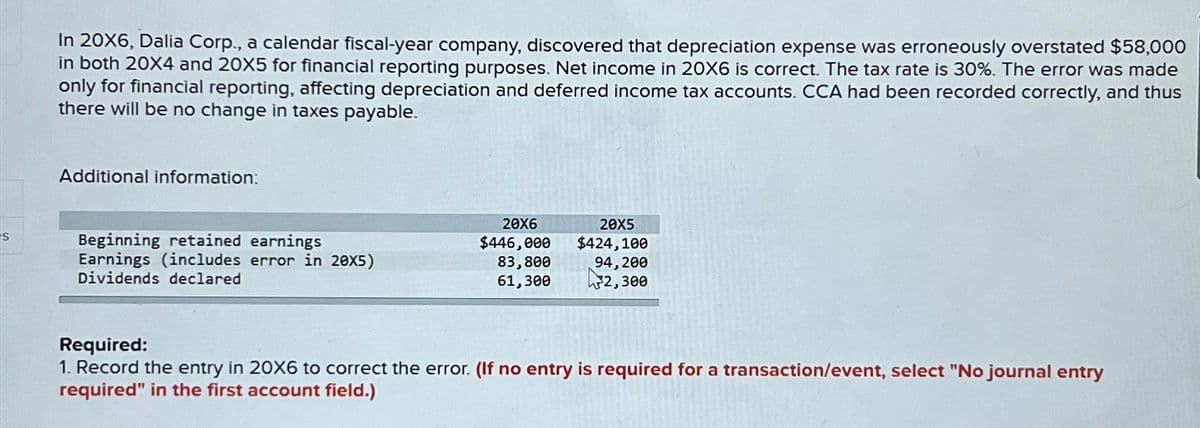

In 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $58,000 in both 20X4 and 20X5 for financial reporting purposes. Net income in 20X6 is correct. The tax rate is 30%. The error was made only for financial reporting, affecting depreciation and deferred income tax accounts. CCA had been recorded correctly, and thus there will be no change in taxes payable. Additional information: 20X6 S Beginning retained earnings $446,000 20X5 $424,100 Earnings (includes error in 20x5) Dividends declared 83,800 61,300 94,200 2,300 Required: 1. Record the entry in 20X6 to correct the error. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

In 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $58,000 in both 20X4 and 20X5 for financial reporting purposes. Net income in 20X6 is correct. The tax rate is 30%. The error was made only for financial reporting, affecting depreciation and deferred income tax accounts. CCA had been recorded correctly, and thus there will be no change in taxes payable. Additional information: 20X6 S Beginning retained earnings $446,000 20X5 $424,100 Earnings (includes error in 20x5) Dividends declared 83,800 61,300 94,200 2,300 Required: 1. Record the entry in 20X6 to correct the error. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 3BCRQ

Related questions

Question

Transcribed Image Text:In 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $58,000

in both 20X4 and 20X5 for financial reporting purposes. Net income in 20X6 is correct. The tax rate is 30%. The error was made

only for financial reporting, affecting depreciation and deferred income tax accounts. CCA had been recorded correctly, and thus

there will be no change in taxes payable.

Additional information:

20X6

S

Beginning retained earnings

$446,000

20X5

$424,100

Earnings (includes error in 20x5)

Dividends declared

83,800

61,300

94,200

2,300

Required:

1. Record the entry in 20X6 to correct the error. (If no entry is required for a transaction/event, select "No journal entry

required" in the first account field.)

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning