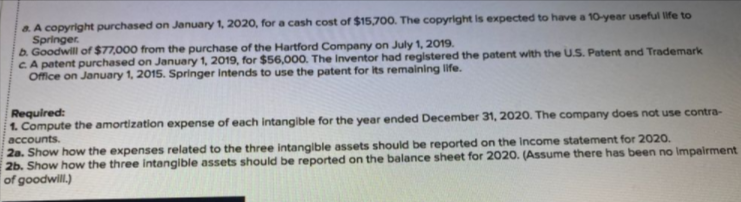

a. A copyright purchased on January 1, 2020, for a cash cost of $15,70O. The copyright is expected to have a 10-year useful life to Springer. b. Goodwill of $77,000 from the purchase of the Hartford Company on July 1, 2019. CA patent purchased on January 1, 2019, for $56,000. The Inventor had registered the patent with the U.S. Patent and Trademark Office on January 1, 2015. Springer Intends to use the patent for its remaining life. Required: 1. Compute the amortization expense of each intangible for the year ended December 31, 2020. The company does not use contra- accounts. 2a. Show how the expenses related to the three intangible assets should be reported on the Income statement for 2020. 2b. Show how the three intangible assets should be reported on the balance sheet for 2020. (Assume there has been no Impairment of goodwill.)

a. A copyright purchased on January 1, 2020, for a cash cost of $15,70O. The copyright is expected to have a 10-year useful life to Springer. b. Goodwill of $77,000 from the purchase of the Hartford Company on July 1, 2019. CA patent purchased on January 1, 2019, for $56,000. The Inventor had registered the patent with the U.S. Patent and Trademark Office on January 1, 2015. Springer Intends to use the patent for its remaining life. Required: 1. Compute the amortization expense of each intangible for the year ended December 31, 2020. The company does not use contra- accounts. 2a. Show how the expenses related to the three intangible assets should be reported on the Income statement for 2020. 2b. Show how the three intangible assets should be reported on the balance sheet for 2020. (Assume there has been no Impairment of goodwill.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 76APSA

Related questions

Question

Transcribed Image Text:a. A copyright purchased on January 1, 2020, for a cash cost of $15,70O. The copyright is expected to have a 10-year useful life to

Springer.

b. Goodwill of $77,000 from the purchase of the Hartford Company on July 1, 2019.

CA patent purchased on January 1, 2019, for $56,000. The Inventor had registered the patent with the U.S. Patent and Trademark

Office on January 1, 2015. Springer Intends to use the patent for its remaining life.

Required:

1. Compute the amortization expense of each intangible for the year ended December 31, 2020. The company does not use contra-

accounts.

2a. Show how the expenses related to the three intangible assets should be reported on the Income statement for 2020.

2b. Show how the three intangible assets should be reported on the balance sheet for 2020. (Assume there has been no Impairment

of goodwill.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT