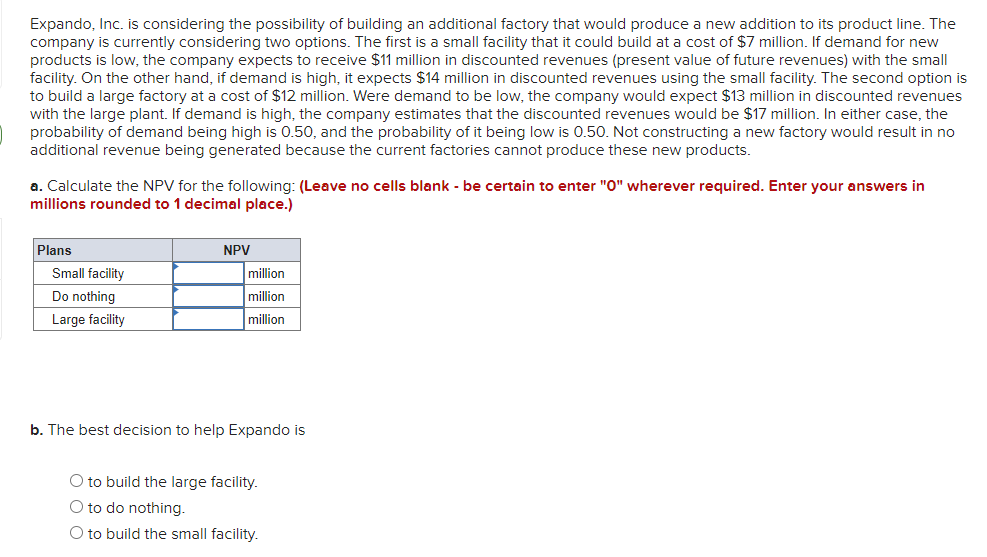

Expando, Inc. is considering the possibility of building an additional factory that would produce a new addition to its product line. The company is currently considering two options. The first is a small facility that it could build at a cost of $7 million. If demand for new products is low, the company expects to receive $11 million in discounted revenues (present value of future revenues) with the small facility. On the other hand, if demand is high, it expects $14 million in discounted revenues using the small facility. The second option i to build a large factory at a cost of $12 million. Were demand to be low, the company would expect $13 million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be $17 million. In either case, the probability of demand being high is 0.50, and the probability of it being low is 0.50. Not constructing a new factory would result in no additional revenue being generated because the current factories cannot produce these new products. a. Calculate the NPV for the following: (Leave no cells blank - be certain to enter "O" wherever required. Enter your answers in millions rounded to 1 decimal place.) Plans NPV Small facility million Do nothing million Large facility million b. The best decision to help Expando is to build the large facility. O to do nothing.

Expando, Inc. is considering the possibility of building an additional factory that would produce a new addition to its product line. The company is currently considering two options. The first is a small facility that it could build at a cost of $7 million. If demand for new products is low, the company expects to receive $11 million in discounted revenues (present value of future revenues) with the small facility. On the other hand, if demand is high, it expects $14 million in discounted revenues using the small facility. The second option i to build a large factory at a cost of $12 million. Were demand to be low, the company would expect $13 million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be $17 million. In either case, the probability of demand being high is 0.50, and the probability of it being low is 0.50. Not constructing a new factory would result in no additional revenue being generated because the current factories cannot produce these new products. a. Calculate the NPV for the following: (Leave no cells blank - be certain to enter "O" wherever required. Enter your answers in millions rounded to 1 decimal place.) Plans NPV Small facility million Do nothing million Large facility million b. The best decision to help Expando is to build the large facility. O to do nothing.

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter15: Decision Analysis

Section: Chapter Questions

Problem 10P: Hemmingway, Inc. is considering a $5 million research and development (R&D) project. Profit...

Related questions

Question

100%

Transcribed Image Text:Expando, Inc. is considering the possibility of building an additional factory that would produce a new addition to its product line. The

company is currently considering two options. The first is a small facility that it could build at a cost of $7 million. If demand for new

products is low, the company expects to receive $11 million in discounted revenues (present value of future revenues) with the small

facility. On the other hand, if demand is high, it expects $14 million in discounted revenues using the small facility. The second option is

to build a large factory at a cost of $12 million. Were demand to be low, the company would expect $13 million in discounted revenues

with the large plant. If demand is high, the company estimates that the discounted revenues would be $17 million. In either case, the

probability of demand being high is 0.50, and the probability of it being low is 0.50. Not constructing a new factory would result in no

additional revenue being generated because the current factories cannot produce these new products.

a. Calculate the NPV for the following: (Leave no cells blank - be certain to enter "O" wherever required. Enter your answers in

millions rounded to 1 decimal place.)

Plans

NPV

Small facility

million

Do nothing

million

Large facility

million

b. The best decision to help Expando is

O to build the large facility.

O to do nothing.

O to build the small facility.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,