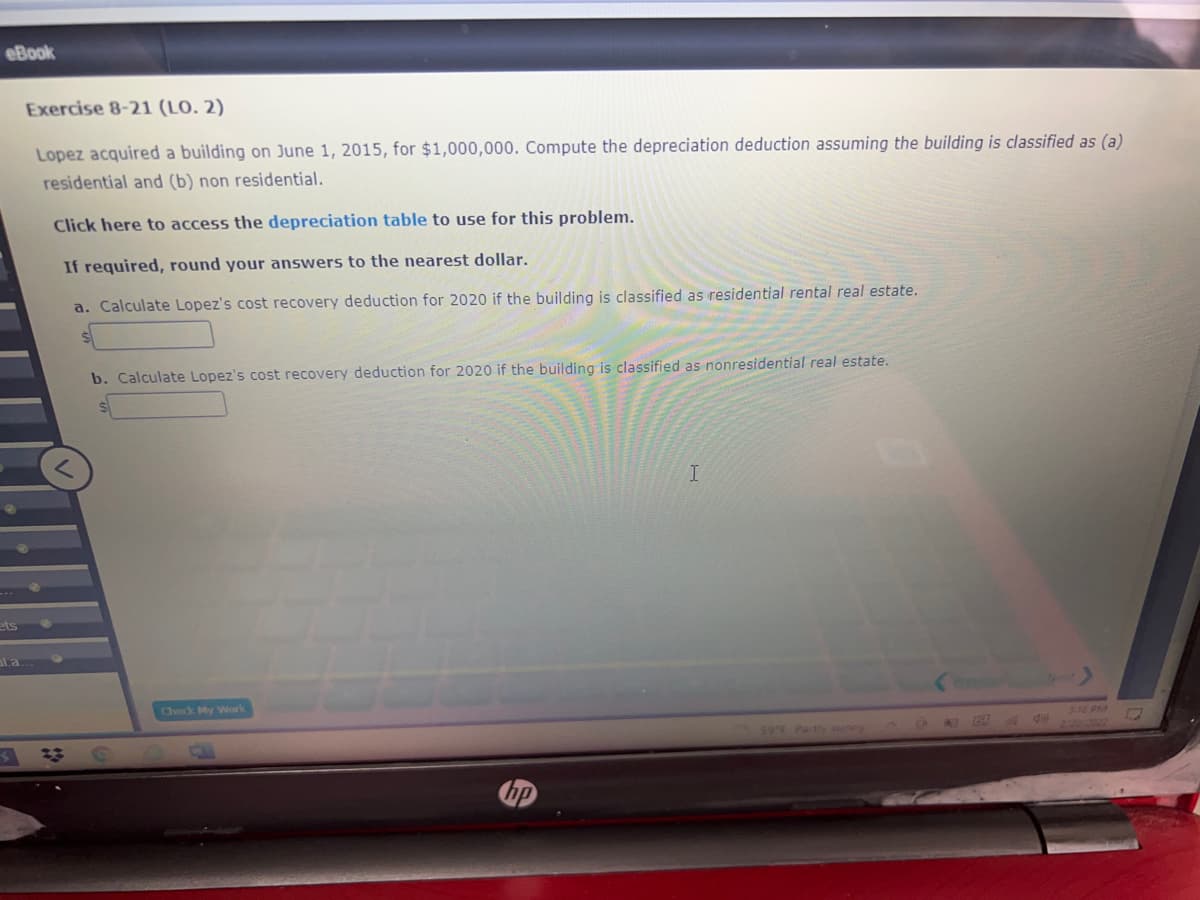

Exercise 8-21 (LO. 2) Lopez acquired a building on June 1, 2015, for $1,000,000. Compute the depreciation deduction assuming the building is classified as (a) residential and (b) non residential. Click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. a. Calculate Lopez's cost recovery deduction for 2020 if the building is classified as residential rental real estate. b. Calculate Lopez's cost recovery deduction for 2020 if the building is classified as nonresidential real estate.

Exercise 8-21 (LO. 2) Lopez acquired a building on June 1, 2015, for $1,000,000. Compute the depreciation deduction assuming the building is classified as (a) residential and (b) non residential. Click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. a. Calculate Lopez's cost recovery deduction for 2020 if the building is classified as residential rental real estate. b. Calculate Lopez's cost recovery deduction for 2020 if the building is classified as nonresidential real estate.

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 23CE

Related questions

Question

Transcribed Image Text:eBook

Exercise 8-21 (LO. 2)

Lopez acquired a building on June 1, 2015, for $1,000,000. Compute the depreciation deduction assuming the building is classified as (a)

residential and (b) non residential.

Click here to access the depreciation table to use for this problem.

If required, round your answers to the nearest dollar.

a. Calculate Lopez's cost recovery deduction for 2020 if the building is classified as residential rental real estate.

b. Calculate Lopez's cost recovery deduction for 2020 if the building is classified as nonresidential real estate.

ets

al.a

Check My Work

216 PM

59 F Partly suney

CA

4 de

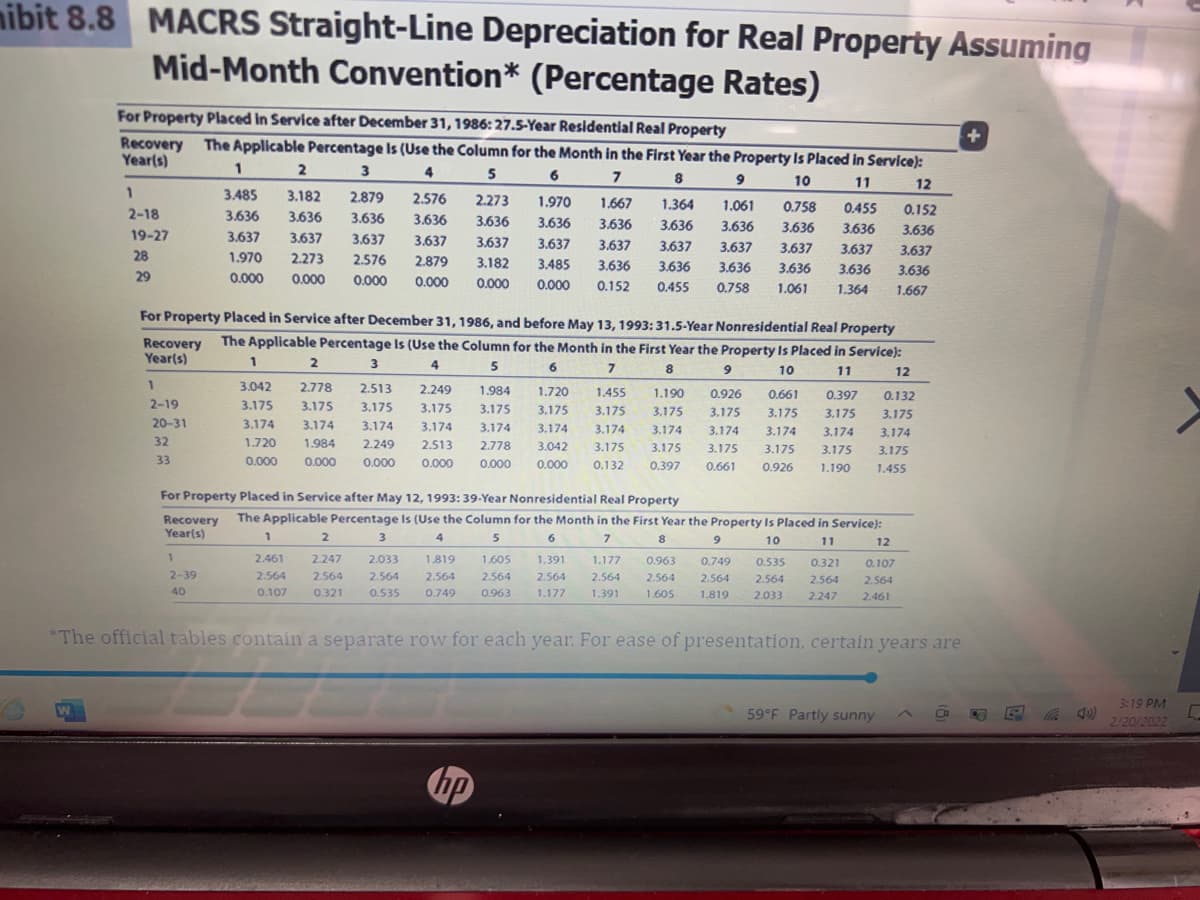

Transcribed Image Text:mibit 8.8 MACRS Straight-Line Depreciation for Real Property Assuming

Mid-Month Convention* (Percentage Rates)

For Property Placed in Service after December 31, 1986: 27.5-Year Residential Real Property

Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service):

Year(s)

1

4

5

6

8

9

10

11

12

3.485

3.182

2.879

2.576

2.273

1.970

1.667

1.364

1.061

0.758

0.455

0.152

2-18

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

19-27

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

28

1.970

2.273

2.576

2.879

3.182

3.485

3.636

3.636

3.636

3.636

3.636

3.636

29

0.000

0.000

0.000

0.000

0.000

0.000

0.152

0.455

0.758

1.061

1.364

1.667

For Property Placed in Service after December 31, 1986, and before May 13, 1993:31.5-Year Nonresidential Real Property

The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service):

Recovery

Year(s)

3

4

5

6

7

10

11

12

3.042

2.778

2.513

2.249

1.984

1.720

1.455

1.190

0.926

0.661

0.397

0.132

2-19

3.175

3.175

3.175

3.175

3.175

3.175

3.175

3,175

3.175

3.175

3.175

3.175

20-31

3.174

3.174

3.174

3.174

3.174

3.174

3.174

3.174

3.174

3.174

3.174

3.174

32

1.720

1.984

2.249

2.513

2.778

3.042

3.175

3.175

3.175

3.175

3.175

3.175

33

0.000

0.000

0.000

0.000

0.000

0.000

0.132

0.397

0.661

0.926

1.190

1,455

For Property Placed in Service after May 12, 1993: 39-Year Nonresidential Real Property

The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service):

Recovery

Year(s)

1

2.

4

6.

8

10

11

12

1.

2.461

2.247

2.033

1.819

1.605

1.391

1.177

0.963

0.749

0.535

0.321

0.107

2-39

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

40

0.107

0.321

0.535

0.749

0.963

1.177

1.391

1.605

1.819

2.033

2.247

2.461

*The official tables contain a separate row for each year. For ease of presentation, certain years are

3:19 PM

59°F Partly sunny

2/20/2022

bp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning