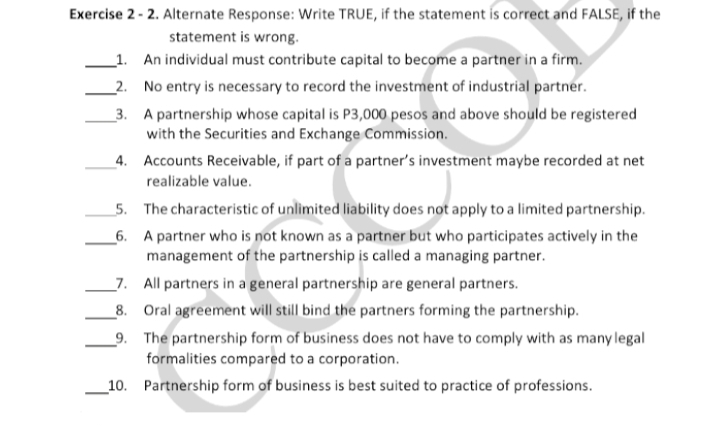

Exercise 2-2. Alternate Response: Write TRUE, if the statement is correct and FALS statement is wrong. 1. An individual must contribute capital to become a partner in a firm. 2. No entry is necessary to record the investment of industrial partner. 3. A partnership whose capital is P3,000 pesos and above should be regist with the Securities and Exchange Commission. 4. Accounts Receivable, if part of a partner's investment maybe recorded realizable value. 5. The characteristic of unlimited liability does not apply to a limited partne 99 6. A partner who is not known as a partner but who participates actively in management of the partnership is called a managing partner.

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Step by step

Solved in 2 steps