Amizone Q6 Odd Lid acquired the entire oquity shao capital of Evon Ltd on 1st January 2019 for a consideration of Rs 600 million Al the time of acqurtion, the share capitai of Even Lid consisted of 20 milion oqaty shares of Rs 10 each The company had reserve and surpks amounting to Rs 560 milon The Balance Sheets of the two companies as on 31st March, 2019 are given below Odd Lid. (Rs. In million) Even Ltd. (Rs. In million) Liabilities: Share Capital Reserve and Suplus Loan Funds Creditors 500 200 2540 750 1400 680 3030 3200 1650 Total 7890 Assets: FIxed Assets Investments Inventones Debtors Loans and Advances Other Assets Total 1430 650 630 2580 925 100 320 560 1260 1340 7890 165 960 3030 Additional Information: 1. Even Lid borrowed Rs 1000 milion from Odd Ltd on 1st April 2019 at 10% per annum The loan amount and interest thereon are due to be paid 2 Odd Lid bought goods from Even Lid for Rs 200 million during the yoar. Even Lid charged a margin of 25% on cost Out of these goods, 1/4th is still unsold 3. The debtors for Even Lid incude an amount of Rs. 140 milion receivables from Odd Lid You are required to prepare consolidated balance sheet.

Amizone Q6 Odd Lid acquired the entire oquity shao capital of Evon Ltd on 1st January 2019 for a consideration of Rs 600 million Al the time of acqurtion, the share capitai of Even Lid consisted of 20 milion oqaty shares of Rs 10 each The company had reserve and surpks amounting to Rs 560 milon The Balance Sheets of the two companies as on 31st March, 2019 are given below Odd Lid. (Rs. In million) Even Ltd. (Rs. In million) Liabilities: Share Capital Reserve and Suplus Loan Funds Creditors 500 200 2540 750 1400 680 3030 3200 1650 Total 7890 Assets: FIxed Assets Investments Inventones Debtors Loans and Advances Other Assets Total 1430 650 630 2580 925 100 320 560 1260 1340 7890 165 960 3030 Additional Information: 1. Even Lid borrowed Rs 1000 milion from Odd Ltd on 1st April 2019 at 10% per annum The loan amount and interest thereon are due to be paid 2 Odd Lid bought goods from Even Lid for Rs 200 million during the yoar. Even Lid charged a margin of 25% on cost Out of these goods, 1/4th is still unsold 3. The debtors for Even Lid incude an amount of Rs. 140 milion receivables from Odd Lid You are required to prepare consolidated balance sheet.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 2E

Related questions

Question

Show your work

Transcribed Image Text:Google

Amizone

Am

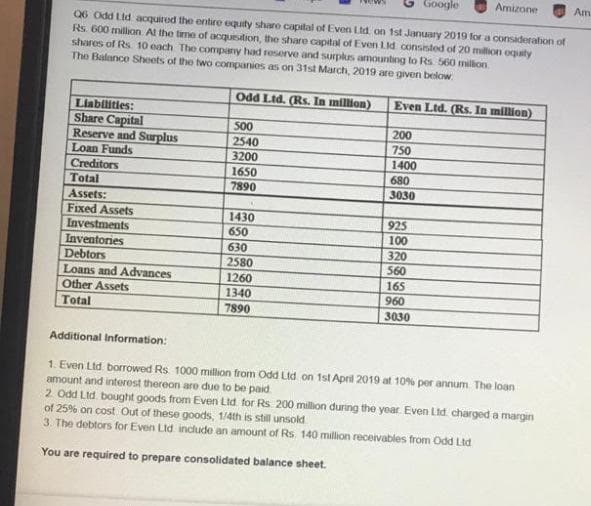

Q6 Odd Lld acquired the entire equity sharo capital of Even Ltd on 1st January 2019 for a consideration of

Rs. 600 million Al the time of acqusition, the share capital of Even Lid consisted of 20 million oquty

shares of Rs 10 each The company had reserve and surplus amounting to Rs 560 milion

The Balance Sheets of the two companies as on 31st March, 2019 are given below

Odd Lid. (Rs. In million)

Even Ltd. (Rs. In million)

Liabilities:

Share Capital

Reserve and Surplus

Loan Funds

500

2540

3200

200

750

1400

Creditors

Total

1650

7890

680

3030

Assets:

Fixed Assets

Investments

Inventories

1430

650

925

100

630

2580

1260

320

560

Debtors

Loans and Advances

Other Assets

1340

7890

165

960

3030

Total

Additional Information:

1. Even Ltd borTowed Rs 1000 million from Odd Ltd on 1st April 2019 at 10% per annum. The loan

amount and interest thereon are due to be paid.

2 Odd Ltd. bought goods from Even Ltd for Rs 200 million during the year. Even Lid charged a margin

of 25% on cost Out of these goods, 1/4th is still unsold

3. The debtors for Even Ltd include an amount of Rs. 140 million receivables from Odd Ltd

You are required to prepare consolidated balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning