Aliya files her current year tax return on June 18 of the following year. On October 8 she pays the amount due, if any, without requesting an extension. The tax shown on her return is $30,000. Aliya pays no estimated taxes and claims no tax credits on her current year return. Read the requirements. Requirement a. What penalties will the IRS likely impose on Aliya (ignoring the penalty for underpayment of estimated taxes)? On what dollar amount, and for how many days, will Aliya owe interest? Assume Aliya committed no fraud and that any penalty and interest period begins on April 16. Assume her wage withholding tax amounts to $23,000. Complete the table below to show the penalties that the IRS will likely impose on Aliya. Minus: Total penalties Aliya owes interest on for | days. Whot il the IDS ike

Aliya files her current year tax return on June 18 of the following year. On October 8 she pays the amount due, if any, without requesting an extension. The tax shown on her return is $30,000. Aliya pays no estimated taxes and claims no tax credits on her current year return. Read the requirements. Requirement a. What penalties will the IRS likely impose on Aliya (ignoring the penalty for underpayment of estimated taxes)? On what dollar amount, and for how many days, will Aliya owe interest? Assume Aliya committed no fraud and that any penalty and interest period begins on April 16. Assume her wage withholding tax amounts to $23,000. Complete the table below to show the penalties that the IRS will likely impose on Aliya. Minus: Total penalties Aliya owes interest on for | days. Whot il the IDS ike

Chapter12: Tax Administration And Tax Planning

Section: Chapter Questions

Problem 3P

Related questions

Question

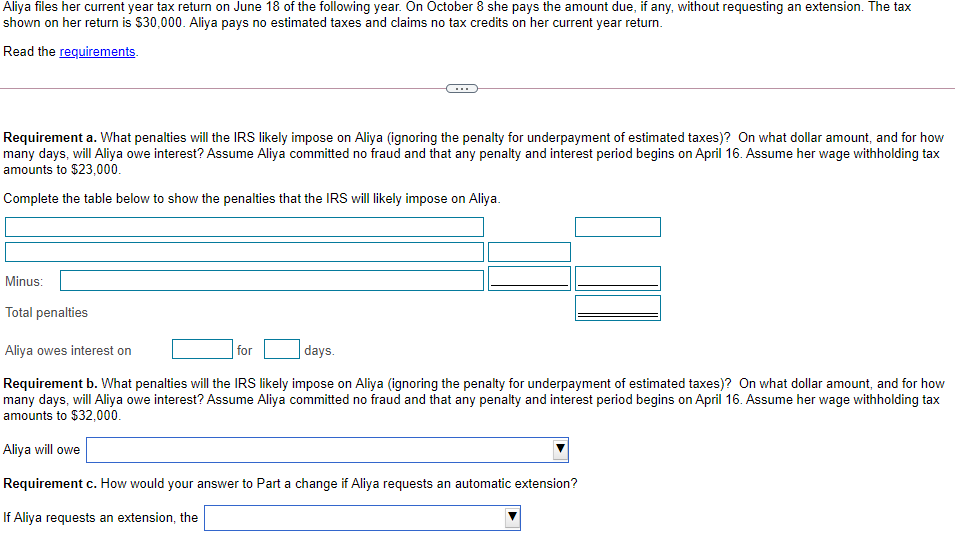

Transcribed Image Text:Aliya files her current year tax return on June 18 of the following year. On October 8 she pays the amount due, if any, without requesting an extension. The tax

shown on her return is $30,000. Aliya pays no estimated taxes and claims no tax credits on her current year return.

Read the requirements.

Requirement a. What penalties will the IRS likely impose on Aliya (ignoring the penalty for underpayment of estimated taxes)? On what dollar amount, and for how

many days, will Aliya owe interest? Assume Aliya committed no fraud and that any penalty and interest period begins on April 16. Assume her wage withholding tax

amounts to $23,000.

Complete the table below to show the penalties that the IRS will likely impose on Aliya.

Minus:

Total penalties

Aliya owes interest on

for

days.

Requirement b. What penalties will the IRS likely impose on Aliya (ignoring the penalty for underpayment of estimated taxes)? On what dollar amount, and for how

many days, will Aliya owe interest? Assume Aliya committed no fraud and that any penalty and interest period begins on April 16. Assume her wage withholding tax

amounts to $32,000.

Aliya will owe

Requirement c. How would your answer to Part a change if Aliya requests an automatic extension?

If Aliya requests an extension, the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT