Santana Rey is considering the purchase of equipment for Busin company to add a new product to its computer furniture line. The $366,240 and to have a six-year life and no salvage value. The e income of $15,039 and net cash flow of $76,836 in each year of an 8% return on all investments. (PV of $1, FV of $1, PVA of $1, an factor(s) from the tables provided.) (Negative net present valu minus sign. Do not round intermediate calculations. Round you

Santana Rey is considering the purchase of equipment for Busin company to add a new product to its computer furniture line. The $366,240 and to have a six-year life and no salvage value. The e income of $15,039 and net cash flow of $76,836 in each year of an 8% return on all investments. (PV of $1, FV of $1, PVA of $1, an factor(s) from the tables provided.) (Negative net present valu minus sign. Do not round intermediate calculations. Round you

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter26: Capital Budgeting (capbud)

Section: Chapter Questions

Problem 1R

Related questions

Question

please note there are several required answers

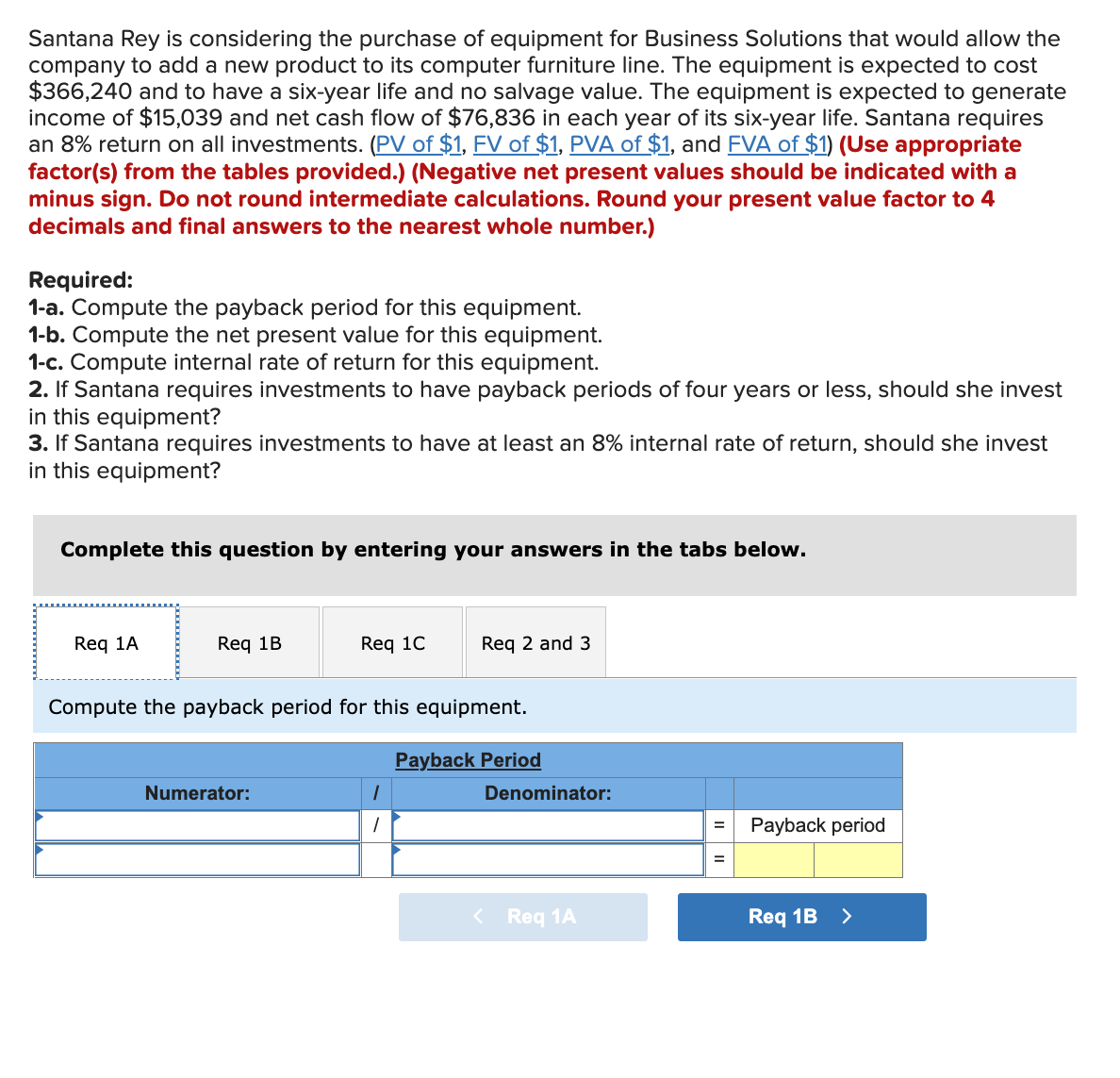

Transcribed Image Text:Santana Rey is considering the purchase of equipment for Business Solutions that would allow the

company to add a new product to its computer furniture line. The equipment is expected to cost

$366,240 and to have a six-year life and no salvage value. The equipment is expected to generate

income of $15,039 and net cash flow of $76,836 in each year of its six-year life. Santana requires

an 8% return on all investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate

factor(s) from the tables provided.) (Negative net present values should be indicated with a

minus sign. Do not round intermediate calculations. Round your present value factor to 4

decimals and final answers to the nearest whole number.)

Required:

1-a. Compute the payback period for this equipment.

1-b. Compute the net present value for this equipment.

1-c. Compute internal rate of return for this equipment.

2. If Santana requires investments to have payback periods of four years or less, should she invest

in this equipment?

3. If Santana requires investments to have at least an 8% internal rate of return, should she invest

in this equipment?

Complete this question by entering your answers in the tabs below.

Req 1A

Req 1B

Req 1C

Numerator:

Compute the payback period for this equipment.

Req 2 and 3

1

Payback Period

Denominator:

< Req 1A

=

=

Payback period

Req 1B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning