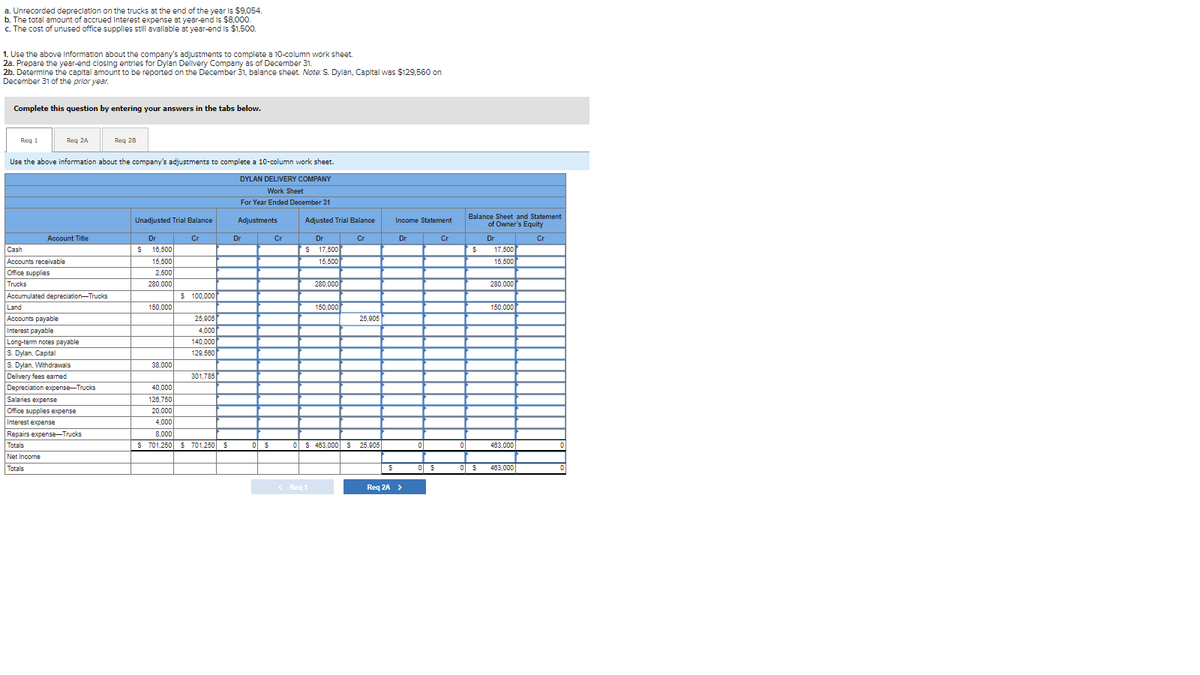

a. Unrecorded depreciation on the trucks at the end of the year is $9.054. b. The total amount of accrued Interest expense at year-end is $8,000 C. The cost of unused office supples still avallable at year-end is $1.500. 1. Use the above Information about the company's adjustments to complete a 10-column work sheet 2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31. 20. Determine the capital amount to be roported on the December 31, balance sheet. Note. S. Dylan, Capital was $129,560 on December 31 of the prior year. Complete this question by entering your answers in the tabs below. Reg Reg 2A Reg 20 Use the above information about the company's adjustments to complee a 10-column werk sheet. DYLAN DELIVERY COMPANY Work Sheet For Year Ended December 31 Balance Sheet and Statement of Owner's Equity Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Account Tite Dr Cr Dr Cr Dr Cr Dr Cr Dr Cr $ 10.600 Cash Accounts receivable Office supplies Trucks Accumulated depreciaion-Trucks Land Accounts payable S 17.600 16.600 17.600 16.600 2.600 200.000 16.600 200.000 200.000 $ 100.000 160.000 150.000 150 000 26.006 26.005 Interest payable 4.000 Long-tem notes payable S. Dylan, Captal S. Dylan Wthdrawals Delivery fees eamed Depreciation expense-Trucks 140.000 120.600 38.000 301.785 40.000 Salates expense Office supplies epense 120.760 20.000 4,000 8.000 S 701.260 $ 701.250 $ Interest expense Repairs expense-Trvoks Totals Net Income Totals O$ 403.000 $ 26.006 403.000 403.000

a. Unrecorded depreciation on the trucks at the end of the year is $9.054. b. The total amount of accrued Interest expense at year-end is $8,000 C. The cost of unused office supples still avallable at year-end is $1.500. 1. Use the above Information about the company's adjustments to complete a 10-column work sheet 2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31. 20. Determine the capital amount to be roported on the December 31, balance sheet. Note. S. Dylan, Capital was $129,560 on December 31 of the prior year. Complete this question by entering your answers in the tabs below. Reg Reg 2A Reg 20 Use the above information about the company's adjustments to complee a 10-column werk sheet. DYLAN DELIVERY COMPANY Work Sheet For Year Ended December 31 Balance Sheet and Statement of Owner's Equity Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Account Tite Dr Cr Dr Cr Dr Cr Dr Cr Dr Cr $ 10.600 Cash Accounts receivable Office supplies Trucks Accumulated depreciaion-Trucks Land Accounts payable S 17.600 16.600 17.600 16.600 2.600 200.000 16.600 200.000 200.000 $ 100.000 160.000 150.000 150 000 26.006 26.005 Interest payable 4.000 Long-tem notes payable S. Dylan, Captal S. Dylan Wthdrawals Delivery fees eamed Depreciation expense-Trucks 140.000 120.600 38.000 301.785 40.000 Salates expense Office supplies epense 120.760 20.000 4,000 8.000 S 701.260 $ 701.250 $ Interest expense Repairs expense-Trvoks Totals Net Income Totals O$ 403.000 $ 26.006 403.000 403.000

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter15: Financial Statements And Year-end Accounting For A Merchandising Business

Section: Chapter Questions

Problem 10SPB

Related questions

Question

Transcribed Image Text:a. Unrecorded depreclation on the trucks at the end of the year is $9,054.

b. The total amount of accrued Interest expense at year-end is $8.000.

c. The cost of unused office supplies still avallable at year-end is $1,500.

1. Use the above Information about the company's adjustments to complete a 10-column work sheet.

2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31.

2b. Determine the capital amount to be reported on the December 31, balance sheet. Note: S. Dylan, Capital was $129,560 on

December 31 of the prior year.

Complete this question by entering your answers in the tabs below.

Req 1

Req 2A

Req 28

Use the above information about the company's adjustments to complete a 10-column work sheet.

DYLAN DELIVERY COMPANY

Work Sheet

For Year Ended December 31

Adjusted Trial Balance

Balance Sheet and Statement

of Owner's Equity

Unadjusted Trial Balance

Adjustments

Income Statement

Account Title

Dr

Cr

Dr

Cr

Dr

Cr

Dr

Cr

Dr

Cr

Cash

16,500

S 17,500

17,500

Accounts receivable

15,500

15,500

15,500

Office supplies

2,500

280,000

Trucks

Accumulated depreciation-Trucks

280,000

280,000

$ 100,000

150,000

150,000

Land

Accounts payable

150,000

25,905

25,905

Interest payable

4,000

Long-tem notes payable

S. Dylan, Capital

S. Dylan, Withdrawals

140,000

129,500

38,000

Delivery fees earned

301,785

Depreciation expense-Trucks

Salaries expense

40,000

126,750

Office supplies expense

20,000

Interest expense

4,000

Repairs expense-Trucks

8,000

Totals

S 701,250 $ 701,250 5

이 $

O$ 463,000 $ 25,905

ol

483,000

Net Income

Totals

이 $

이 $

463.000

< Reg 1

Reg 2A >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning