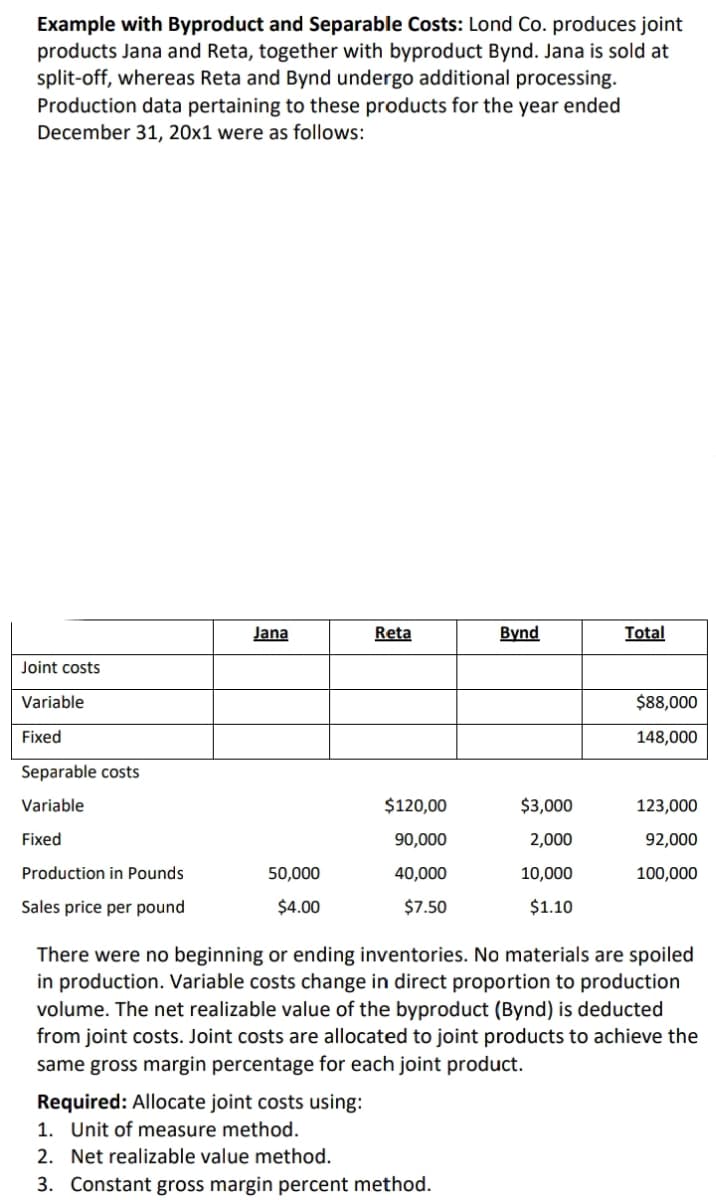

Example with Byproduct and Separable Costs: Lond Co. produces joint products Jana and Reta, together with byproduct Bynd. Jana is sold at split-off, whereas Reta and Bynd undergo additional processing. Production data pertaining to these products for the year ended December 31, 20x1 were as follows: Jana Reta Bynd Total Joint costs Variable $88,000 Fixed 148,000 Separable costs Variable $120,00 $3,000 123,000 Fixed 90,000 2,000 92,000 Production in Pounds 50,000 40,000 10,000 100,000 Sales price per pound $4.00 $7.50 $1.10 There were no beginning or ending inventories. No materials are spoiled in production. Variable costs change in direct proportion to production volume. The net realizable value of the byproduct (Bynd) is deducted from joint costs. Joint costs are allocated to joint products to achieve the same gross margin percentage for each joint product. Required: Allocate joint costs using: 1. Unit of measure method. 2. Net realizable value method. 3. Constant gross margin percent method.

Example with Byproduct and Separable Costs: Lond Co. produces joint products Jana and Reta, together with byproduct Bynd. Jana is sold at split-off, whereas Reta and Bynd undergo additional processing. Production data pertaining to these products for the year ended December 31, 20x1 were as follows: Jana Reta Bynd Total Joint costs Variable $88,000 Fixed 148,000 Separable costs Variable $120,00 $3,000 123,000 Fixed 90,000 2,000 92,000 Production in Pounds 50,000 40,000 10,000 100,000 Sales price per pound $4.00 $7.50 $1.10 There were no beginning or ending inventories. No materials are spoiled in production. Variable costs change in direct proportion to production volume. The net realizable value of the byproduct (Bynd) is deducted from joint costs. Joint costs are allocated to joint products to achieve the same gross margin percentage for each joint product. Required: Allocate joint costs using: 1. Unit of measure method. 2. Net realizable value method. 3. Constant gross margin percent method.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 10CE: A company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each...

Related questions

Question

Transcribed Image Text:Example with Byproduct and Separable Costs: Lond Co. produces joint

products Jana and Reta, together with byproduct Bynd. Jana is sold at

split-off, whereas Reta and Bynd undergo additional processing.

Production data pertaining to these products for the year ended

December 31, 20x1 were as follows:

Jana

Reta

Bynd

Total

Joint costs

Variable

$88,000

Fixed

148,000

Separable costs

Variable

$120,00

$3,000

123,000

Fixed

90,000

2,000

92,000

Production in Pounds

50,000

40,000

10,000

100,000

Sales price per pound

$4.00

$7.50

$1.10

There were no beginning or ending inventories. No materials are spoiled

in production. Variable costs change in direct proportion to production

volume. The net realizable value of the byproduct (Bynd) is deducted

from joint costs. Joint costs are allocated to joint products to achieve the

same gross margin percentage for each joint product.

Required: Allocate joint costs using:

1. Unit of measure method.

2. Net realizable value method.

3. Constant gross margin percent method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning