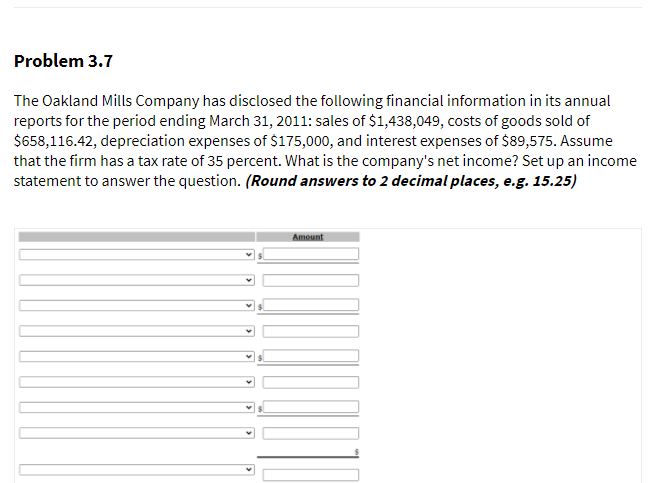

Problem 3.7 The Oakland Mills Company has disclosed the following financial information in its annual reports for the period ending March 31, 2011: sales of $1,438,049, costs of goods sold of $658,116.42, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has a tax rate of 35 percent. What is the company's net income? Set up an income statement to answer the question. (Round answers to 2 decimal places, e.g. 15.25) Amount

Problem 3.7 The Oakland Mills Company has disclosed the following financial information in its annual reports for the period ending March 31, 2011: sales of $1,438,049, costs of goods sold of $658,116.42, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has a tax rate of 35 percent. What is the company's net income? Set up an income statement to answer the question. (Round answers to 2 decimal places, e.g. 15.25) Amount

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.4.1MBA: Return on assets The following data (in millions) were adapted from recent financial statements of...

Related questions

Question

Transcribed Image Text:Problem 3.7

The Oakland Mills Company has disclosed the following financial information in its annual

reports for the period ending March 31, 2011: sales of $1,438,049, costs of goods sold of

$658,116.42, depreciation expenses of $175,000, and interest expenses of $89,575. Assume

that the firm has a tax rate of 35 percent. What is the company's net income? Set up an income

statement to answer the question. (Round answers to 2 decimal places, e.g. 15.25)

Amount

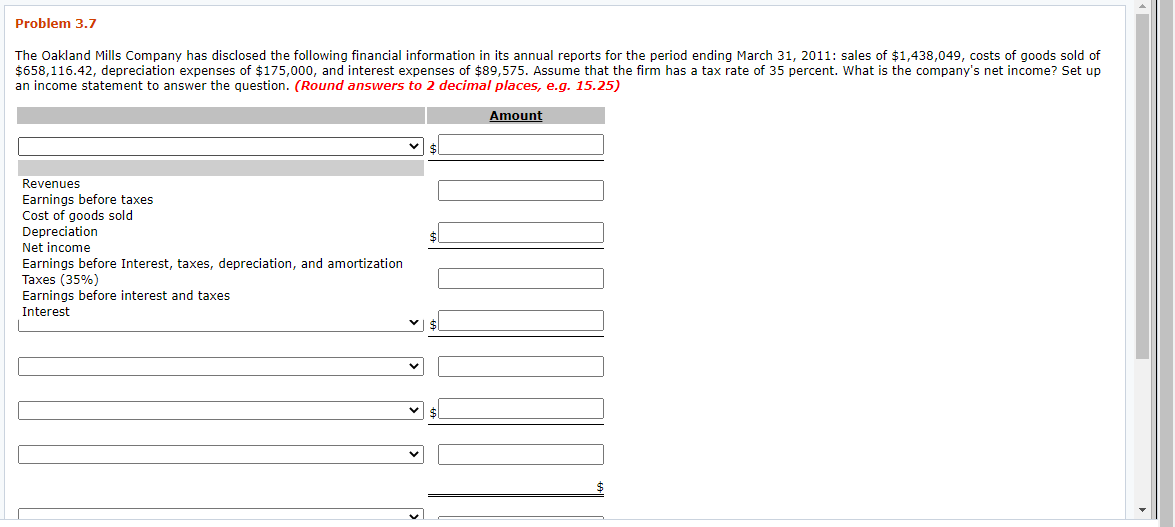

Transcribed Image Text:Problem 3.7

The Oakland Mills Company has disclosed the following financial information in its annual reports for the period ending March 31, 2011: sales of $1,438,049, costs of goods sold of

$658,116.42, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has a tax rate of 35 percent. What is the company's net income? Set up

an income statement to answer the question. (Round answers to 2 decimal places, e.g. 15.25)

Amount

Revenues

Earnings before taxes

Cost of goods sold

Depreciation

Net income

$1

Earnings before Interest, taxes, depreciation, and amortization

Taxes (35%)

Earnings before interest and taxes

Interest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning