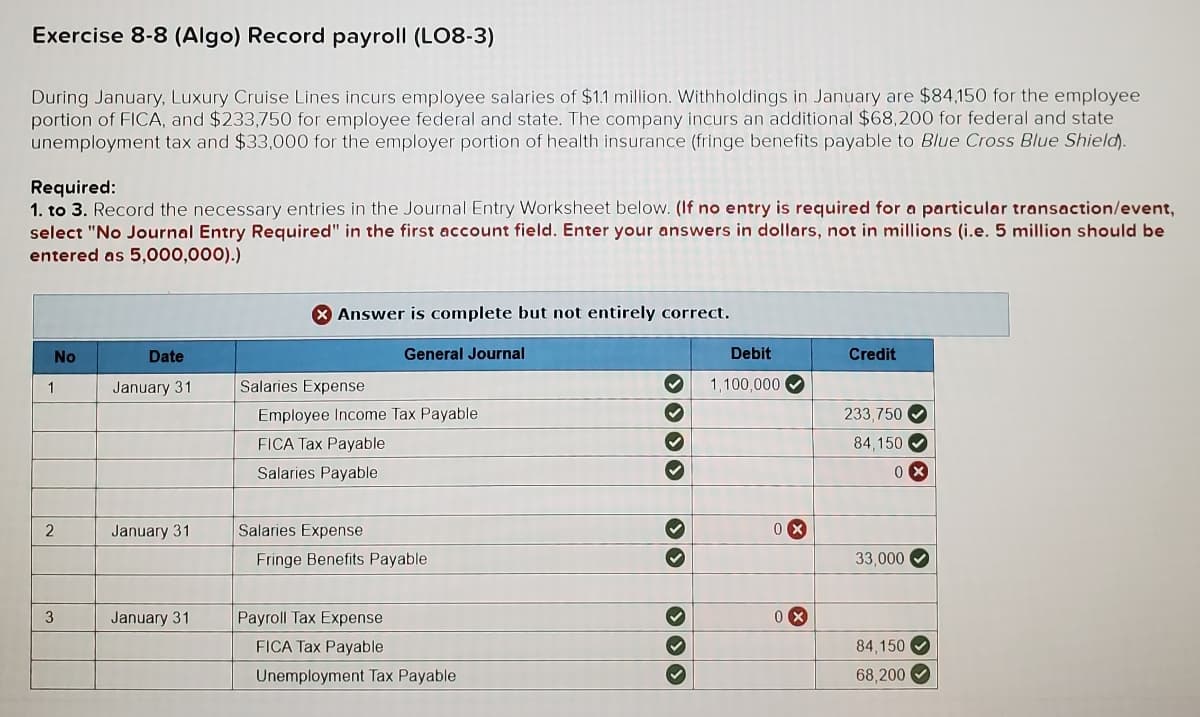

Exercise 8-8 (Algo) Record payroll (L08-3) During January, Luxury Cruise Lines incurs employee salaries of $1.1 million. Withholdings in January are $84,150 for the employee portion of FICA, and $233,750 for employee federal and state. The company incurs an additional $68,200 for federal and state unemployment tax and $33,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shield). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) No 1 2 3 Date January 31 January 31 January 31 Answer is complete but not entirely correct. General Journal Salaries Expense Employee Income Tax Payable FICA Tax Payable Salaries Payable Salaries Expense Fringe Benefits Payable Payroll Tax Expense FICA Tax Payable Unemployment Tax Payable ✓ Debit 1,100,000✔ 0x 0X Credit 233,750 84,150✔ 0x 33,000 84,150 68,200✔

Exercise 8-8 (Algo) Record payroll (L08-3) During January, Luxury Cruise Lines incurs employee salaries of $1.1 million. Withholdings in January are $84,150 for the employee portion of FICA, and $233,750 for employee federal and state. The company incurs an additional $68,200 for federal and state unemployment tax and $33,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shield). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) No 1 2 3 Date January 31 January 31 January 31 Answer is complete but not entirely correct. General Journal Salaries Expense Employee Income Tax Payable FICA Tax Payable Salaries Payable Salaries Expense Fringe Benefits Payable Payroll Tax Expense FICA Tax Payable Unemployment Tax Payable ✓ Debit 1,100,000✔ 0x 0X Credit 233,750 84,150✔ 0x 33,000 84,150 68,200✔

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 3E

Related questions

Question

Hi,

I need help solving for the cells highlighted in red.

I do not know how to find these values.

Thank you for your help.

Transcribed Image Text:Exercise 8-8 (Algo) Record payroll (L08-3)

During January, Luxury Cruise Lines incurs employee salaries of $1.1 million. Withholdings in January are $84,150 for the employee

portion of FICA, and $233,750 for employee federal and state. The company incurs an additional $68,200 for federal and state

unemployment tax and $33,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shield).

Required:

1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event,

select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be

entered as 5,000,000).)

No

1

2

3

Date

January 31

January 31

January 31

X Answer is complete but not entirely correct.

General Journal

Salaries Expense

Employee Income Tax Payable

FICA Tax Payable

Salaries Payable

Salaries Expense

Fringe Benefits Payable

Payroll Tax Expense

FICA Tax Payable

Unemployment Tax Payable

✓

✔

Debit

1,100,000

0x

0X

Credit

233,750✔

84,150✔

0x

33,000✔

84,150

68,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning