Explain to Daniel how the date of commencement of his business is determined and what tax implications that this might have on him. i) Illustrate, with examples, how the period chosen for Daniel's first accounting period affects the determination of his tax basis periods. He will close his accounts on 31 December.

Explain to Daniel how the date of commencement of his business is determined and what tax implications that this might have on him. i) Illustrate, with examples, how the period chosen for Daniel's first accounting period affects the determination of his tax basis periods. He will close his accounts on 31 December.

Chapter3: Business Income And Expenses

Section: Chapter Questions

Problem 21P: Cindy operates a computerized engineering drawing business from her home. Cindy maintains a home...

Related questions

Question

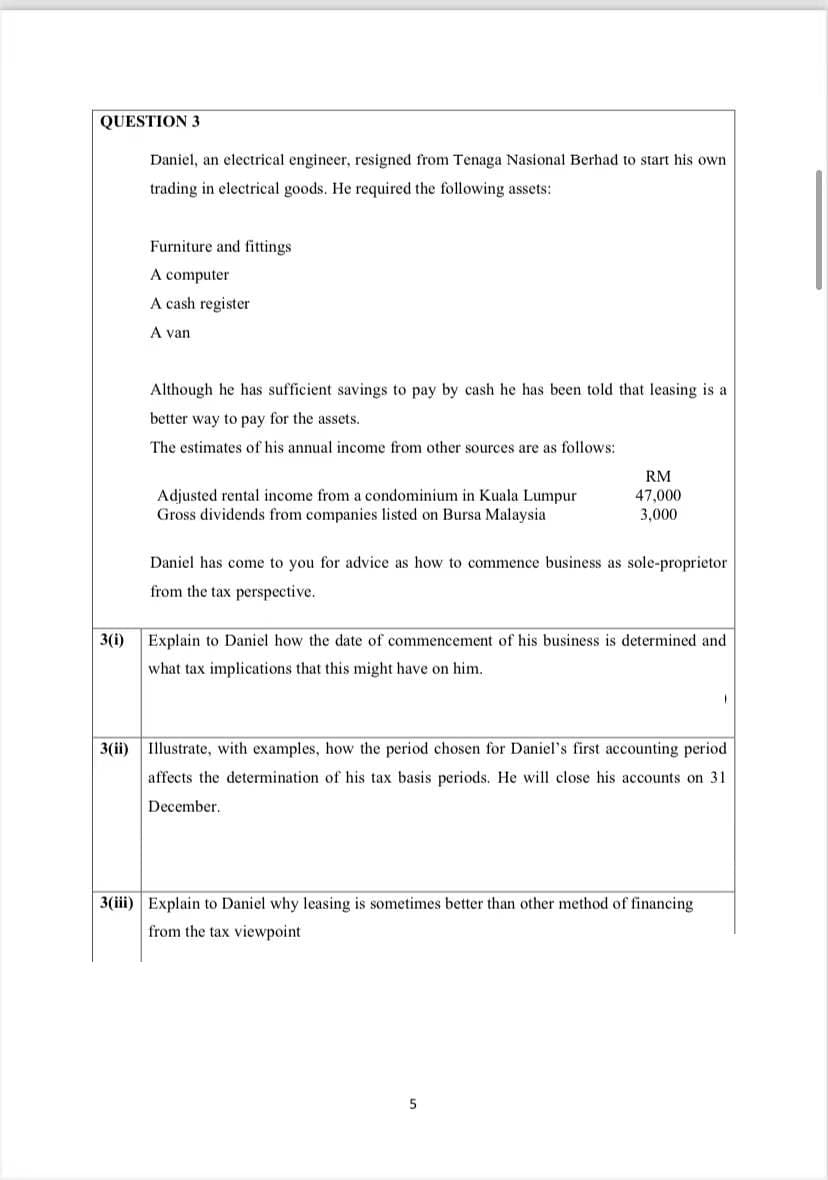

Transcribed Image Text:QUESTION 3

Daniel, an electrical engineer, resigned from Tenaga Nasional Berhad to start his own

trading in electrical goods. He required the following assets:

Furniture and fittings

A computer

A cash register

A van

Although he has sufficient savings to pay by cash he has been told that leasing is a

better way to pay for the assets.

The estimates of his annual income from other sources are as follows:

RM

Adjusted rental income from a condominium in Kuala Lumpur

Gross dividends from companies listed on Bursa Malaysia

47,000

3,000

Daniel has come to you for advice as how to commence business as sole-proprietor

from the tax perspective.

3(i)

Explain to Daniel how the date of commencement of his business is determined and

what tax implications that this might have on him.

3(ii) Illustrate, with examples, how the period chosen for Daniel's first accounting period

affects the determination of his tax basis periods. He will close his accounts on 31

December.

3(iii) Explain to Daniel why leasing is sometimes better than other method of financing

from the tax viewpoint

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning