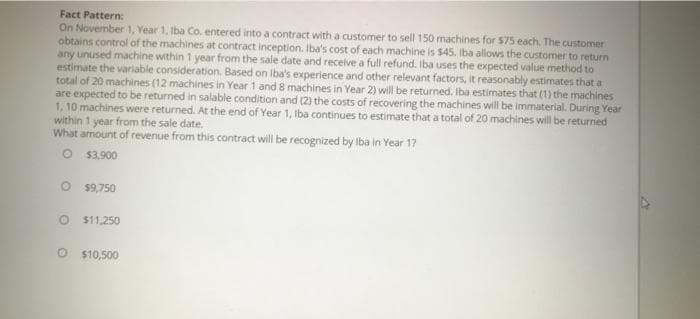

Fact Pattern: On November 1, Year 1, Iba Co. entered into a contract with a customer to sell 150 machines for $75 each. The customer obtains control of the machines at contract inception. Iba's cost of each machine is $45. Iiba allows the customer to return any unused machine within 1 year from the sale date and receive a full refund. Iba uses the expected value method to estimate the variable consideration. Based on Iba's experience and other relevant factors, it reasonably estimates that a total of 20 machines (12 machines in Year 1 and 8 machines in Year 2) will be returned, Iba estimates that (1) the machines are expected to be returned in salable condition and (2) the costs of recovering the machines will be immaterial. During Year 1, 10 machines were returned. At the end of Year 1, Iba continues to estimate that a total of 20 machines will be returned within 1 year from the sale date. What amount of revenue from this contract will be recognized by Iba in Year 17 $3,900 $9,750 $11,250 O $10,500

Fact Pattern: On November 1, Year 1, Iba Co. entered into a contract with a customer to sell 150 machines for $75 each. The customer obtains control of the machines at contract inception. Iba's cost of each machine is $45. Iiba allows the customer to return any unused machine within 1 year from the sale date and receive a full refund. Iba uses the expected value method to estimate the variable consideration. Based on Iba's experience and other relevant factors, it reasonably estimates that a total of 20 machines (12 machines in Year 1 and 8 machines in Year 2) will be returned, Iba estimates that (1) the machines are expected to be returned in salable condition and (2) the costs of recovering the machines will be immaterial. During Year 1, 10 machines were returned. At the end of Year 1, Iba continues to estimate that a total of 20 machines will be returned within 1 year from the sale date. What amount of revenue from this contract will be recognized by Iba in Year 17 $3,900 $9,750 $11,250 O $10,500

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 15E: On January 1, 2019, Piper Company entered into an agreement with Save-Mart to sell its most popular...

Related questions

Question

Transcribed Image Text:Fact Pattern:

On November 1, Year 1, Iba Co. entered into a contract with a customer to sell 150 machines for 575 each. The customer

obtains control of the machines at contract inception. Iba's cost of each machine is $45. Iba allows the customer to return

any unused machine within 1 year from the sale date and recelve a full refund. Iba uses the expected value method to

estimate the variable consideration. Based on Iba's experience and other relevant factors, it reasonably estimates that a

total of 20 machines (12 machines in Year 1 and 8 machines in Year 2) will be returned. Iba estimates that (1) the machines

are expected to be returned in salable condition and (2) the costs of recovering the machines will be immaterial. During Year

1, 10 machines were returned. At the end of Year 1, Iba continues to estimate that a total of 20 machines will be returned

within 1 year from the sale date.

What amount of revenue from this contract will be recognized by Iba in Year 17

$3,900

$9,750

$11,250

O $10,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning