EzTech, a calendar year accrual basis corporation, generated $994,300 ordinary income from its business this year. It also sold the following assets, all of which were held for more than 12 months: Accumulated Initial Basis Depreciation* Machinery $ 97,500 $ 39,660 Office equipment Warehouse Sale Price $ 70,000 57,500 125,000 50,000 12,470 163,500 21,620 72,700 n/a Investment securities Investment land 83,100 350,000 n/a 328,000 *Through date of sale. EzTech used the straight-line method to calculate depreciation on the warehouse and has no nonrecaptured Section 1231 losses. Required: a. Compute EzTech's taxable income. b. Recompute taxable income assuming that EzTech used the land in its business instead of holding it for investment. Complete this question by entering your answers in the tabs below. Required A Required B Compute EzTech's taxable income. Taxable income < Required A Required B

EzTech, a calendar year accrual basis corporation, generated $994,300 ordinary income from its business this year. It also sold the following assets, all of which were held for more than 12 months: Accumulated Initial Basis Depreciation* Machinery $ 97,500 $ 39,660 Office equipment Warehouse Sale Price $ 70,000 57,500 125,000 50,000 12,470 163,500 21,620 72,700 n/a Investment securities Investment land 83,100 350,000 n/a 328,000 *Through date of sale. EzTech used the straight-line method to calculate depreciation on the warehouse and has no nonrecaptured Section 1231 losses. Required: a. Compute EzTech's taxable income. b. Recompute taxable income assuming that EzTech used the land in its business instead of holding it for investment. Complete this question by entering your answers in the tabs below. Required A Required B Compute EzTech's taxable income. Taxable income < Required A Required B

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 21P

Related questions

Question

100%

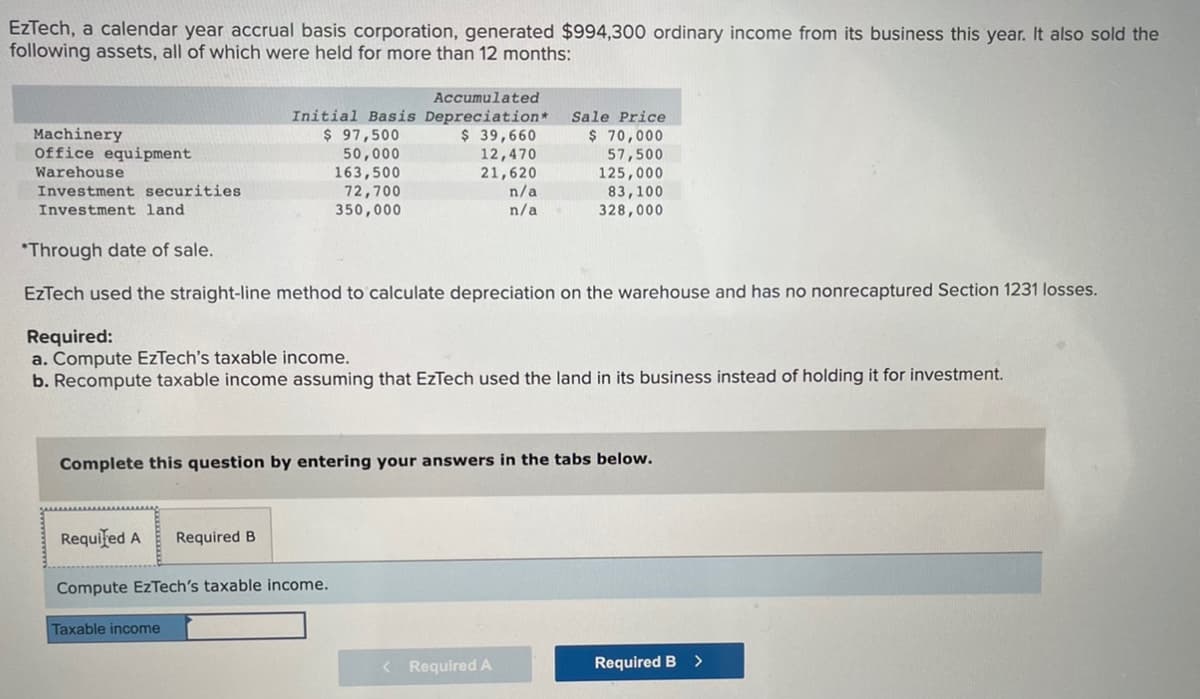

EzTech, a calendar year accrual basis corporation, generated $994,300 ordinary income from its business this year. It also sold the

following assets, all of which were held for more than 12 months:

Machinery

Office equipment

Warehouse

Investment securities

Investment land

Accumulated

Initial Basis Depreciation *

$ 97,500

$ 39,660

50,000

12,470

163,500

21,620

72.700

n/a

350,000

n/a

Sale Price

$

70,000

57,500

125,000

83,100

328,000

*Through date of sale.

EzTech used the straight-line method to calculate depreciation on the warehouse and has no nonrecaptured Section 1231 losses.

Required:

a. Compute EzTech's taxable income.

b. Recompute taxable income assuming that EzTech used the land in its business instead of holding it for investment.

Transcribed Image Text:EzTech, a calendar year accrual basis corporation, generated $994,300 ordinary income from its business this year. It also sold the

following assets, all of which were held for more than 12 months:

Accumulated

Initial Basis Depreciation*

Machinery

$ 97,500

$ 39,660

Sale Price

$ 70,000

57,500

Office equipment

Warehouse

50,000

12,470

163,500

21,620

125,000

72,700

n/a

Investment securities

Investment land

83,100

350,000

n/a

328,000

*Through date of sale.

EzTech used the straight-line method to calculate depreciation on the warehouse and has no nonrecaptured Section 1231 losses.

Required:

a. Compute EzTech's taxable income.

b. Recompute taxable income assuming that EzTech used the land in its business instead of holding it for investment.

Complete

question

entering your answers in the tabs below.

Required A Required B

Compute EzTech's taxable income.

Taxable income

< Required A

Required B >

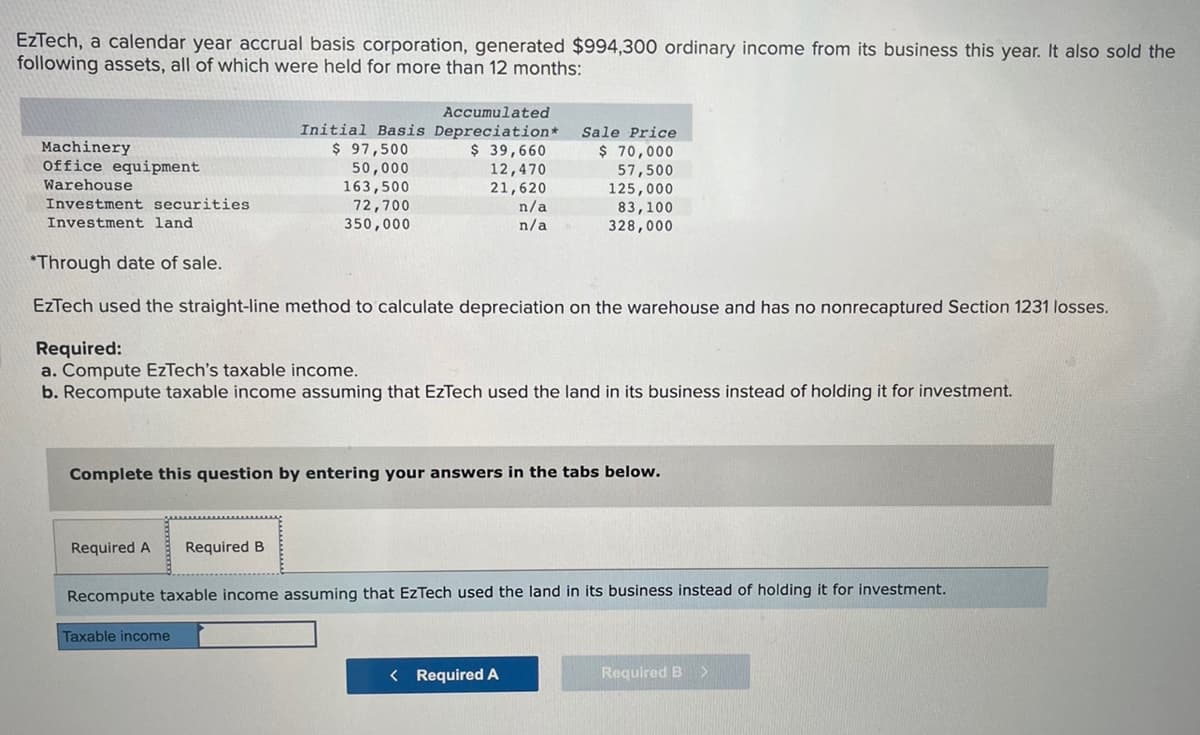

Transcribed Image Text:EzTech, a calendar year accrual basis corporation, generated $994,300 ordinary income from its business this year. It also sold the

following assets, all of which were held for more than 12 months:

Accumulated

Initial Basis Depreciation*

Sale Price

Machinery

$ 97,500

$ 39,660

office equipment

Warehouse

$ 70,000

57,500

12,470

50,000

163,500

21,620

125,000

72,700

n/a

Investment securities

Investment land

83,100

350,000

n/a

328,000

*Through date of sale.

EzTech used the straight-line method to calculate depreciation on the warehouse and has no nonrecaptured Section 1231 losses.

Required:

a. Compute EzTech's taxable income.

b. Recompute taxable income assuming that EzTech used the land in its business instead of holding it for investment.

Complete this question by entering your answers in the tabs below.

Required A Required B

Recompute taxable income assuming that EzTech used the land in its business instead of holding it for investment.

Taxable income

< Required A

Required B

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning