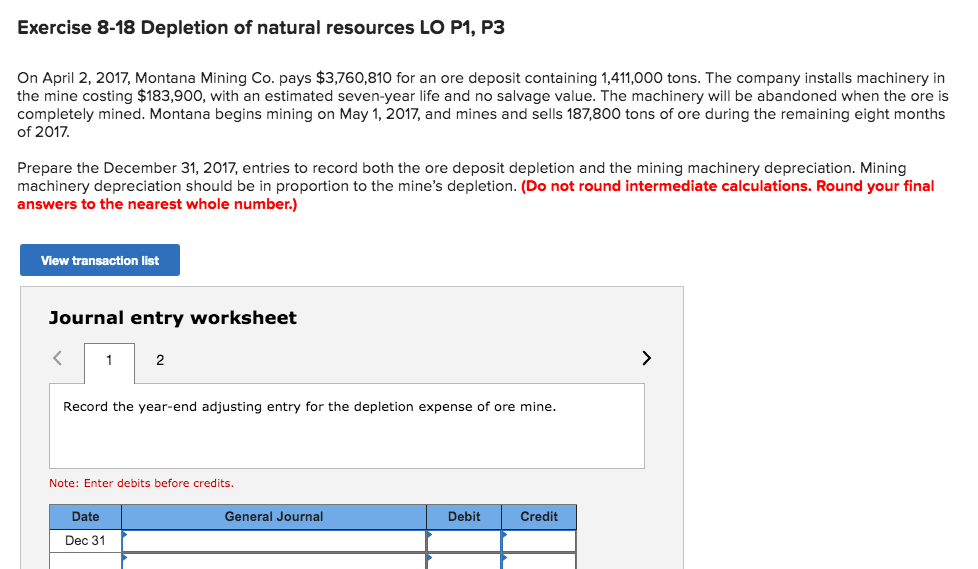

Exercise 8-18 Depletion of natural resources LO P1, P3 On April 2, 2017, Montana Mining Co. pays $3,760,810 for an ore deposit containing 1,411,000 tons. The company installs machinery in the mine costing $183,900, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is completely mined. Montana begins mining on May 1, 2017, and mines and sells 187,800 tons of ore during the remaining eight months of 2017. Prepare the December 31, 2017, entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.) View transaction list Journal entry worksheet 2 Record the year-end adjusting entry for the depletion expense of ore mine. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Journal entry worksheet 2 Record the year-end adjusting entry for the depreciation expense of the mining machinery. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31

Exercise 8-18 Depletion of natural resources LO P1, P3 On April 2, 2017, Montana Mining Co. pays $3,760,810 for an ore deposit containing 1,411,000 tons. The company installs machinery in the mine costing $183,900, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is completely mined. Montana begins mining on May 1, 2017, and mines and sells 187,800 tons of ore during the remaining eight months of 2017. Prepare the December 31, 2017, entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.) View transaction list Journal entry worksheet 2 Record the year-end adjusting entry for the depletion expense of ore mine. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Journal entry worksheet 2 Record the year-end adjusting entry for the depreciation expense of the mining machinery. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Fixed Assets And Intangible Assets

Section: Chapter Questions

Problem 10.3CP: Effect of depreciation on net income Tuttle Construction Co. specializes in building replicas of...

Related questions

Question

100%

Transcribed Image Text:Exercise 8-18 Depletion of natural resources LO P1, P3

On April 2, 2017, Montana Mining Co. pays $3,760,810 for an ore deposit containing 1,411,000 tons. The company installs machinery in

the mine costing $183,900, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is

completely mined. Montana begins mining on May 1, 2017, and mines and sells 187,800 tons of ore during the remaining eight months

of 2017.

Prepare the December 31, 2017, entries to record both the ore deposit depletion and the mining machinery depreciation. Mining

machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final

answers to the nearest whole number.)

View transaction list

Journal entry worksheet

2

Record the year-end adjusting entry for the depletion expense of ore mine.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Dec 31

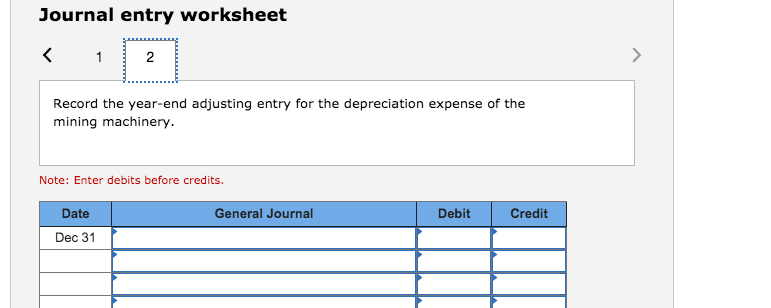

Transcribed Image Text:Journal entry worksheet

2

Record the year-end adjusting entry for the depreciation expense of the

mining machinery.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Dec 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning