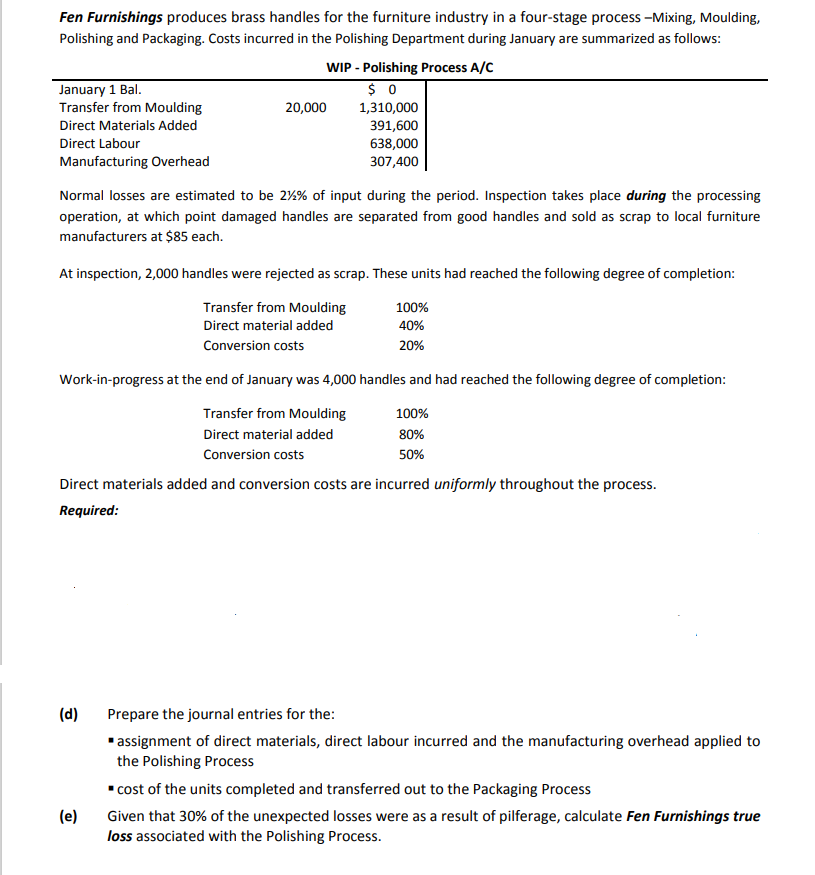

Fen Furnishings produces brass handles for the furniture industry in a four-stage process -Mixing, Moulding, Polishing and Packaging. Costs incurred in the Polishing Department during January are summarized as follows: WIP - Polishing Process A/C January 1 Bal. Transfer from Moulding 20,000 1,310,000 391,600 638,000 307,400 Direct Materials Added Direct Labour Manufacturing Overhead Normal losses are estimated to be 2%% of input during the period. Inspection takes place during the processing operation, at which point damaged handles are separated from good handles and sold as scrap to local furniture manufacturers at $85 each. At inspection, 2,000 handles were rejected as scrap. These units had reached the following degree of completion: Transfer from Moulding 100% Direct material added 40% Conversion costs 20% Work-in-progress at the end of January was 4,000 handles and had reached the following degree of completion: Transfer from Moulding 100% Direct material added 80% Conversion costs 50% Direct materials added and conversion costs are incurred uniformly throughout the process. Required: (d) Prepare the journal entries for the: • assignment of direct materials, direct labour incurred and the manufacturing overhead applied to the Polishing Process * cost of the units completed and transferred out to the Packaging Process (e) Given that 30% of the unexpected losses were as a result of pilferage, calculate Fen Furnishings true loss associated with the Polishing Process.

Fen Furnishings produces brass handles for the furniture industry in a four-stage process -Mixing, Moulding, Polishing and Packaging. Costs incurred in the Polishing Department during January are summarized as follows: WIP - Polishing Process A/C January 1 Bal. Transfer from Moulding 20,000 1,310,000 391,600 638,000 307,400 Direct Materials Added Direct Labour Manufacturing Overhead Normal losses are estimated to be 2%% of input during the period. Inspection takes place during the processing operation, at which point damaged handles are separated from good handles and sold as scrap to local furniture manufacturers at $85 each. At inspection, 2,000 handles were rejected as scrap. These units had reached the following degree of completion: Transfer from Moulding 100% Direct material added 40% Conversion costs 20% Work-in-progress at the end of January was 4,000 handles and had reached the following degree of completion: Transfer from Moulding 100% Direct material added 80% Conversion costs 50% Direct materials added and conversion costs are incurred uniformly throughout the process. Required: (d) Prepare the journal entries for the: • assignment of direct materials, direct labour incurred and the manufacturing overhead applied to the Polishing Process * cost of the units completed and transferred out to the Packaging Process (e) Given that 30% of the unexpected losses were as a result of pilferage, calculate Fen Furnishings true loss associated with the Polishing Process.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter6: Process Costing

Section: Chapter Questions

Problem 42P: Larkin Company produces leather strips for western belts using three processes: cutting, design and...

Related questions

Question

Please assist

Transcribed Image Text:Fen Furnishings produces brass handles for the furniture industry in a four-stage process -Mixing, Moulding,

Polishing and Packaging. Costs incurred in the Polishing Department during January are summarized as follows:

WIP - Polishing Process A/C

January 1 Bal.

Transfer from Moulding

20,000

1,310,000

391,600

638,000

307,400

Direct Materials Added

Direct Labour

Manufacturing Overhead

Normal losses are estimated to be 24% of input during the period. Inspection takes place during the processing

operation, at which point damaged handles are separated from good handles and sold as scrap to local furniture

manufacturers at $85 each.

At inspection, 2,000 handles were rejected as scrap. These units had reached the following degree of completion:

Transfer from Moulding

100%

Direct material added

40%

Conversion costs

20%

Work-in-progress at the end of January was 4,000 handles and had reached the following degree of completion:

Transfer from Moulding

100%

Direct material added

80%

Conversion costs

50%

Direct materials added and conversion costs are incurred uniformly throughout the process.

Required:

(d)

Prepare the journal entries for the:

*assignment of direct materials, direct labour incurred and the manufacturing overhead applied to

the Polishing Process

" cost of the units completed and transferred out to the Packaging Process

(e)

Given that 30% of the unexpected losses were as a result of pilferage, calculate Fen Furnishings true

loss associated with the Polishing Process.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning