Exercise 6-4A (Static) Determining the cost of an asset LO 6-1 Southwest Milling Co. purchased a front-end loader to move stacks of lumber. The loader had a list price of $140,000. The seller agreed to allow a 4 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Freight cost amounted to $1.200. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $1,800. The loader operator is paid an annual salary of $60,000. The cost of the company's theft insurance policy increased by $800 per year as a result of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $6,000. Required Determine the amount to be capitalized in the asset account for the purchase of the front-end loader. (Amounts to be deducted should be indicated with minus sign.) Costs that are to be capitalized List price

Exercise 6-4A (Static) Determining the cost of an asset LO 6-1 Southwest Milling Co. purchased a front-end loader to move stacks of lumber. The loader had a list price of $140,000. The seller agreed to allow a 4 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Freight cost amounted to $1.200. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $1,800. The loader operator is paid an annual salary of $60,000. The cost of the company's theft insurance policy increased by $800 per year as a result of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $6,000. Required Determine the amount to be capitalized in the asset account for the purchase of the front-end loader. (Amounts to be deducted should be indicated with minus sign.) Costs that are to be capitalized List price

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 44E: Cost of a Fixed Asset Colson Photography Service purchased a new digital imaging machine on April 15...

Related questions

Question

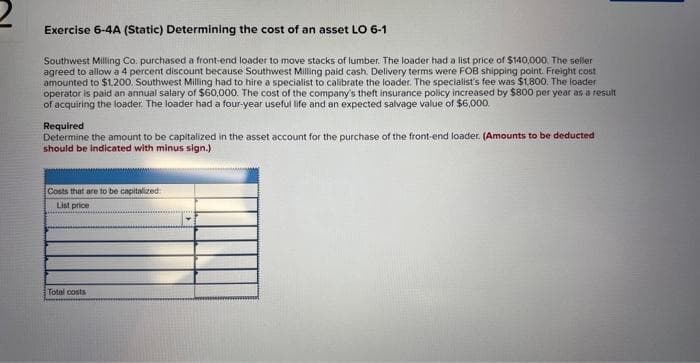

Transcribed Image Text:Exercise 6-4A (Static) Determining the cost of an asset LO 6-1

Southwest Milling Co. purchased a front-end loader to move stacks of lumber. The loader had a list price of $140,000. The seller

agreed to allow a 4 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Freight cost

amounted to $1.200. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $1,800. The loader

operator is paid an annual salary of $60,000. The cost of the company's theft insurance policy increased by $800 per year as a result

of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $6,000.

Required

Determine the amount to be capitalized in the asset account for the purchase of the front-end loader. (Amounts to be deducted

should be indicated with minus sign.)

Costs that are to be capitalized

List price

Total costs

Transcribed Image Text:Exercise 6-4A (Static) Determining the cost of an asset LO 6-1

Southwest Milling Co. purchased a front-end loader to move stacks of lumber. The loader had a list price of $140,000. The seller

agreed to allow a 4 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Freight cost

amounted to $1.200. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $1,800. The loader

operator is paid an annual salary of $60,000. The cost of the company's theft insurance policy increased by $800 per year as a result

of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $6,000.

Required

Determine the amount to be capitalized in the asset account for the purchase of the front-end loader. (Amounts to be deducted

should be indicated with minus sign.)

Costs that are to be capitalized

List price

Total costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,