Expected return and standard deviation. Use the following information to answer the questions: a. What is the expected return of each asset? b. What is the variance of each asset? c. What is the standard deviation of each asset? Hint: Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phra answers you will type. Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Return on Asset A in State of Economy Boom Normal Recession Probability of State 0.35 0.51 0.14 State 0.05 0.05 0.05 Return on Asset B in State 0.23 0.08 -0.05 Return on Asset C in State 0.33 0.17 -0.22

Expected return and standard deviation. Use the following information to answer the questions: a. What is the expected return of each asset? b. What is the variance of each asset? c. What is the standard deviation of each asset? Hint: Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phra answers you will type. Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Return on Asset A in State of Economy Boom Normal Recession Probability of State 0.35 0.51 0.14 State 0.05 0.05 0.05 Return on Asset B in State 0.23 0.08 -0.05 Return on Asset C in State 0.33 0.17 -0.22

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter8: Time Series Analysis And_forecasting

Section: Chapter Questions

Problem 18P: Consider the following time series:

Construct a time series plot. What type of pattern exists in...

Related questions

Question

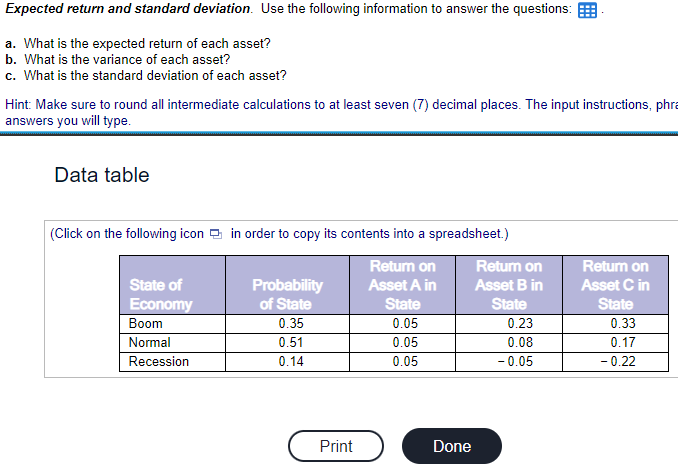

Transcribed Image Text:Expected return and standard deviation. Use the following information to answer the questions:

a. What is the expected return of each asset?

b. What is the variance of each asset?

c. What is the standard deviation of each asset?

Hint: Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phra

answers you will type.

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Return on

Asset A in

State of

Economy

Boom

Normal

Recession

Probability

of State

0.35

0.51

0.14

Print

State

0.05

0.05

0.05

Done

Return on

Asset B in

State

0.23

0.08

-0.05

Return on

Asset C in

State

0.33

0.17

-0.22

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning