Exercise 2-4 Recording product costs LO P1, P2, P3 Starr Company reports the following Information for August Raw materials purchased on account Direct materials used in production Factory wages earned (direct labor) Overhead rate $ 86,608 $58,480 $19,858 120% of direct labor cost Prepare Journal entries to record the following events. 1. Raw materlals purchased. 2. Direct materlals used In production. 3. DIrect labor used In production. 4. Applied overhead. View transaction list Journal entry worksheet 2 4 Record the entry to assign direct materials to jobs Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general jourmal

Exercise 2-4 Recording product costs LO P1, P2, P3 Starr Company reports the following Information for August Raw materials purchased on account Direct materials used in production Factory wages earned (direct labor) Overhead rate $ 86,608 $58,480 $19,858 120% of direct labor cost Prepare Journal entries to record the following events. 1. Raw materlals purchased. 2. Direct materlals used In production. 3. DIrect labor used In production. 4. Applied overhead. View transaction list Journal entry worksheet 2 4 Record the entry to assign direct materials to jobs Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general jourmal

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter19: Job Order Costing

Section: Chapter Questions

Problem 19.4APR: Analyzing manufacturing cost accounts Fire Rock Company manufactures Designer paddle boards in a...

Related questions

Question

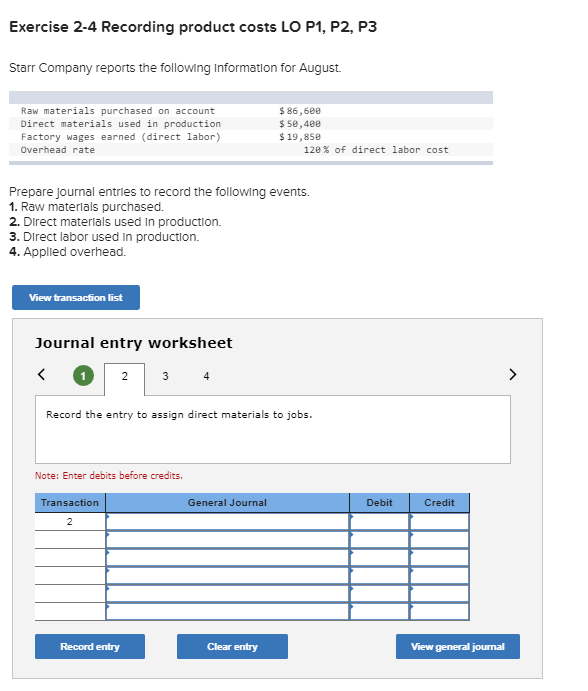

Transcribed Image Text:Exercise 2-4 Recording product costs LO P1, P2, P3

Starr Company reports the following Information for August

Raw materials purchased on account

Direct materials used in production

Factory wages earned (direct labor)

Overhead rate

$ 86,608

$58,480

$19,858

120% of direct labor cost

Prepare Journal entries to record the following events.

1. Raw materlals purchased.

2. Direct materlals used In production.

3. DIrect labor used In production.

4. Applied overhead.

View transaction list

Journal entry worksheet

2

4

Record the entry to assign direct materials to jobs

Note: Enter debits before credits

Transaction

General Journal

Debit

Credit

Record entry

Clear entry

View general jourmal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning