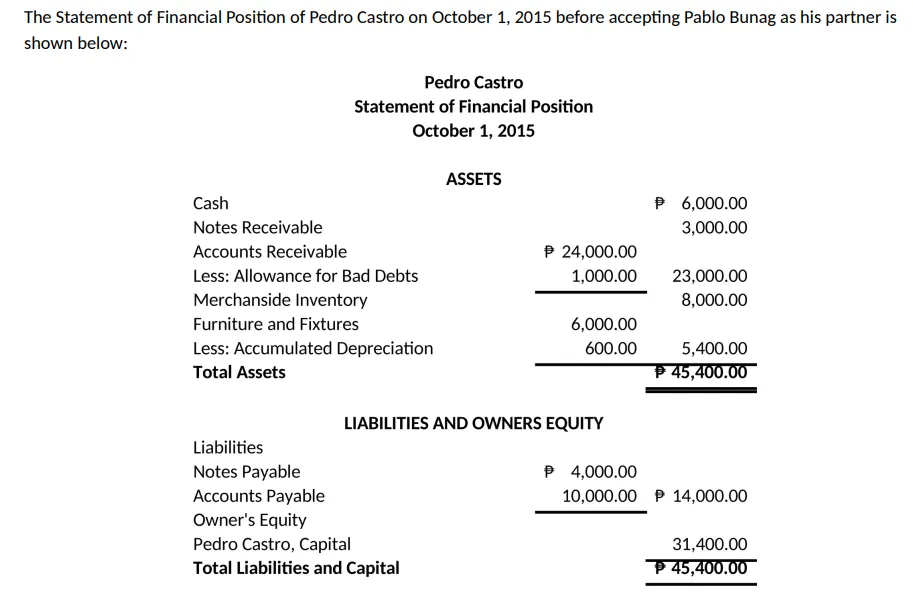

The Statement of Financial Position of Pedro Castro on October 1, 2015 before accepting Pablo Bunag as his partner is shown below: Pedro Castro Statement of Financial Position October 1, 2015 ASSETS Cash P 6,000.00 Notes Receivable 3,000.00 Accounts Receivable P 24,000.00 Less: Allowance for Bad Debts 1,000.00 23,000.00 Merchanside Inventory 8,000.00 Furniture and Fixtures 6,000.00 Less: Accumulated Depreciation 600.00 5,400.00 Total Assets P 45,400.00 LIABILITIES AND OWNERS EQUITY Liabilities P 4,000.00 Notes Payable Accounts Payable Owner's Equity Pedro Castro, Capital Total Liabilities and Capital 10,000.00 P 14,000.00 31,400.00 P 45,400.00

The Statement of Financial Position of Pedro Castro on October 1, 2015 before accepting Pablo Bunag as his partner is shown below: Pedro Castro Statement of Financial Position October 1, 2015 ASSETS Cash P 6,000.00 Notes Receivable 3,000.00 Accounts Receivable P 24,000.00 Less: Allowance for Bad Debts 1,000.00 23,000.00 Merchanside Inventory 8,000.00 Furniture and Fixtures 6,000.00 Less: Accumulated Depreciation 600.00 5,400.00 Total Assets P 45,400.00 LIABILITIES AND OWNERS EQUITY Liabilities P 4,000.00 Notes Payable Accounts Payable Owner's Equity Pedro Castro, Capital Total Liabilities and Capital 10,000.00 P 14,000.00 31,400.00 P 45,400.00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:The Statement of Financial Position of Pedro Castro on October 1, 2015 before accepting Pablo Bunag as his partner is

shown below:

Pedro Castro

Statement of Financial Position

October 1, 2015

ASSETS

Cash

P 6,000.00

Notes Receivable

3,000.00

Accounts Receivable

P 24,000.00

Less: Allowance for Bad Debts

1,000.00

23,000.00

Merchanside Inventory

8,000.00

Furniture and Fixtures

6,000.00

Less: Accumulated Depreciation

600.00

5,400.00

Total Assets

P 45,400.00

LIABILITIES AND OWNERS EQUITY

Liabilities

P 4,000.00

Notes Payable

Accounts Payable

Owner's Equity

Pedro Castro, Capital

Total Liabilities and Capital

10,000.00 P 14,000.00

31,400.00

P 45,400.00

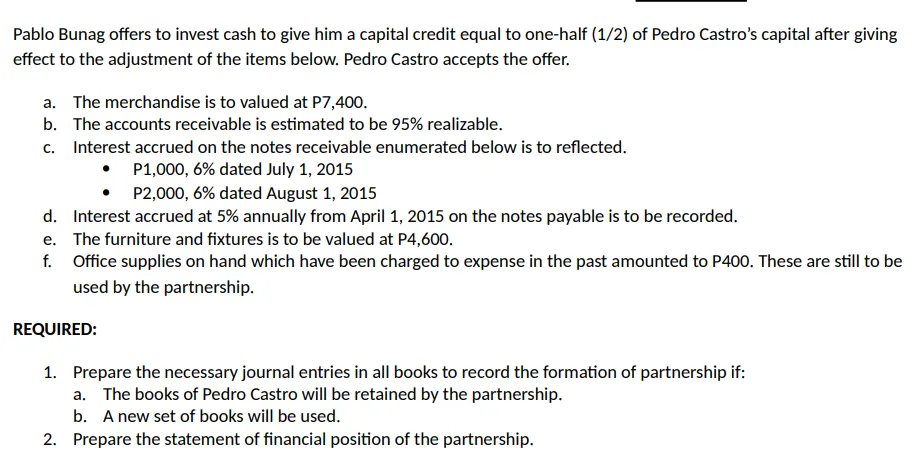

Transcribed Image Text:Pablo Bunag offers to invest cash to give him a capital credit equal to one-half (1/2) of Pedro Castro's capital after giving

effect to the adjustment of the items below. Pedro Castro accepts the offer.

a. The merchandise is to valued at P7,400.

b. The accounts receivable is estimated to be 95% realizable.

c. Interest accrued on the notes receivable enumerated below is to reflected.

P1,000, 6% dated July 1, 2015

P2,000, 6% dated August 1, 2015

d. Interest accrued at 5% annually from April 1, 2015 on the notes payable is to be recorded.

e. The furniture and fixtures is to be valued at P4,600.

f. Office supplies on hand which have been charged to expense in the past amounted to P400. These are still to be

used by the partnership.

REQUIRED:

1. Prepare the necessary journal entries in all books to record the formation of partnership if:

a. The books of Pedro Castro will be retained by the partnership.

b. A new set of books will be used.

2. Prepare the statement of financial position of the partnership.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning