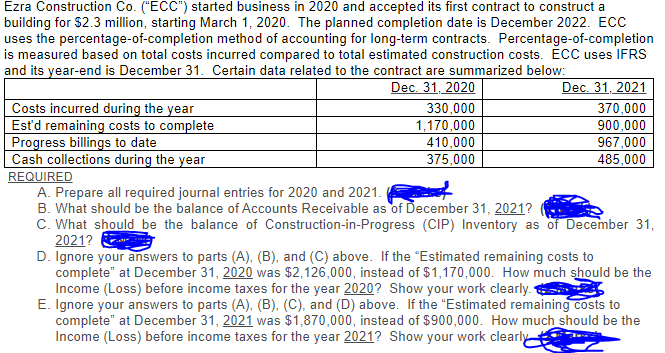

Ezra Construction Co. ("ECC") started business in 2020 and accepted its first contract to construct a building for $2.3 million, starting March 1, 2020. The planned completion date is December 2022. ECC uses the percentage-of-completion method of accounting for long-term contracts. Percentage-of-completion is measured based on total costs incurred compared to total estimated construction costs. ECC uses IFRS and its year-end is December 31. Certain data related to the contract are summarized below: Dec. 31, 2020 Dec. 31, 2021 370,000 Costs incurred during the year Est'd remaining costs to complete Progress billings to date Cash collections during the year 330,000 1,170,000 410,000 375,000 900,000 967,000 485,000 REQUIRED A. Prepare all required journal entries for 2020 and 2021. B. What should be the balance of Accounts Receivable as of December 31, 2021? C. What should be the balance of Construction-in-Progress (CIP) Inventory as of December 31, 2021? D. Ignore your answers to parts (A), (B), and (C) above. If the "Estimated remaining costs to complete" at December 31, 2020 was $2,126,000, instead of $1,170,000. How much should be the Income (Loss) before income taxes for the year 2020? Show your work clearly. E. Ignore your answers to parts (A), (B), (C), and (D) above. If the "Estimated remaining costs to complete" at December 31, 2021 was $1,870,000, instead of $900,000. How much should be the Income (Loss) before income taxes for the year 2021? Show your work clearly

Ezra Construction Co. ("ECC") started business in 2020 and accepted its first contract to construct a building for $2.3 million, starting March 1, 2020. The planned completion date is December 2022. ECC uses the percentage-of-completion method of accounting for long-term contracts. Percentage-of-completion is measured based on total costs incurred compared to total estimated construction costs. ECC uses IFRS and its year-end is December 31. Certain data related to the contract are summarized below: Dec. 31, 2020 Dec. 31, 2021 370,000 Costs incurred during the year Est'd remaining costs to complete Progress billings to date Cash collections during the year 330,000 1,170,000 410,000 375,000 900,000 967,000 485,000 REQUIRED A. Prepare all required journal entries for 2020 and 2021. B. What should be the balance of Accounts Receivable as of December 31, 2021? C. What should be the balance of Construction-in-Progress (CIP) Inventory as of December 31, 2021? D. Ignore your answers to parts (A), (B), and (C) above. If the "Estimated remaining costs to complete" at December 31, 2020 was $2,126,000, instead of $1,170,000. How much should be the Income (Loss) before income taxes for the year 2020? Show your work clearly. E. Ignore your answers to parts (A), (B), (C), and (D) above. If the "Estimated remaining costs to complete" at December 31, 2021 was $1,870,000, instead of $900,000. How much should be the Income (Loss) before income taxes for the year 2021? Show your work clearly

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 41P

Related questions

Question

Transcribed Image Text:Ezra Construction Co. ("ECC") started business in 2020 and accepted its first contract to construct a

building for $2.3 million, starting March 1, 2020. The planned completion date is December 2022. ECC

uses the percentage-of-completion method of accounting for long-term contracts. Percentage-of-completion

is measured based on total costs incurred compared to total estimated construction costs. ECC uses IFRS

and its year-end is December 31. Certain data related to the contract are summarized below:

Dec. 31, 2020

Dec. 31, 2021

Costs incurred during the year

Est'd remaining costs to complete

Progress billings to date

Cash collections during the year

330,000

370,000

900,000

967,000

485,000

1,170,000

410,000

375,000

REQUIRED

A. Prepare all required journal entries for 2020 and 2021.

B. What should be the balance of Accounts Receivable as of December 31, 2021?

C. What should be the balance of Construction-in-Progress (CIP) Inventory as of December 31,

2021?

D. Ignore your answers to parts (A), (B), and (C) above. If the "Estimated remaining costs to

complete" at December 31, 2020 was $2,126,000, instead of $1,170,000. How much should be the

Income (Loss) before income taxes for the year 2020? Show your work clearly.

E. Ignore your answers to parts (A), (B), (C), and (D) above. If the "Estimated remaining costs to

complete" at December 31, 2021 was $1,870,000, instead of $900,000. How much should be the

Income (Loss) before income taxes for the year 2021? Show your work clearly

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT