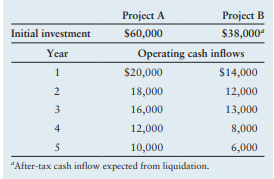

Expansion versus replacement cash flows Stable Nuclear Plant Corporation has estimated the cash flows over the 5-year lives for two projects, A and B. These cash flows are summarized in the table below. If project A were actually a replacement for project B and the $38,000 initial investment shown for project B were the after-tax cash inflow expected from liquidating it, what would be the relevant cash flows for this replacement decision? How can an expansion decision such as project A be viewed as a special form of a replacement decision? Explain.

Expansion versus replacement cash flows Stable Nuclear Plant Corporation has estimated the cash flows over the 5-year lives for two projects, A and B. These cash flows are summarized in the table below. If project A were actually a replacement for project B and the $38,000 initial investment shown for project B were the after-tax cash inflow expected from liquidating it, what would be the relevant cash flows for this replacement decision? How can an expansion decision such as project A be viewed as a special form of a replacement decision? Explain.

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 9EP

Related questions

Question

Expansion versus replacement cash flows Stable Nuclear Plant Corporation has estimated the cash flows over the 5-year lives for two projects, A and B. These cash flows are summarized in the table below.

- If project A were actually a replacement for project B and the $38,000 initial investment shown for project B were the after-tax

cash inflow expected from liquidating it, what would be the relevant cash flows for this replacement decision? - How can an expansion decision such as project A be viewed as a special form of a replacement decision? Explain.

Transcribed Image Text:Project A

Project B

Initial investment

S60,000

$38,000

Year

Operating cash inflows

1

$20,000

$14,000

2

18,000

12,000

3

16,000

13,000

4

12,000

8,000

5

10,000

6,000

"After-tax cash inflow expected from liquidation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning