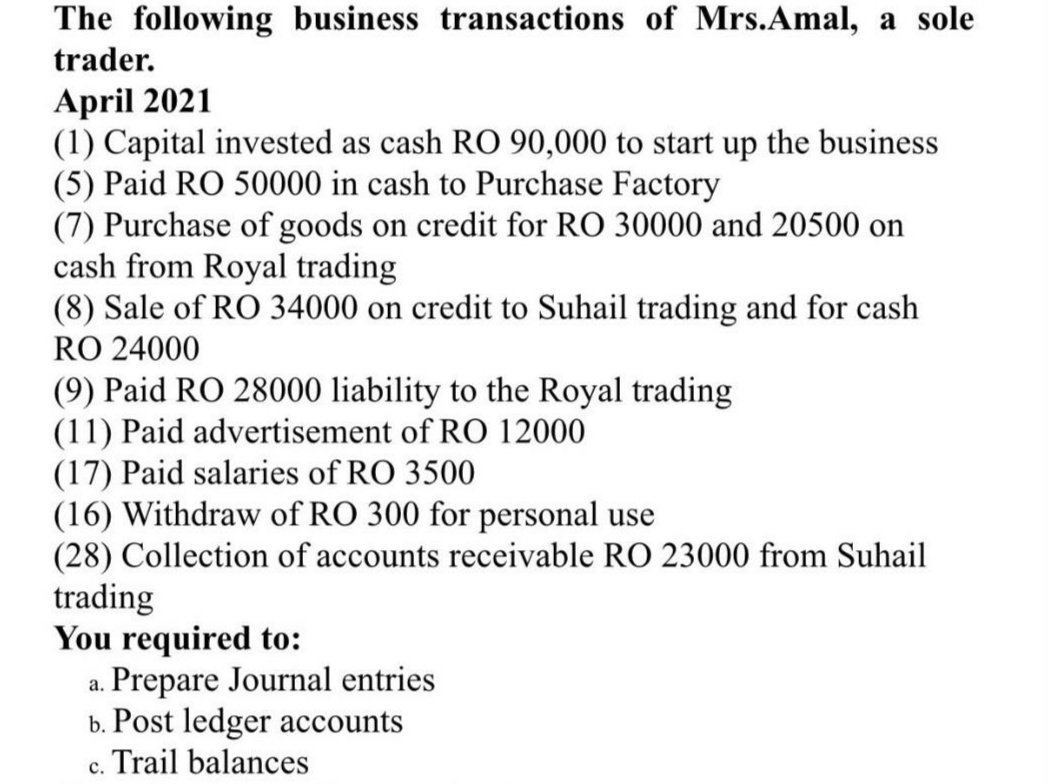

following business transactions of MMrs.Amal, a sol trader. April 2021 (1) Capital invested as cash RO 90,000 to start up the business 5) Paid RO 50000 in cash to Purchase Factory (7) Purchase of goods on credit for RO 30000 and 20500 on cash from Royal trading (8) Sale of RO 34000 on credit to Suhail trading and for cash RO 24000 9) Paid RO 28000 liability to the Royal trading (11) Paid advertisement of RO 12000 17) Paid salaries of RO 3500 16) Withdraw of RO 300 for personal use (28) Collection of accounts receivable RO 23000 from Suhail crading You required to: . Prepare Journal entries b. Post ledger accounts а. Trail balances

following business transactions of MMrs.Amal, a sol trader. April 2021 (1) Capital invested as cash RO 90,000 to start up the business 5) Paid RO 50000 in cash to Purchase Factory (7) Purchase of goods on credit for RO 30000 and 20500 on cash from Royal trading (8) Sale of RO 34000 on credit to Suhail trading and for cash RO 24000 9) Paid RO 28000 liability to the Royal trading (11) Paid advertisement of RO 12000 17) Paid salaries of RO 3500 16) Withdraw of RO 300 for personal use (28) Collection of accounts receivable RO 23000 from Suhail crading You required to: . Prepare Journal entries b. Post ledger accounts а. Trail balances

Chapter9: Payroll, Estimated Payments, And Retirement Plans

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:The following business transactions of Mrs.Amal, a sole

trader.

April 2021

(1) Capital invested as cash RO 90,000 to start up the business

(5) Paid RO 50000 in cash to Purchase Factory

(7) Purchase of goods on credit for RO 30000 and 20500 on

cash from Royal trading

(8) Sale of RO 34000 on credit to Suhail trading and for cash

RO 24000

(9) Paid RO 28000 liability to the Royal trading

(11) Paid advertisement of RO 12000

(17) Paid salaries of RO 3500

(16) Withdraw of RO 300 for personal use

(28) Collection of accounts receivable RO 23000 from Suhail

trading

You required to:

Prepare Journal entries

b. Post ledger accounts

c. Trail balances

а.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT