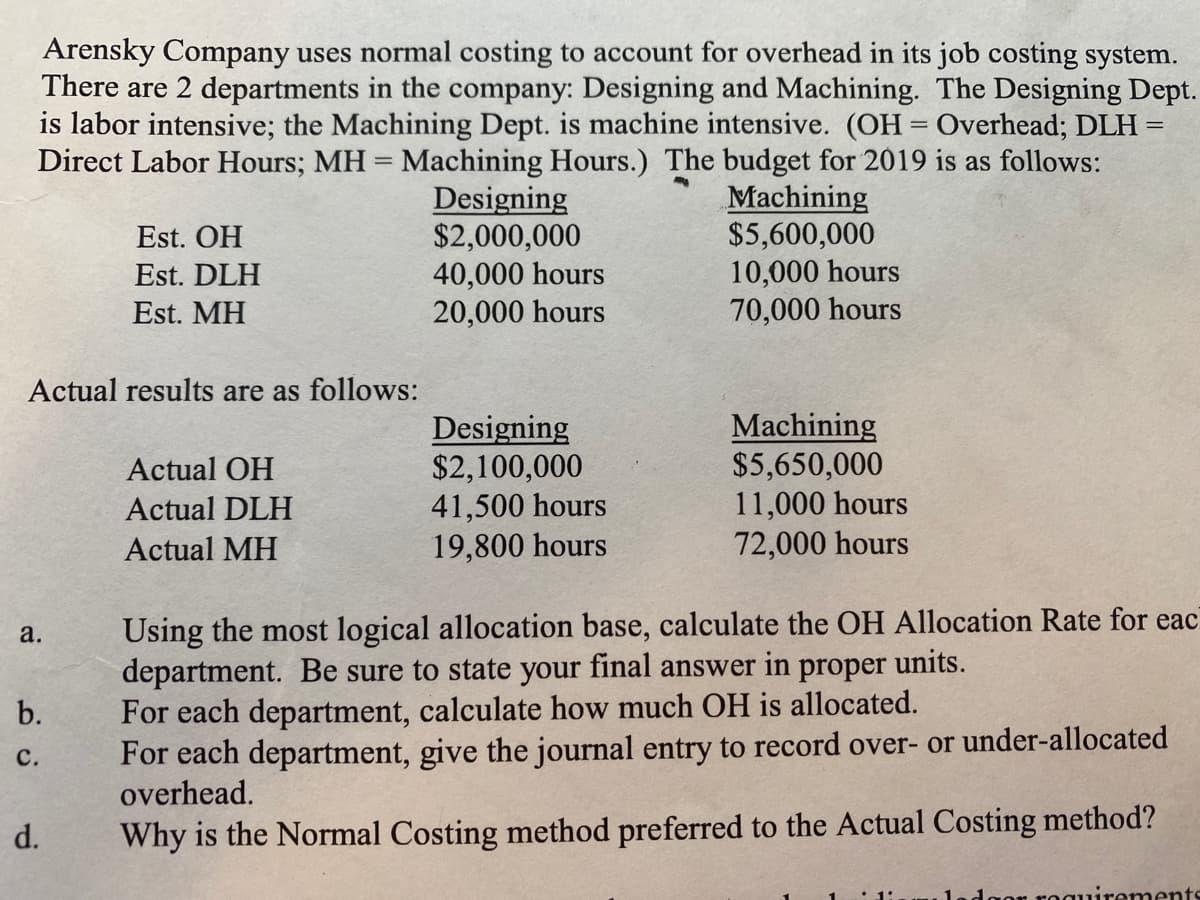

Arensky Company uses normal costing to account for overhead in its job costing system. There are 2 departments in the company: Designing and Machining. The Designing Dept is labor intensive; the Machining Dept. is machine intensive. (OH = Overhead; DLH = Direct Labor Hours; MH = Machining Hours.) The budget for 2019 is as follows: Actual results are as follows: a. Est. OH Est. DLH Est. MH b. C. Actual OH Actual DLH Actual MH Designing $2,000,000 40,000 hours 20,000 hours Designing $2,100,000 41,500 hours 19,800 hours Machining $5,600,000 10,000 hours 70,000 hours Machining $5,650,000 11,000 hours 72,000 hours Using the most logical allocation base, calculate the OH Allocation Rate for eac department. Be sure to state your final answer in proper units. For each department, calculate how much OH is allocated. For each department, give the journal entry to record over- or under-allocated overhead.

Arensky Company uses normal costing to account for overhead in its job costing system. There are 2 departments in the company: Designing and Machining. The Designing Dept is labor intensive; the Machining Dept. is machine intensive. (OH = Overhead; DLH = Direct Labor Hours; MH = Machining Hours.) The budget for 2019 is as follows: Actual results are as follows: a. Est. OH Est. DLH Est. MH b. C. Actual OH Actual DLH Actual MH Designing $2,000,000 40,000 hours 20,000 hours Designing $2,100,000 41,500 hours 19,800 hours Machining $5,600,000 10,000 hours 70,000 hours Machining $5,650,000 11,000 hours 72,000 hours Using the most logical allocation base, calculate the OH Allocation Rate for eac department. Be sure to state your final answer in proper units. For each department, calculate how much OH is allocated. For each department, give the journal entry to record over- or under-allocated overhead.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 30P: Primera Company produces two products and uses a predetermined overhead rate to apply overhead....

Related questions

Question

Transcribed Image Text:Arensky Company uses normal costing to account for overhead in its job costing system.

There are

departments in the company: Designing and Machining. The Designing Dept.

is labor intensive; the Machining Dept. is machine intensive. (OH- Overhead; DLH =

Direct Labor Hours; MH = Machining Hours.) The budget for 2019 is as follows:

Actual results are as follows:

a.

b.

C.

Est. OH

Est. DLH

Est. MH

d.

Actual OH

Actual DLH

Actual MH

Designing

$2,000,000

40,000 hours

20,000 hours

Designing

$2,100,000

41,500 hours

19,800 hours

Machining

$5,600,000

10,000 hours

70,000 hours

Machining

$5,650,000

11,000 hours

72,000 hours

Using the most logical allocation base, calculate the OH Allocation Rate for eac

department. Be sure to state your final answer in proper units.

For each department, calculate how much OH is allocated.

For each department, give the journal entry to record over- or under-allocated

overhead.

Why is the Normal Costing method preferred to the Actual Costing method?

uirements

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College