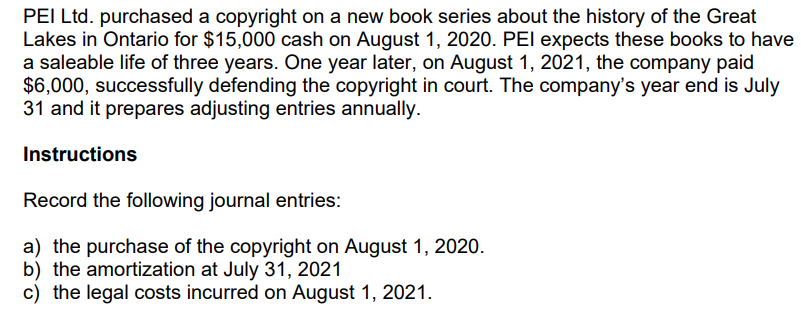

PEI Ltd. purchased a copyright on a new book series about the history of the Great Lakes in Ontario for $15,000 cash on August 1, 2020. PEI expects these books to have a saleable life of three years. One year later, on August 1, 2021, the company paid $6,000, successfully defending the copyright in court. The company's year end is July 31 and it prepares adjusting entries annually. Instructions Record the following journal entries: a) the purchase of the copyright on August 1, 2020. b) the amortization at July 31, 2021 c) the legal costs incurred on August 1, 2021.

PEI Ltd. purchased a copyright on a new book series about the history of the Great Lakes in Ontario for $15,000 cash on August 1, 2020. PEI expects these books to have a saleable life of three years. One year later, on August 1, 2021, the company paid $6,000, successfully defending the copyright in court. The company's year end is July 31 and it prepares adjusting entries annually. Instructions Record the following journal entries: a) the purchase of the copyright on August 1, 2020. b) the amortization at July 31, 2021 c) the legal costs incurred on August 1, 2021.

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 62P

Related questions

Question

Please show calculations, thank you.

Transcribed Image Text:PEI Ltd. purchased a copyright on a new book series about the history of the Great

Lakes in Ontario for $15,000 cash on August 1, 2020. PEI expects these books to have

a saleable life of three years. One year later, on August 1, 2021, the company paid

$6,000, successfully defending the copyright in court. The company's year end is July

31 and it prepares adjusting entries annually.

Instructions

Record the following journal entries:

a) the purchase of the copyright on August 1, 2020.

b) the amortization at July 31, 2021

c) the legal costs incurred on August 1, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT