Exercise 1-25 (Algo) Analyzing return on assets LO A2 Świss Group reports net income of $25,000 for the year. At the beginning of the year, Swiss Group had $185,000 in assets. By the end of the year, assets had grown to $235,000. What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if competitors average an 7% return on assets? Complete this question by enterlng your answers In the tabs below. Return on Group Perform Assets What is Swiss Group's return on assets for the current year? Numerator: Denominator: Return on assets %3D Group Perform >

Exercise 1-25 (Algo) Analyzing return on assets LO A2 Świss Group reports net income of $25,000 for the year. At the beginning of the year, Swiss Group had $185,000 in assets. By the end of the year, assets had grown to $235,000. What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if competitors average an 7% return on assets? Complete this question by enterlng your answers In the tabs below. Return on Group Perform Assets What is Swiss Group's return on assets for the current year? Numerator: Denominator: Return on assets %3D Group Perform >

Chapter2: Analysis Of Financial Statements

Section: Chapter Questions

Problem 20PROB

Related questions

Question

I need help with this

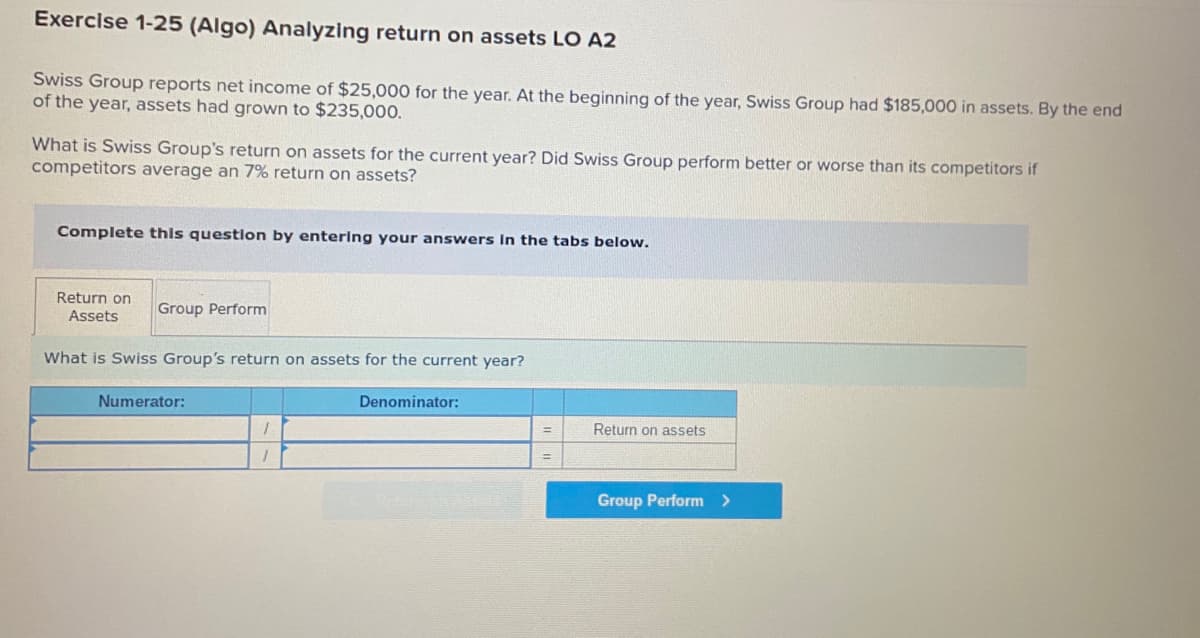

Transcribed Image Text:Exercise 1-25 (Algo) Analyzing return on assets LO A2

Swiss Group reports net income of $25,000 for the year. At the beginning of the year, Swiss Group had $185,000 in assets. By the end

of the year, assets had grown to $235,000.

What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if

competitors average an 7% return on assets?

Complete this question by entering your answers In the tabs below.

Return on

Assets

Group Perform

What is Swiss Group's return on assets for the current year?

Numerator:

Denominator:

Return on assets

Group Perform >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning