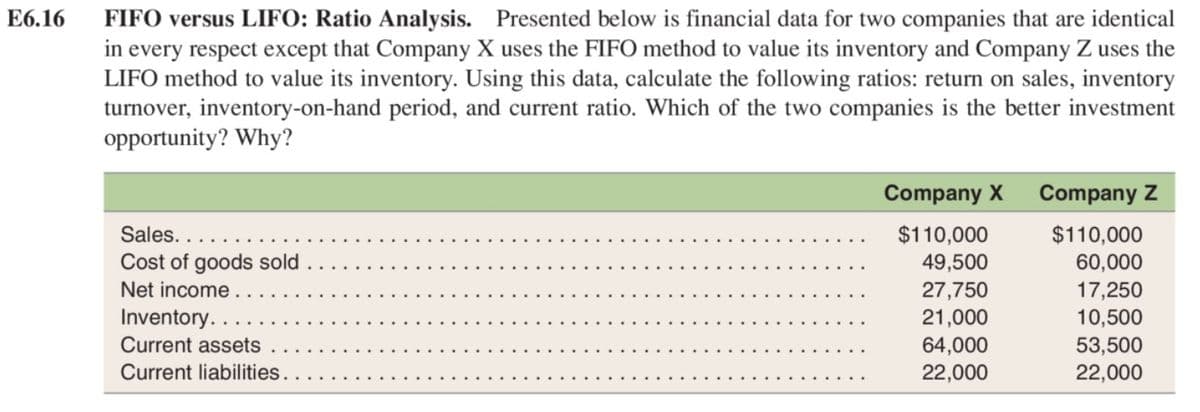

FIFO versus LIFO: Ratio Analysis. Presented below is financial data for two companies that are identical in every respect except that Company X uses the FIFO method to value its inventory and Company Z uses the LIFO method to value its inventory. Using this data, calculate the following ratios: return on sales, inventory turnover, inventory-on-hand period, and current ratio. Which of the two companies is the better investment opportunity? Why? Company X Company Z Sales... $110,000 49,500 27,750 21,000 64,000 $110,000 Cost of goods sold Net income .. Inventory. 60,000 17,250 10,500 53,500 22,000 Current assets Current liabilities.. 22,000

FIFO versus LIFO: Ratio Analysis. Presented below is financial data for two companies that are identical in every respect except that Company X uses the FIFO method to value its inventory and Company Z uses the LIFO method to value its inventory. Using this data, calculate the following ratios: return on sales, inventory turnover, inventory-on-hand period, and current ratio. Which of the two companies is the better investment opportunity? Why? Company X Company Z Sales... $110,000 49,500 27,750 21,000 64,000 $110,000 Cost of goods sold Net income .. Inventory. 60,000 17,250 10,500 53,500 22,000 Current assets Current liabilities.. 22,000

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter9: Stocks And Their Valuation

Section: Chapter Questions

Problem 5DQ

Related questions

Question

Using this data, calculate the following ratios: return on sales, inventory turnover, inventory-on-hand period, and

Transcribed Image Text:E6.16

FIFO versus LIFO: Ratio Analysis. Presented below is financial data for two companies that are identical

in every respect except that Company X uses the FIFO method to value its inventory and Company Z uses the

LIFO method to value its inventory. Using this data, calculate the following ratios: return on sales, inventory

turnover, inventory-on-hand period, and current ratio. Which of the two companies is the better investment

opportunity? Why?

Company X

Company Z

Sales...

$110,000

$110,000

Cost of goods sold

49,500

60,000

Net income.

27,750

21,000

17,250

Inventory.

Current assets

10,500

53,500

22,000

64,000

Current liabilities.

22,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning