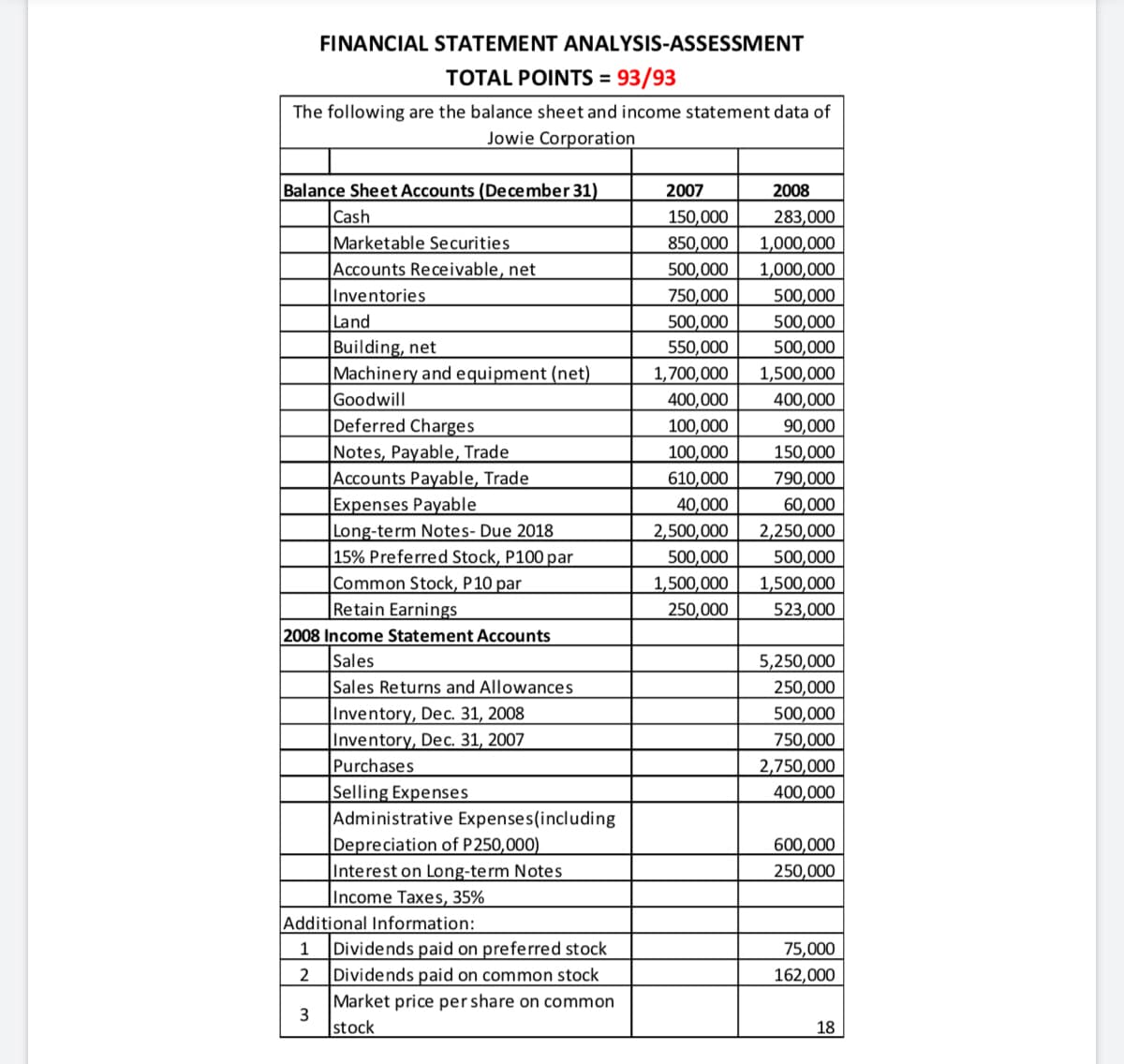

FINANCIAL STATEMENT ANALYSIS-ASSESSMENT TOTAL POINTS = 93/93 The following are the balance sheet and income statement data of Jowie Corporation Balance Sheet Accounts (December 31) Cash 2007 2008 150,000 283,000 Marketable Securities Accounts Receivable, net Inventories Land 1,000,000 1,000,000 850,000 500,000 750,000 500,000 500,000 500,000 Building, net Machinery and equipment (net). Goodwill Deferred Charges Notes, Payable, Trade |Accounts Payable, Trade Expenses Payable Long-term Notes- Due 2018 15% Preferred Stock, P100 par |Common Stock, P10 par Retain Earnings 2008 Income Statement Accounts Sales Sales Returns and Allowances Inventory, Dec. 31, 2008 Inventory, Dec. 31, 2007 Purchases Selling Expenses Administrative Expenses(including Depreciation of P 250,000) Interest on Long-term Notes Income Taxes, 35% Additional Information: Dividends paid on preferred stock 550,000 1,700,000 400,000 500,000 1,500,000 400,000 100,000 90,000 100,000 150,000 610,000 790,000 40,000 60,000 2,500,000 500,000 2,250,000 500,000 1,500,000 1,500,000 250,000 523,000 5,250,000 250,000 500,000 750,000 2,750,000 400,000 600,000 250,000 1 75,000 Dividends paid on common stock 162,000 Market price per share on common 3 stock 18

FINANCIAL STATEMENT ANALYSIS-ASSESSMENT TOTAL POINTS = 93/93 The following are the balance sheet and income statement data of Jowie Corporation Balance Sheet Accounts (December 31) Cash 2007 2008 150,000 283,000 Marketable Securities Accounts Receivable, net Inventories Land 1,000,000 1,000,000 850,000 500,000 750,000 500,000 500,000 500,000 Building, net Machinery and equipment (net). Goodwill Deferred Charges Notes, Payable, Trade |Accounts Payable, Trade Expenses Payable Long-term Notes- Due 2018 15% Preferred Stock, P100 par |Common Stock, P10 par Retain Earnings 2008 Income Statement Accounts Sales Sales Returns and Allowances Inventory, Dec. 31, 2008 Inventory, Dec. 31, 2007 Purchases Selling Expenses Administrative Expenses(including Depreciation of P 250,000) Interest on Long-term Notes Income Taxes, 35% Additional Information: Dividends paid on preferred stock 550,000 1,700,000 400,000 500,000 1,500,000 400,000 100,000 90,000 100,000 150,000 610,000 790,000 40,000 60,000 2,500,000 500,000 2,250,000 500,000 1,500,000 1,500,000 250,000 523,000 5,250,000 250,000 500,000 750,000 2,750,000 400,000 600,000 250,000 1 75,000 Dividends paid on common stock 162,000 Market price per share on common 3 stock 18

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.17E: Profitability metrics The following selected data were taken from the financial statements of The...

Related questions

Question

100%

Evaluate the firm’s profitability for 2008 by computing:

a. Return on Common Stockholders’ Equity.

b. Earnings Per Share (EPS)

c. Price-earnings Ratio

d. Pay-out Ratio to Common Shares

e. Dividend Yield Per Share on Common Stock

Transcribed Image Text:FINANCIAL STATEMENT ANALYSIS-ASSESSMENT

TOTAL POINTS = 93/93

The following are the balance sheet and income statement data of

Jowie Corporation

Balance Sheet Accounts (De cember 31)

2007

2008

Cash

283,000

1,000,000

150,000

Marketable Securities

Accounts Receivable, net

850,000

500,000

1,000,000

500,000

Inventories

Land

750,000

500,000

500,000

Building, net

Machinery and equipment (net)

Goodwill

|Deferred Charges

Notes, Payable, Trade

Accounts Payable, Trade

Expenses Payable

Long-term Notes- Due 2018

15% Preferred Stock, P100 par

Common Stock, P10 par

Retain Earnings

2008 Income Statement Accounts

Sales

550,000

500,000

1,700,000

1,500,000

400,000

400,000

100,000

100,000

610,000

40,000

90,000

150,000

790,000

60,000

2,500,000

2,250,000

500,000

500,000

1,500,000

1,500,000

250,000

523,000

5,250,000

250,000

Sales Returns and Allowances

Inventory, Dec. 31, 2008

Inventory, Dec. 31, 2007

Purchases

Selling Expenses

Administrative Expenses(including

Depreciation of P250,000)

Interest on Long-term Notes

Income Taxes, 35%

Additional Information:

Dividends paid on preferred stock

Dividends paid on common stock

500,000

750,000

2,750,000

400,000

600,000

250,000

1

75,000

2

162,000

Market price per share on common

3

stock

18

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College