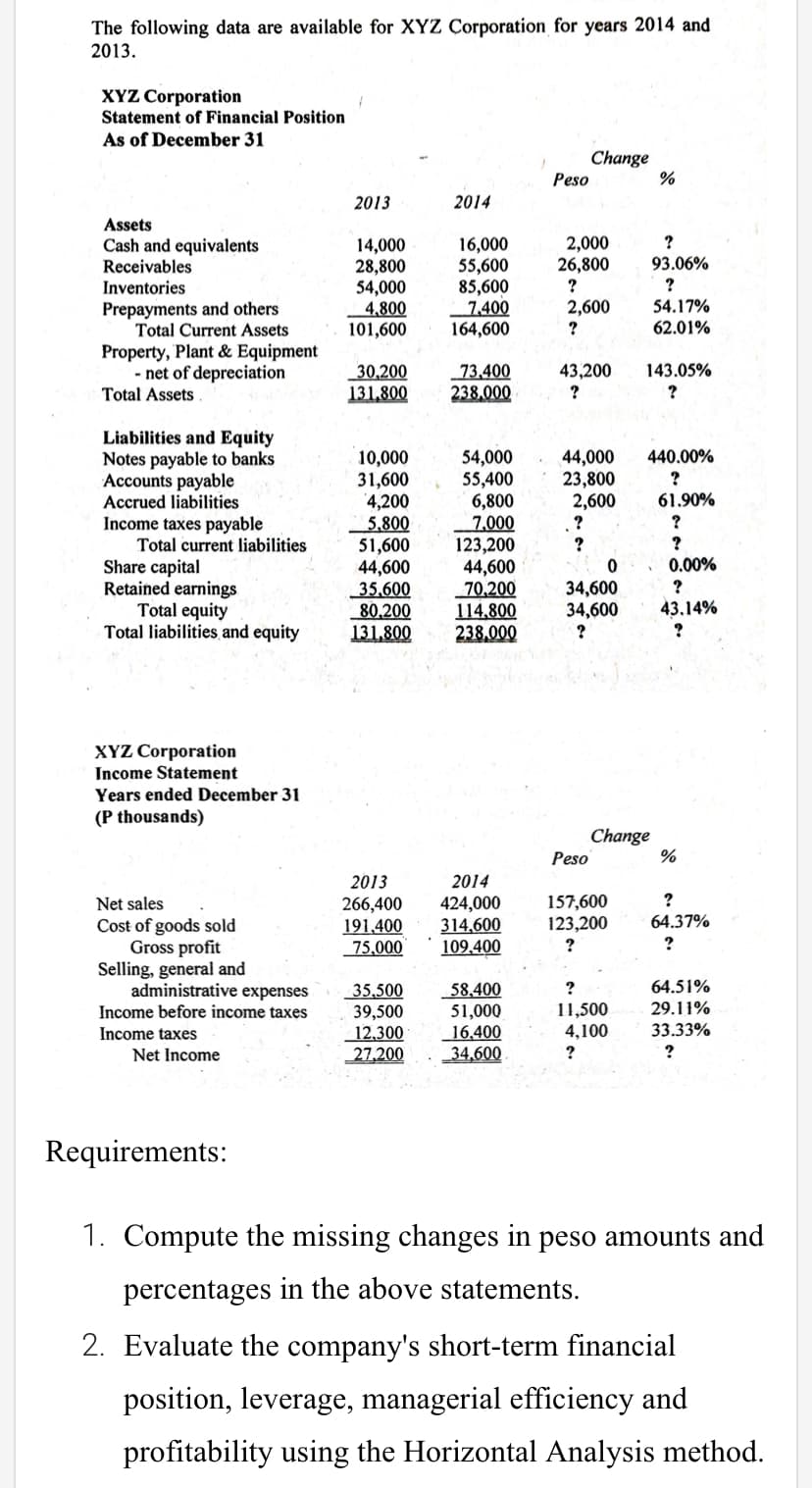

The following data are available for XYZ Corporation for years 2014 and 2013. XYZ Corporation Statement of Financial Position As of December 31 Change Peso % 2013 2014 Assets 2,000 26,800 Cash and equivalents Receivables Inventories 14,000 28,800 54,000 4,800 101,600 16,000 55,600 85,600 7,400 164,600 93.06% ? Prepayments and others Total Current Assets 2,600 54.17% 62.01% Property, Plant & Equipment - net of depreciation Total Assets. 73,400 238.000 43,200 143.05% 30,200 131,800 Liabilities and Equity Notes payable to banks Accounts payable Accrued liabilities Income taxes payable Total current liabilities 54,000 55,400 6,800 7,000 123,200 44,600 70,200 114,800 238.000 44,000 23,800 2,600 440.00% 10,000 31,600 4,200 5,800 51,600 44,600 35,600 80,200 131,800 ? 61.90% ? 0.00% Share capital Retained earnings Total equity Total liabilities and equity 34,600 34,600 ? 43.14%

The following data are available for XYZ Corporation for years 2014 and 2013. XYZ Corporation Statement of Financial Position As of December 31 Change Peso % 2013 2014 Assets 2,000 26,800 Cash and equivalents Receivables Inventories 14,000 28,800 54,000 4,800 101,600 16,000 55,600 85,600 7,400 164,600 93.06% ? Prepayments and others Total Current Assets 2,600 54.17% 62.01% Property, Plant & Equipment - net of depreciation Total Assets. 73,400 238.000 43,200 143.05% 30,200 131,800 Liabilities and Equity Notes payable to banks Accounts payable Accrued liabilities Income taxes payable Total current liabilities 54,000 55,400 6,800 7,000 123,200 44,600 70,200 114,800 238.000 44,000 23,800 2,600 440.00% 10,000 31,600 4,200 5,800 51,600 44,600 35,600 80,200 131,800 ? 61.90% ? 0.00% Share capital Retained earnings Total equity Total liabilities and equity 34,600 34,600 ? 43.14%

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 17E

Related questions

Question

Transcribed Image Text:The following data are available for XYZ Corporation for years 2014 and

2013.

XYZ Corporation

Statement of Financial Position

As of December 31

Change

Peso

%

2013

2014

Assets

Cash and equivalents

Receivables

Inventories

Prepayments and others

Total Current Assets

14,000

28,800

54,000

4,800

101,600

16,000

55,600

85,600

_7,400

164,600

2,000

26,800

?

93.06%

?

2,600

54.17%

62.01%

Property, Plant & Equipment

- net of depreciation

Total Assets

43,200

73,400

238,000

143.05%

30,200

131.800

Liabilities and Equity

Notes payable to banks

Accounts payable

Accrued liabilities

Income taxes payable

Total current liabilities

Share capital

Retained earnings

Total equity

Total liabilities and equity

10,000

31,600

4,200

_ 5,800

51,600

44,600

35.600

80,200

131,800

54,000

55,400

6,800

7,000

123,200

44,600

70,200

44,000

23,800

2,600

.?

?

440.00%

61.90%

0.00%

34,600

34,600

43,14%

114,800

238.000

XYZ Corporation

Income Statement

Years ended December 31

(P thousands)

Change

Peso

2013

2014

266,400

191,400

75,000

424,000

314,600

109.400

157,600

123,200

Net sales

64.37%

Cost of goods sold

Gross profit

Selling, general and

administrative expenses

Income before income taxes

?

?

64.51%

35,500

39,500

12,300

27,200

58.400

51,000

_16,400

_34,600

11,500

4,100

29.11%

Income taxes

33.33%

Net Income

?

?

Requirements:

1. Compute the missing changes in peso amounts and

percentages in the above statements.

2.

Evaluate the company's short-term financial

position, leverage, managerial efficiency and

profitability using the Horizontal Analysis method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning