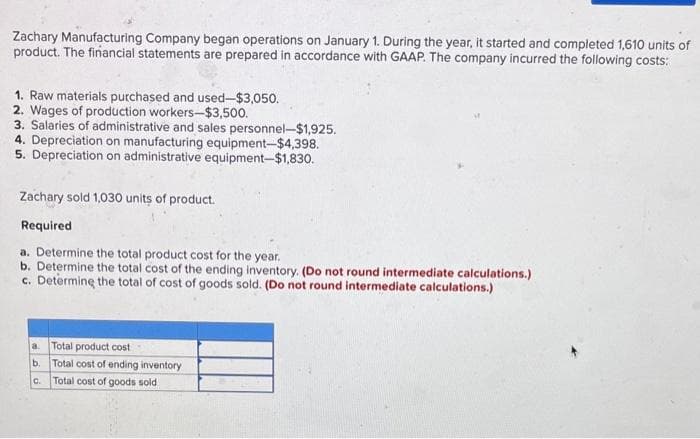

Zachary Manufacturing Company began operations on January 1. During the year, it started and completed 1,610 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,050. 2. Wages of production workers-$3,500. 3. Salaries of administrative and sales personnel-$1,925. 4. Depreciation on manufacturing equipment-$4,398. 5. Depreciation on administrative equipment-$1,830. Zachary sold 1,030 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) a Total product cost b. Total cost of ending inventory C. Total cost of goods sold

Zachary Manufacturing Company began operations on January 1. During the year, it started and completed 1,610 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,050. 2. Wages of production workers-$3,500. 3. Salaries of administrative and sales personnel-$1,925. 4. Depreciation on manufacturing equipment-$4,398. 5. Depreciation on administrative equipment-$1,830. Zachary sold 1,030 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) a Total product cost b. Total cost of ending inventory C. Total cost of goods sold

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter5: Process Cost Accounting—general Procedures

Section: Chapter Questions

Problem 8E: Argo Manufacturing Co. had 500 units, three-fifths completed, in process at the beginning of the...

Related questions

Question

T1.

Transcribed Image Text:Zachary Manufacturing Company began operations on January 1. During the year, it started and completed 1,610 units of

product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs:

1. Raw materials purchased and used-$3,050.

2. Wages of production workers-$3,500.

3. Salaries of administrative and sales personnel-$1,925.

4. Depreciation on manufacturing equipment-$4,398.

5. Depreciation on administrative equipment-$1,830.

Zachary sold 1,030 units of product.

Required

a. Determine the total product cost for the year.

b. Determine the total cost of the ending inventory. (Do not round intermediate calculations.)

c. Determine the total of cost of goods sold. (Do not round intermediate calculations.)

a.

Total product cost

b. Total cost of ending inventory

C. Total cost of goods sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,