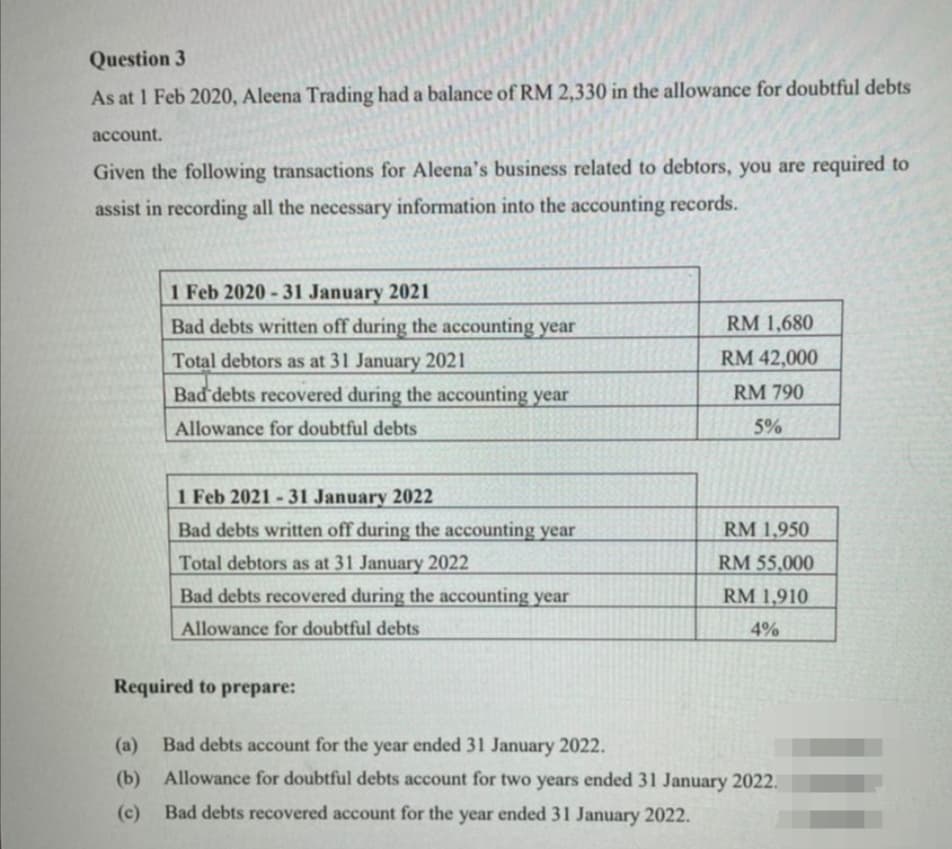

Question 3 As at 1 Feb 2020, Aleena Trading had a balance of RM 2,330 in the allowance for doubtful debts account. Given the following transactions for Aleena's business related to debtors, you are required to assist in recording all the necessary information into the accounting records. 1 Feb 2020 - 31 January 2021 Bad debts written off during the accounting year RM 1,680 RM 42,000 Total debtors as at 31 January 2021 Bad debts recovered during the accounting year RM 790 Allowance for doubtful debts 5% 1 Feb 2021 - 31 January 2022 Bad debts written off during the accounting year RM 1,950 Total debtors as at 31 January 2022 RM 55,000 Bad debts recovered during the accounting year RM 1,910 Allowance for doubtful debts 4% Required to prepare: (a) Bad debts account for the year ended 31 January 2022. (b) Allowance for doubtful debts account for two years ended 31 January 2022. (c) Bad debts recovered account for the year ended 31 January 2022.

Question 3 As at 1 Feb 2020, Aleena Trading had a balance of RM 2,330 in the allowance for doubtful debts account. Given the following transactions for Aleena's business related to debtors, you are required to assist in recording all the necessary information into the accounting records. 1 Feb 2020 - 31 January 2021 Bad debts written off during the accounting year RM 1,680 RM 42,000 Total debtors as at 31 January 2021 Bad debts recovered during the accounting year RM 790 Allowance for doubtful debts 5% 1 Feb 2021 - 31 January 2022 Bad debts written off during the accounting year RM 1,950 Total debtors as at 31 January 2022 RM 55,000 Bad debts recovered during the accounting year RM 1,910 Allowance for doubtful debts 4% Required to prepare: (a) Bad debts account for the year ended 31 January 2022. (b) Allowance for doubtful debts account for two years ended 31 January 2022. (c) Bad debts recovered account for the year ended 31 January 2022.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.1DC: Reading 3M Companys Balance Sheet: Accounts Receivable The following current asset appears on the...

Related questions

Question

Do c) only.

Transcribed Image Text:Question 3

As at 1 Feb 2020, Aleena Trading had a balance of RM 2,330 in the allowance for doubtful debts

account.

Given the following transactions for Aleena's business related to debtors, you are required to

assist in recording all the necessary information into the accounting records.

1 Feb 2020 -31 January 2021

Bad debts written off during the accounting year

RM 1,680

RM 42,000

Total debtors as at 31 January 2021

Bad debts recovered during the accounting year

RM 790

Allowance for doubtful debts

5%

1 Feb 2021 - 31 January 2022

Bad debts written off during the accounting year

RM 1,950

Total debtors as at 31 January 2022

RM 55,000

Bad debts recovered during the accounting year

RM 1,910

Allowance for doubtful debts

4%

Required to prepare:

(a) Bad debts account for the year ended 31 January 2022.

(b) Allowance for doubtful debts account for two years ended 31 January 2022.

(c) Bad debts recovered account for the year ended 31 January 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT