f. Purchased 7,500 shares of Solstice Corp. at $40 per share plus a $150 brokerage commission. The investment is classified as an available-for-sale investment. Description Debit Credit g. Purchased 8,000 shares of treasury common stock at $33 per share. Description Debit Credit h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for $24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. Description Debit Credit i. Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. Description Debit Credit

f. Purchased 7,500 shares of Solstice Corp. at $40 per share plus a $150 brokerage commission. The investment is classified as an available-for-sale investment. Description Debit Credit g. Purchased 8,000 shares of treasury common stock at $33 per share. Description Debit Credit h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for $24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. Description Debit Credit i. Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. Description Debit Credit

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 80IIP

Related questions

Question

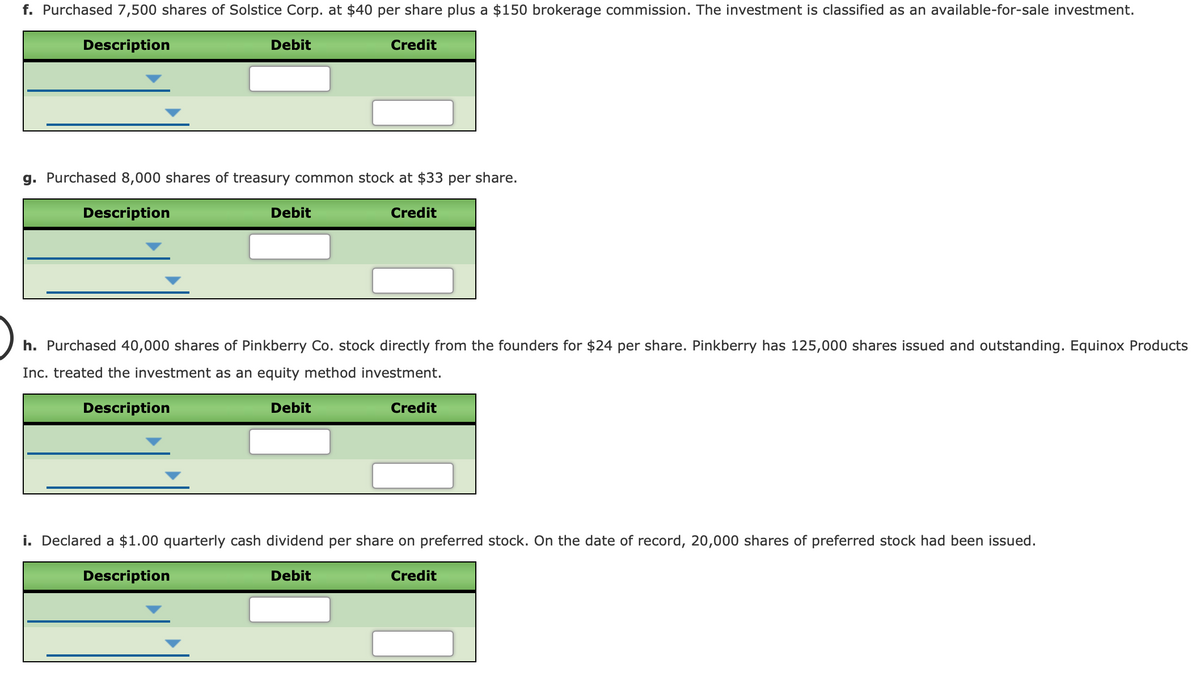

Transcribed Image Text:f. Purchased 7,500 shares of Solstice Corp. at $40 per share plus a $150 brokerage commission. The investment is classified as an available-for-sale investment.

Description

Debit

Credit

g. Purchased 8,000 shares of treasury common stock at $33 per share.

Description

Debit

Credit

h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for $24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products

Inc. treated the investment as an equity method investment.

Description

Debit

Credit

i. Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued.

Description

Debit

Credit

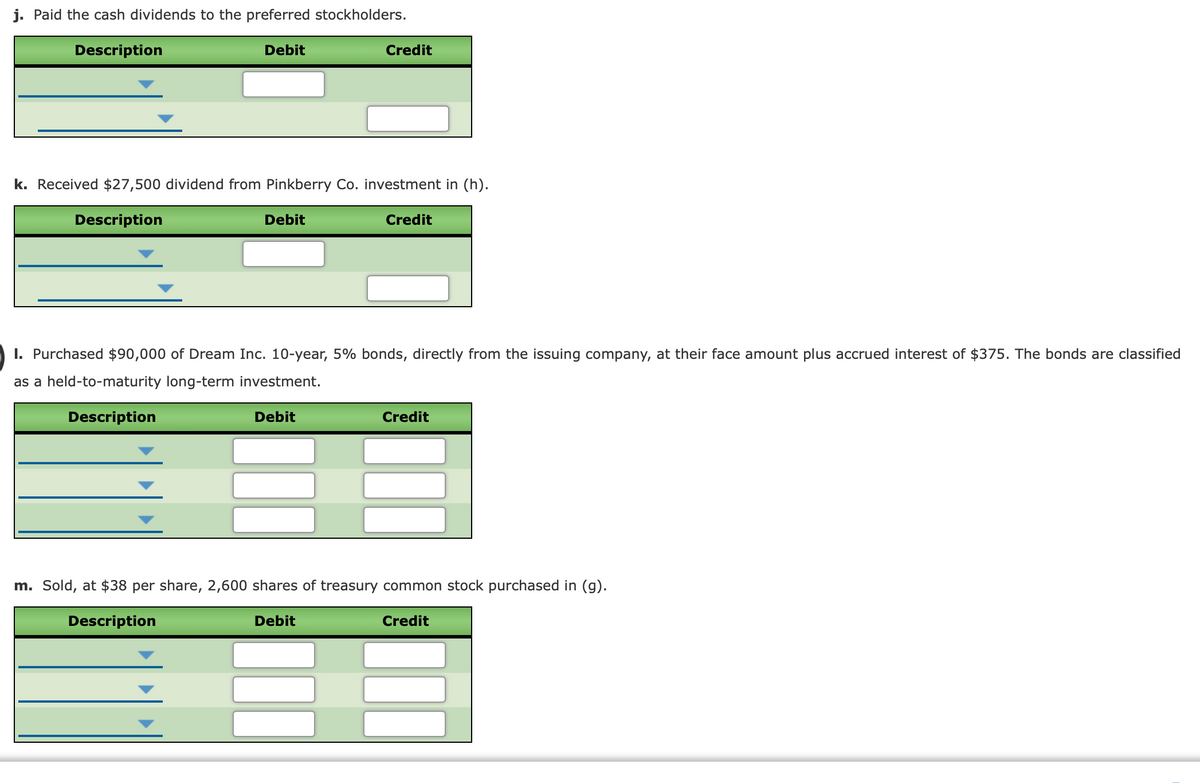

Transcribed Image Text:j. Paid the cash dividends to the preferred stockholders.

Description

Debit

Credit

k. Received $27,500 dividend from Pinkberry Co. investment in (h).

Description

Debit

Credit

I. Purchased $90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of $375. The bonds are classified

as a held-to-maturity long-term investment.

Description

Debit

Credit

m. Sold, at $38 per share, 2,600 shares of treasury common stock purchased in (g).

Description

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning