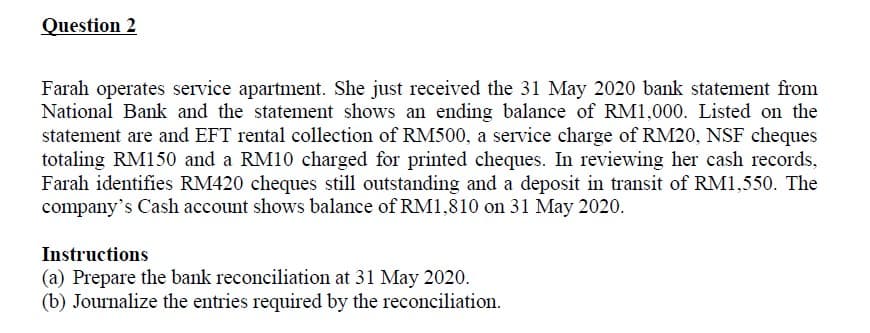

Farah operates service apartment. She just received the 31 May 2020 bank statement from National Bank and the statement shows an ending balance of RM1,000. Listed on the statement are and EFT rental collection of RM500, a service charge of RM20, NSF cheques totaling RM150 and a RM10 charged for printed cheques. In reviewing her cash records, Farah identifies RM420 cheques still outstanding and a deposit in transit of RM1,550. The company's Cash account shows balance of RM1,810 on 31 May 2020. Instructions (a) Prepare the bank reconciliation at 31 May 2020. (b) Journalize the entries required by the reconciliation.

Farah operates service apartment. She just received the 31 May 2020 bank statement from National Bank and the statement shows an ending balance of RM1,000. Listed on the statement are and EFT rental collection of RM500, a service charge of RM20, NSF cheques totaling RM150 and a RM10 charged for printed cheques. In reviewing her cash records, Farah identifies RM420 cheques still outstanding and a deposit in transit of RM1,550. The company's Cash account shows balance of RM1,810 on 31 May 2020. Instructions (a) Prepare the bank reconciliation at 31 May 2020. (b) Journalize the entries required by the reconciliation.

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter4: Managing Your Cash And Savings

Section: Chapter Questions

Problem 6FPE

Related questions

Question

Transcribed Image Text:Question 2

Farah operates service apartment. She just received the 31 May 2020 bank statement from

National Bank and the statement shows an ending balance of RM1,000. Listed on the

statement are and EFT rental collection of RM500, a service charge of RM20, NSF cheques

totaling RM150 and a RM10 charged for printed cheques. In reviewing her cash records,

Farah identifies RM420 cheques still outstanding and a deposit in transit of RM1,550. The

company's Cash account shows balance of RM1,810 on 31 May 2020.

Instructions

(a) Prepare the bank reconciliation at 31 May 2020.

(b) Journalize the entries required by the reconciliation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage