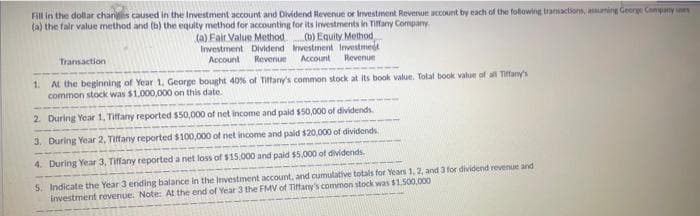

Fill in the dollar chargis caused in the Investment account and Dividend Revenue or Investment Revenue account by each of the following transactions, assuming George Company unes (a) the fair value method and (b) the equity method for accounting for its investments in Tiffany Company (a) Fair Value Method. Transaction (b) Equity Method Investment Dividend Investment Investment Account Revenue Account Revenue 1. At the beginning of Year 1. George bought 40% of Tiffany's common stock at its book value. Total book value of all Tiffany's common stock was $1,000,000 on this date. 2. During Year 1, Tiffany reported $50,000 of net income and paid $50,000 of dividends. 3. During Year 2, Tiffany reported $100,000 of net income and paid $20,000 of dividends. 4. During Year 3, Tiffany reported a net loss of $15,000 and paid $5,000 of dividends. 5. Indicate the Year 3 ending balance in the Investment account, and cumulative totals for Years 1, 2, and 3 for dividend revenue and investment revenue. Note: At the end of Year 3 the FMV of Tiffany's common stock was $1,500,000

Fill in the dollar chargis caused in the Investment account and Dividend Revenue or Investment Revenue account by each of the following transactions, assuming George Company unes (a) the fair value method and (b) the equity method for accounting for its investments in Tiffany Company (a) Fair Value Method. Transaction (b) Equity Method Investment Dividend Investment Investment Account Revenue Account Revenue 1. At the beginning of Year 1. George bought 40% of Tiffany's common stock at its book value. Total book value of all Tiffany's common stock was $1,000,000 on this date. 2. During Year 1, Tiffany reported $50,000 of net income and paid $50,000 of dividends. 3. During Year 2, Tiffany reported $100,000 of net income and paid $20,000 of dividends. 4. During Year 3, Tiffany reported a net loss of $15,000 and paid $5,000 of dividends. 5. Indicate the Year 3 ending balance in the Investment account, and cumulative totals for Years 1, 2, and 3 for dividend revenue and investment revenue. Note: At the end of Year 3 the FMV of Tiffany's common stock was $1,500,000

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter2: The Basics Of Record Keeping And Financial Statement Preparation: Balance Sheet

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:Fill in the dollar changes caused in the Investment account and Dividend Revenue or Investment Revenue account by each of the following transactions, assuming George Company unes

(a) the fair value method and (b) the equity method for accounting for its investments in Tiffany Company

(a) Fair Value Method.

Transaction

(b) Equity Method

Investment Dividend Investment Investment

Account

Revenue

Account

Revenue

1. At the beginning of Year 1. George bought 40% of Tiffany's common stock at its book value. Total book value of all Tiffany's

common stock was $1,000,000 on this date.

2. During Year 1, Tiffany reported $50,000 of net income and paid $50,000 of dividends.

3. During Year 2, Tiffany reported $100,000 of net income and paid $20,000 of dividends.

4. During Year 3, Tiffany reported a net loss of $15,000 and paid $5,000 of dividends.

5. Indicate the Year 3 ending balance in the Investment account, and cumulative totals for Years 1, 2, and 3 for dividend revenue and

investment revenue. Note: At the end of Year 3 the FMV of Tiffany's common stock was $1,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning