Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.11E

Related questions

Question

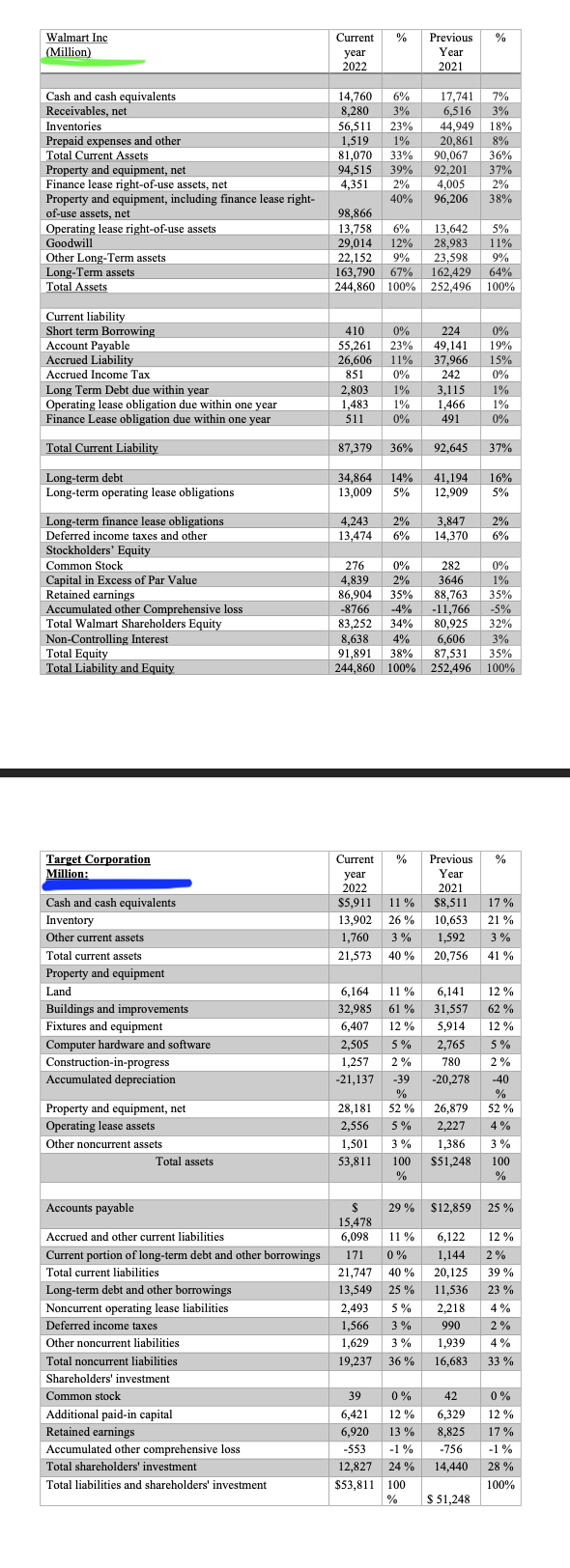

Is the debt primarily short-term or long-term? Why?

Transcribed Image Text:Walmart Inc

(Million)

Cash and cash equivalents

Receivables, net

Inventories

Prepaid expenses and other

Total Current Assets

Property and equipment, net

Finance lease right-of-use assets, net

Property and equipment, including finance lease right-

of-use assets, net

Operating lease right-of-use assets

Goodwill

Other Long-Term assets.

Long-Term assets

Total Assets

Current liability

Short term Borrowing

Account Payable

Accrued Liability

Accrued Income Tax

Long Term Debt due within year

Operating lease obligation due within one year

Finance Lease obligation due within one year

Total Current Liability

Long-term debt

Long-term operating lease obligations

Long-term finance lease obligations

Deferred income taxes and other

Stockholders' Equity

Common Stock

Capital in Excess of Par Value

Retained earnings

Accumulated other Comprehensive loss

Total Walmart Shareholders Equity

Non-Controlling Interest

Total Equity

Total Liability and Equity

Target Corporation

Million:

Cash and cash equivalents

Inventory

Other current assets

Total current assets

Property and equipment

Land

Buildings and improvements

Fixtures and equipment

Computer hardware and software

Construction-in-progress

Accumulated depreciation

Property and equipment, net

Operating lease assets

Other noncurrent assets

Total assets

Accounts payable

Accrued and other current liabilities

Current portion of long-term debt and other borrowings

Total current liabilities

Long-term debt and other borrowings

Noncurrent operating lease liabilities

Deferred income taxes

Other noncurrent liabilities

Total noncurrent liabilities

Shareholders' investment

Common stock

Additional paid-in capital

Retained earnings

Accumulated other comprehensive loss

Total shareholders' investment

Total liabilities and shareholders' investment

Current

year

2022

14,760

8.280

%

6%

3%

56,511

23%

1,519 1%

81,070 33%

90,067

94,515 39% 92,201

4.351 2% 4,005 2%

40%

96,206

38%

87,379

34,864 14%

13,009

5%

98,866

13,758 6% 13,642

5%

29,014 12%

28,983

11%

22,152 9%

23,598

9%

163,790 67%

162,429

64%

244,860 100% 252,496 100%

410 0%

224

55,261 23% 49,141

26,606

11% 37,966

851

0%

242

2,803

1%

1,483 1%

511

0%

4,243 2%

13,474

6%

83,252

8,638

91,891

244,860

276 0%

4.839 2%

36%

HH:

Previous %

Year

2021

17,741 7%

6,516 3%

44,949 18%

20,861

8%

$

15,478

6,098

3,115

1,466

491

92,645

41,194

12,909

29%

3,847

14,370

282

3646

6,164 11% 6,141

32,985 61% 31,557

6,407

12%

5,914

2,505

5%

1,257 2%

-21,137

-39

%

28,181 52%

0%

1%

86,904 35% 88,763 35%

-8766 -4% -11,766

-5%

32%

34% 80,925

4% 6,606

3%

38% 87,531 35%

100% 252,496 100%

2,765

780

-20,278

36%

37%

$12,859

11% 6,122

Current % Previous %

year

Year

2022

2021

$5,911 11% $8,511 17%

13,902 26%

10,653

21%

1,760 3% 1,592 3%

21,573 40% 20,756 41%

0%

19%

15%

0%

1%

1%

0%

37%

2,218

990

16%

5%

26,879

2,556 5% 2,227 4%

1,501

3%

1,386

3%

53,811

100

$51,248

100

%

%

2%

6%

$ 51,248

12%

62 %

12%

5%

2%

-40

%

52%

12%

2%

1,144

20,125 39%

23 %

11,536

25 %

171 0%

21,747 40%

13,549 25 %

2,493 5%

1,566 3%

1,629 3% 1,939

19,237 36% 16,683 33%

4%

2%

4%

0%

39 0% 42

6,421 12% 6,329

12%

6,920 13 % 8,825 17%

-553 -1% -756 -1%

12,827 24% 14,440

28%

$53,811 100

100%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub