Exercise 2-6 Your analysis of Accounts Receivable carried at P2,406,750 on Dec. 31, 2019 shows the following: a. P1,496,832 Debit balance in accounts with customers broken down as: 1. Installment account sales, 2015 2. Installment account sales, 2016 3. Installment account sales, 2017 4. Installment account sales, 2018 5. Installment account sales, 2019 6. Regular account sales(2/10,n/30) P46,864 18,804 52,418 68,056 310,690 1,000,000 P1,496,832 Insiallment credit term: Four(4) years.. 32,082 Credit balance in accounts with customers. Yb. 12,000 Cash deposit with RFM Co. representing a 10% dowr. C. payment a contract to buy merchandise in 2020. 20,000 Advances to employees to be liquidated in cash 10,000 Notes receivable (loan to employees granted 4-2-18 for two d. е. years) f. 140,000 Amount due on capita! stock subscriptions of P300,000; no due date. 100,000 Advances to Donna, president. This is covered by an unsecured note due in two years to be offset against salary. 368,000 Shipment out to consignees. Oniy 60% of the consigninent is reported to be sold on Dec. 31, 2019. The total shipment cost g. h. P240,000. 40,000 Working fund advances to salesmen; 60% of the amount was actually advanced to them; of the amount advanced 60% is not spent yet by them as of Dec. 31, 2019. i.

Exercise 2-6 Your analysis of Accounts Receivable carried at P2,406,750 on Dec. 31, 2019 shows the following: a. P1,496,832 Debit balance in accounts with customers broken down as: 1. Installment account sales, 2015 2. Installment account sales, 2016 3. Installment account sales, 2017 4. Installment account sales, 2018 5. Installment account sales, 2019 6. Regular account sales(2/10,n/30) P46,864 18,804 52,418 68,056 310,690 1,000,000 P1,496,832 Insiallment credit term: Four(4) years.. 32,082 Credit balance in accounts with customers. Yb. 12,000 Cash deposit with RFM Co. representing a 10% dowr. C. payment a contract to buy merchandise in 2020. 20,000 Advances to employees to be liquidated in cash 10,000 Notes receivable (loan to employees granted 4-2-18 for two d. е. years) f. 140,000 Amount due on capita! stock subscriptions of P300,000; no due date. 100,000 Advances to Donna, president. This is covered by an unsecured note due in two years to be offset against salary. 368,000 Shipment out to consignees. Oniy 60% of the consigninent is reported to be sold on Dec. 31, 2019. The total shipment cost g. h. P240,000. 40,000 Working fund advances to salesmen; 60% of the amount was actually advanced to them; of the amount advanced 60% is not spent yet by them as of Dec. 31, 2019. i.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter8: Receivables

Section: Chapter Questions

Problem 8.4BE: Analysis of receivables method At the end of the current year, Accounts Receivable has a balance of...

Related questions

Question

PLEASE ANSWER NO. 2

Transcribed Image Text:104

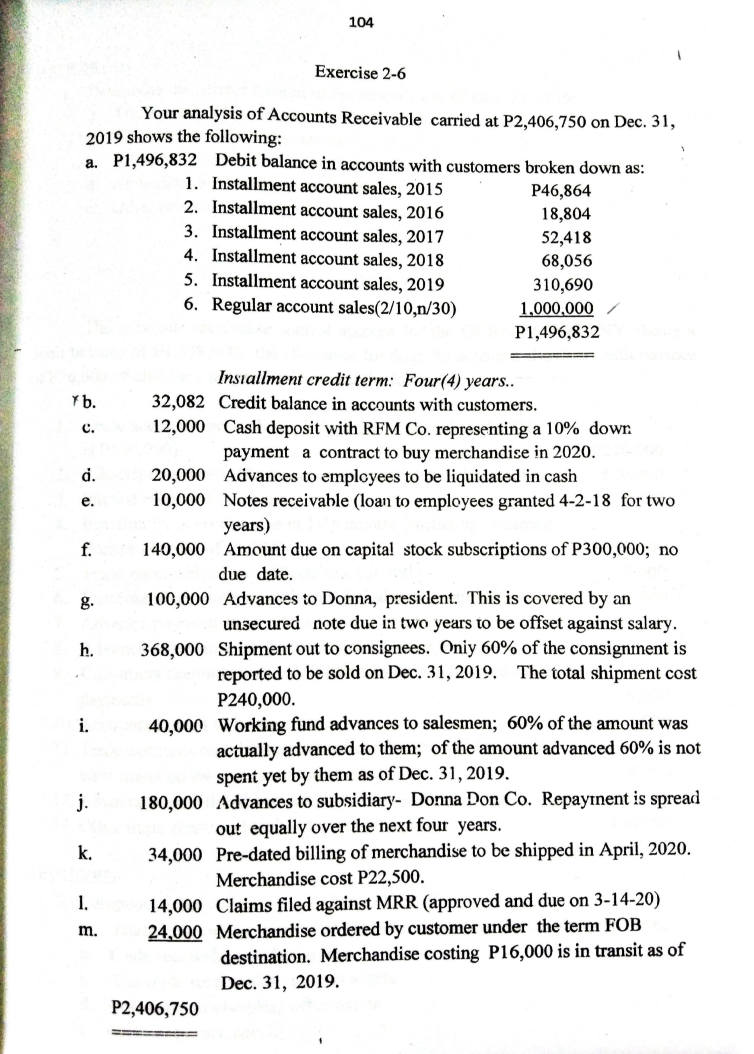

Exercise 2-6

Your analysis of Accounts Receivable carried at P2,406,750 on Dec. 31,

2019 shows the following:

a. P1,496,832 Debit balance in accounts with customers broken down as:

1. Installment account sales, 2015

2. Installment account sales, 2016

3. Installment account sales, 2017

4. Installment account sales, 2018

5. Installment account sales, 2019

6. Regular account sales(2/10,n/30)

P46,864

18,804

52,418

68,056

310,690

1,000,000 /

P1,496,832

Insiallment credit term: Four(4) years..

Yb.

32,082 Credit balance in accounts with customers.

12,000 Cash deposit with RFM Co. representing a 10% down

C.

payment a contract to buy merchandise in 2020.

20,000 Advances to employees to be liquidated in cash

10,000 Notes receivable (loan to employees granted 4-2-18 for two

d.

e.

years)

f.

140,000 Amount due on capita! stock subscriptions of P300,000; no

due date.

100,000 Advances to Donna, president. This is covered by an

unsecured note due in two years to be offset against salary.

368,000 Shipment out to consignees. Oniy 60% of the consignment is

reported to be sold on Dec. 31, 2019. The total shipment cost

g.

h.

P240,000.

40,000 Working fund advances to salesmen; 60% of the amount was

actually advanced to them; of the amount advanced 60% is not

i.

spent yet by them as of Dec. 31, 2019.

j.

180,000 Advances to subsidiary- Donna Don Co. Repayınent is spread

out equally over the next four years.

k.

34,000 Pre-dated billing of merchandise to be shipped in April, 2020.

Merchandise cost P22,500.

14,000 Claims filed against MRR (approved and due on 3-14-20)

24,000 Merchandise ordered by customer under the term FOB

destination. Merchandise costing P16,000 is in transit as of

1.

m.

Dec. 31, 2019.

P2,406,750

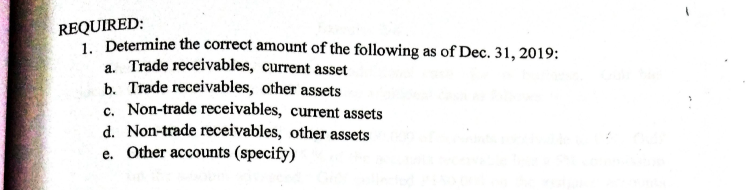

Transcribed Image Text:REQUIRED:

1. Determine the correct amount of the following as of Dec. 31, 2019:

a. Trade receivables, current asset

b. Trade receivables, other assets

Non-trade receivables, current assets

d. Non-trade receivables, other assets

e. Other accounts (specify)

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,