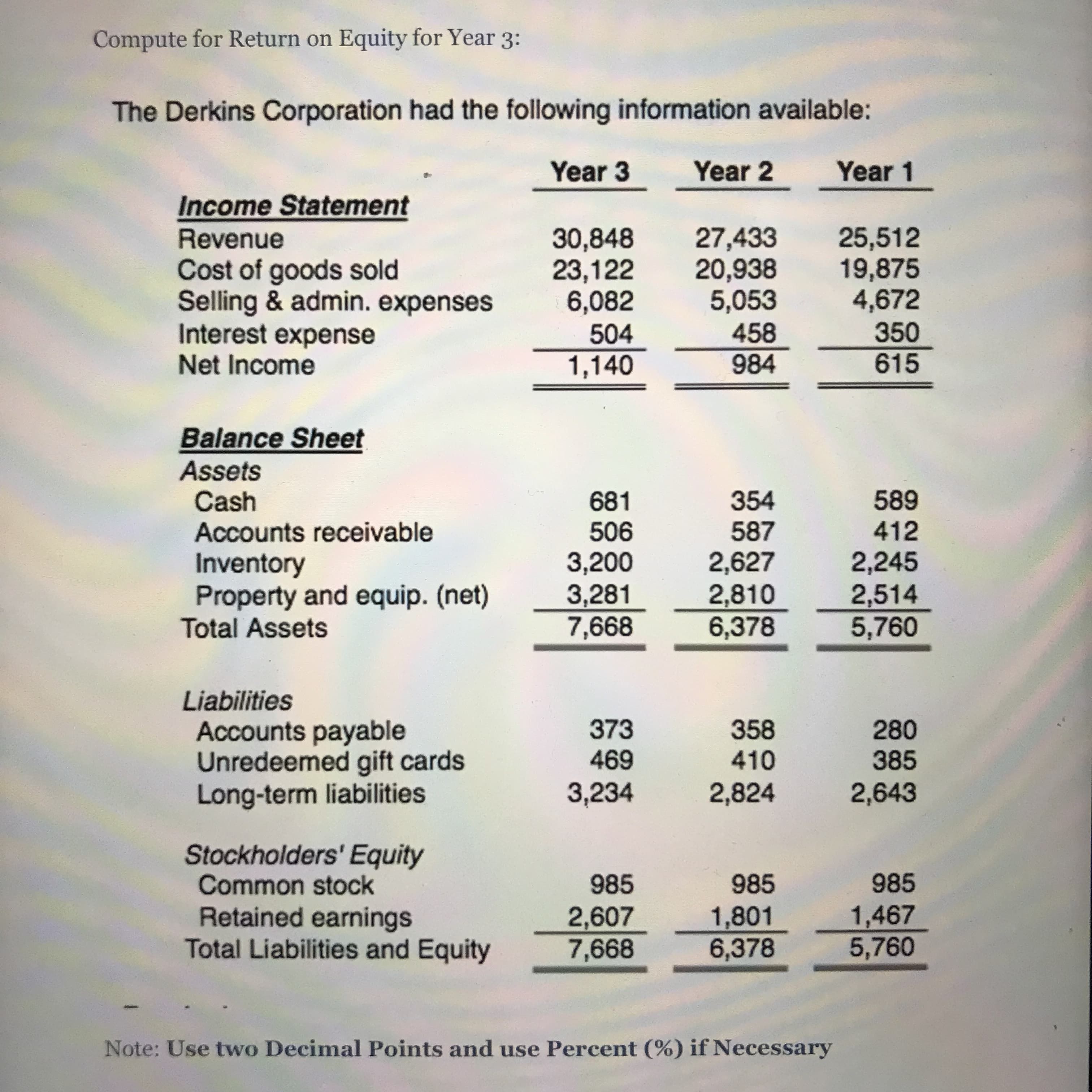

Compute for Return on Equity for Year 3: The Derkins Corporation had the following information available: Year 3 Year 2 Year 1 Income Statement Revenue Cost of goods sold Selling & admin. expenses Interest expense Net Income 30,848 23,122 6,082 27,433 20,938 5,053 458 25,512 19,875 4,672 504 1,140 984 615 Balance Sheet Assets Cash Accounts receivable Inventory Property and equip. (net) Total Assets 681 354 587 412 909 3,200 3,281 7,668 2,627 2,810 6,378 2,245 2,514 Liabilities Accounts payable Unredeemed gift cards 373 358 410 280 385 Long-term liabilities 3,234 2,824 2,643 Stockholders' Equity Common stock Retained earnings Total Liabilities and Equity 985 985 985 2,607 7,668 1,801 6,378 1,467 5,760 Note: Use two Decimal Points and use Percent (%) if Necessary

Compute for Return on Equity for Year 3: The Derkins Corporation had the following information available: Year 3 Year 2 Year 1 Income Statement Revenue Cost of goods sold Selling & admin. expenses Interest expense Net Income 30,848 23,122 6,082 27,433 20,938 5,053 458 25,512 19,875 4,672 504 1,140 984 615 Balance Sheet Assets Cash Accounts receivable Inventory Property and equip. (net) Total Assets 681 354 587 412 909 3,200 3,281 7,668 2,627 2,810 6,378 2,245 2,514 Liabilities Accounts payable Unredeemed gift cards 373 358 410 280 385 Long-term liabilities 3,234 2,824 2,643 Stockholders' Equity Common stock Retained earnings Total Liabilities and Equity 985 985 985 2,607 7,668 1,801 6,378 1,467 5,760 Note: Use two Decimal Points and use Percent (%) if Necessary

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 18E

Related questions

Question

100%

Practice Pack

Transcribed Image Text:Compute for Return on Equity for Year 3:

The Derkins Corporation had the following information available:

Year 3

Year 2

Year 1

Income Statement

Revenue

Cost of goods sold

Selling & admin. expenses

Interest expense

Net Income

30,848

23,122

6,082

27,433

20,938

5,053

458

25,512

19,875

4,672

504

1,140

984

615

Balance Sheet

Assets

Cash

Accounts receivable

Inventory

Property and equip. (net)

Total Assets

681

354

587

412

909

3,200

3,281

7,668

2,627

2,810

6,378

2,245

2,514

Liabilities

Accounts payable

Unredeemed gift cards

373

358

410

280

385

Long-term liabilities

3,234

2,824

2,643

Stockholders' Equity

Common stock

Retained earnings

Total Liabilities and Equity

985

985

985

2,607

7,668

1,801

6,378

1,467

5,760

Note: Use two Decimal Points and use Percent (%) if Necessary

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning