expect to pay $14,000 tithing and $8,0 taxes for the next few years (these are their only itemized deductions). How much would bunching save them over the course of two years if their marginal tax rate is 22% ? (The standard deduction for a married filing jointly taxpayer is $24,000.)

expect to pay $14,000 tithing and $8,0 taxes for the next few years (these are their only itemized deductions). How much would bunching save them over the course of two years if their marginal tax rate is 22% ? (The standard deduction for a married filing jointly taxpayer is $24,000.)

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 44P

Related questions

Question

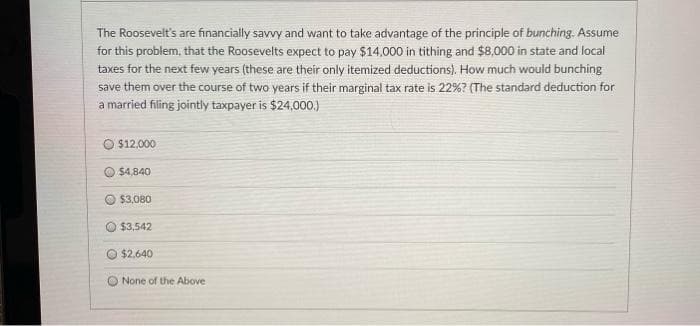

Transcribed Image Text:The Roosevelt's are financially savvy and want to take advantage of the principle of bunching. Assume

for this problem, that the Roosevelts expect to pay $14,000 in tithing and $8,000 in state and local

taxes for the next few years (these are their only itemized deductions). How much would bunching

save them over the course of two years if their marginal tax rate is 22%? (The standard deduction for

a married filing jointly taxpayer is $24,000.)

$12,000

$4,840

$3,080

$3,542

$2,640

O None of the Above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT