800 8.400 NET INCOME $14,000 $13,000 ADDITIONAL INFORMATION: Sold a fixed asset with an original cost of $13,000 and accumulated depreciation of $10,000 and purchased a new fixed asset for cash. Cash Flow from Operations in 2020 is: Select one: a. $35,400 x b. $36,100 c. $38,200 d. $34,700

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.3C

Related questions

Question

A7

Transcribed Image Text:Southwest Company

Balance Sheet and Income Statement

For the Years Ending December 31, 2020 and 2019

2020

2019

Current Assets

Cash

$13,000

$?

Accounts Receivable

19.000 25.000

Inventory

32,000

28,000

Total Current Assets

64,000 62,800

Fixed Assets

102,000 92,000

Less: Accum. Depreciation

(39,000) (36,000)

TOTAL ASSETS

$127,000 $118.800

Current Liabilities

Accounts Payable

Wages Payable

Income Tax Payable

Total Current Liabilities

Long Term Bonds Payable

TOTAL LIABILITIES

Owner's Equity

$15,000 $8.000

4,000

6.000

7,000

6.300

26,000 20.300

28,000 32,000

54,000 52.300

Common Stock ($10 par)

42,000 38.500

31,000 28,000

Retained Earnings

TOTAL LIAB. & OWNER'S EQUITY $127,000 $118.800

INCOME STATEMENT

Sales (all credit sales)

$133,000 $125,000

Less: COGS

60.200 60,200

Gross Margin

72,800 64,800

Less: Operating Expenses

47,600 43,400

Loss on Sale of Fixed Assets

1,400

0

Net Income Before Taxes

23,800

21,400

Less: Income Taxes

9,800

8.400

NET INCOME

$14,000 $13,000

ADDITIONAL INFORMATION: Sold a fixed asset with an original cost of $13,000 and accumulated depreciation of $10,000 and purchased a new fixed asset for cash.

Cash Flow from Operations in 2020 is:

Select one:

a. $35,400 x

b. $36,100

c. $38,200

d. $34,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning