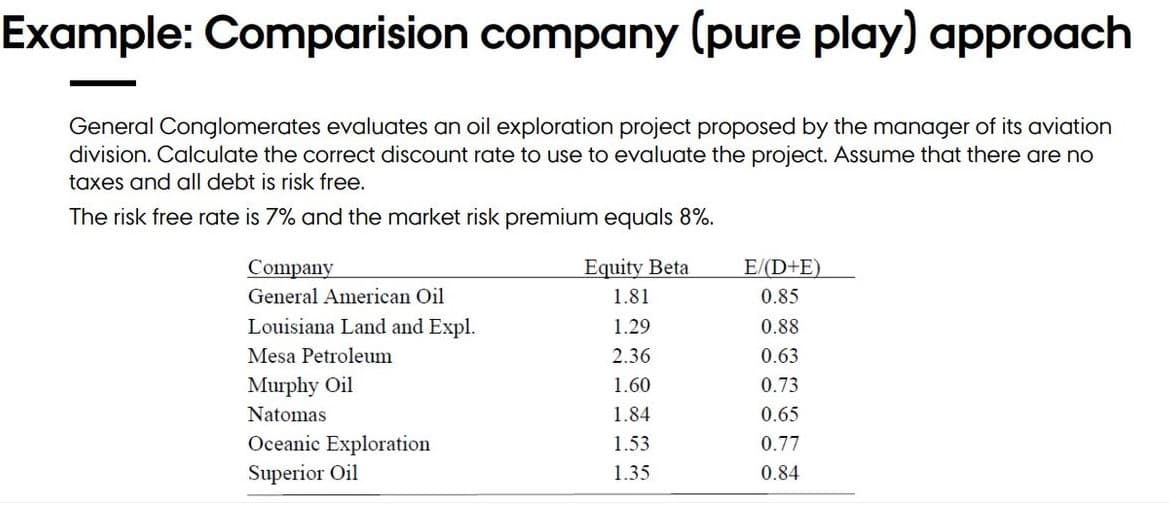

Example: Comparision company (pure play) approach General Conglomerates evaluates an oil exploration project proposed by the manager of its aviation division. Calculate the correct discount rate to use to evaluate the project. Assume that there are no taxes and all debt is risk free. The risk free rate is 7% and the market risk premium equals 8%. Company General American Oil Louisiana Land and Expl. Mesa Petroleum Murphy Oil Natomas Oceanic Exploration Superior Oil Equity Beta 1.81 1.29 2.36 1.60 1.84 1.53 1.35 E/(D+E) 0.85 0.88 0.63 0.73 0.65 0.77 0.84

Example: Comparision company (pure play) approach General Conglomerates evaluates an oil exploration project proposed by the manager of its aviation division. Calculate the correct discount rate to use to evaluate the project. Assume that there are no taxes and all debt is risk free. The risk free rate is 7% and the market risk premium equals 8%. Company General American Oil Louisiana Land and Expl. Mesa Petroleum Murphy Oil Natomas Oceanic Exploration Superior Oil Equity Beta 1.81 1.29 2.36 1.60 1.84 1.53 1.35 E/(D+E) 0.85 0.88 0.63 0.73 0.65 0.77 0.84

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 18P

Related questions

Question

How is GEneral Conglomerates levered beta assumed to be 1.40?

Can you show the calculation

Transcribed Image Text:Example: Comparision company (pure play) approach

General Conglomerates evaluates an oil exploration project proposed by the manager of its aviation

division. Calculate the correct discount rate to use to evaluate the project. Assume that there are no

taxes and all debt is risk free.

The risk free rate is 7% and the market risk premium equals 8%.

Equity Beta

E/(D+E)

Company

General American Oil

1.81

0.85

Louisiana Land and Expl.

1.29

0.88

Mesa Petroleum

2.36

0.63

Murphy Oil

1.60

0.73

Natomas

1.84

0.65

Oceanic Exploration

1.53

0.77

Superior Oil

1.35

0.84

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning