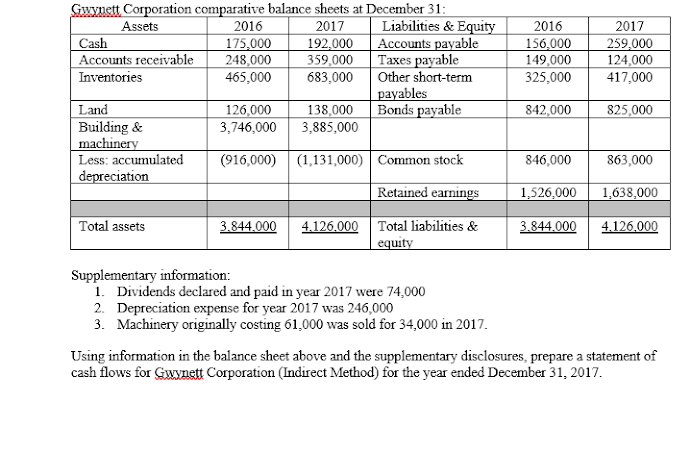

Gwynett Corporation comparative balance sheets at December 31: 2016 175,000 248,000 465,000 Liabilities & Equity Assets Cash Accounts receivable Inventories 2017 192,000 Accounts payable 359,000 683,000 2016 2017 156,000 149,000 325,000 259,000 124,000 417,000 | Taxes payable Other short-term payables Bonds payable Land Building & machinery Less: accumulated depreciation 138,000 3,885,000 825,000 126,000 3,746,000 842,000 (916,000) (1,131,000) Common stock 846,000 863,000 Retained earnings 1,526,000 1,638,000 3.844.000 4.126,000 Total liabilities & equity 4.126.000 Total assets 3.844.000 Supplementary information: 1. Dividends declared and paid in year 2017 were 74,000 2. Depreciation expense for year 2017 was 246,000 3. Machinery originally costing 61,000 was sold for 34,000 in 2017. Using information in the balance sheet above and the supplementary disclosures, prepare a statement of cash flows for Gwynett Corporation (Indirect Method) for the year ended December 31, 2017.

Gwynett Corporation comparative balance sheets at December 31: 2016 175,000 248,000 465,000 Liabilities & Equity Assets Cash Accounts receivable Inventories 2017 192,000 Accounts payable 359,000 683,000 2016 2017 156,000 149,000 325,000 259,000 124,000 417,000 | Taxes payable Other short-term payables Bonds payable Land Building & machinery Less: accumulated depreciation 138,000 3,885,000 825,000 126,000 3,746,000 842,000 (916,000) (1,131,000) Common stock 846,000 863,000 Retained earnings 1,526,000 1,638,000 3.844.000 4.126,000 Total liabilities & equity 4.126.000 Total assets 3.844.000 Supplementary information: 1. Dividends declared and paid in year 2017 were 74,000 2. Depreciation expense for year 2017 was 246,000 3. Machinery originally costing 61,000 was sold for 34,000 in 2017. Using information in the balance sheet above and the supplementary disclosures, prepare a statement of cash flows for Gwynett Corporation (Indirect Method) for the year ended December 31, 2017.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

Transcribed Image Text:Gwynett Corporation comparative balance sheets at December 31:

Liabilities & Equity

Accounts payable

Taxes payable

Other short-term

payables

Bonds payable

Assets

2016

2016

2017

192,000

359,000

683,000

2017

Cash

Accounts receivable

Inventories

175,000

248,000

465,000

156,000

149,000

325,000

259,000

124,000

417,000

Land

Building &

machinery

Less: accumulated

depreciation

126,000

3,746,000

842,000

138,000

3,885,000

825,000

(916,000) (1,131,000) Common stock

846,000

863,000

Retained earnings

1,526,000

1,638,000

Total assets

3.844.000

4.126.000 Total liabilities &

3.844.000

4.126,000

equity

Supplementary information:

1. Dividends declared and paid in year 2017 were 74,000

2. Depreciation expense for year 2017 was 246,000

3. Machinery originally costing 61,000 was sold for 34,000 in 2017.

Using information in the balance sheet above and the supplementary disclosures, prepare a statement of

cash flows for Gwynett Corporation (Indirect Method) for the year ended December 31, 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning