Financial Statement.. studocu.com StuDocu

Business/Professional Ethics Directors/Executives/Acct

8th Edition

ISBN:9781337485913

Author:BROOKS

Publisher:BROOKS

Chapter8: Subprime Lending Fiasco-ethics Issues

Section: Chapter Questions

Problem 3.7EC

Related questions

Question

Transcribed Image Text:491 11:34 10.6 (-)

4G

4 29

KB/s

Financial Statement.

studocu.com

= StuDocu

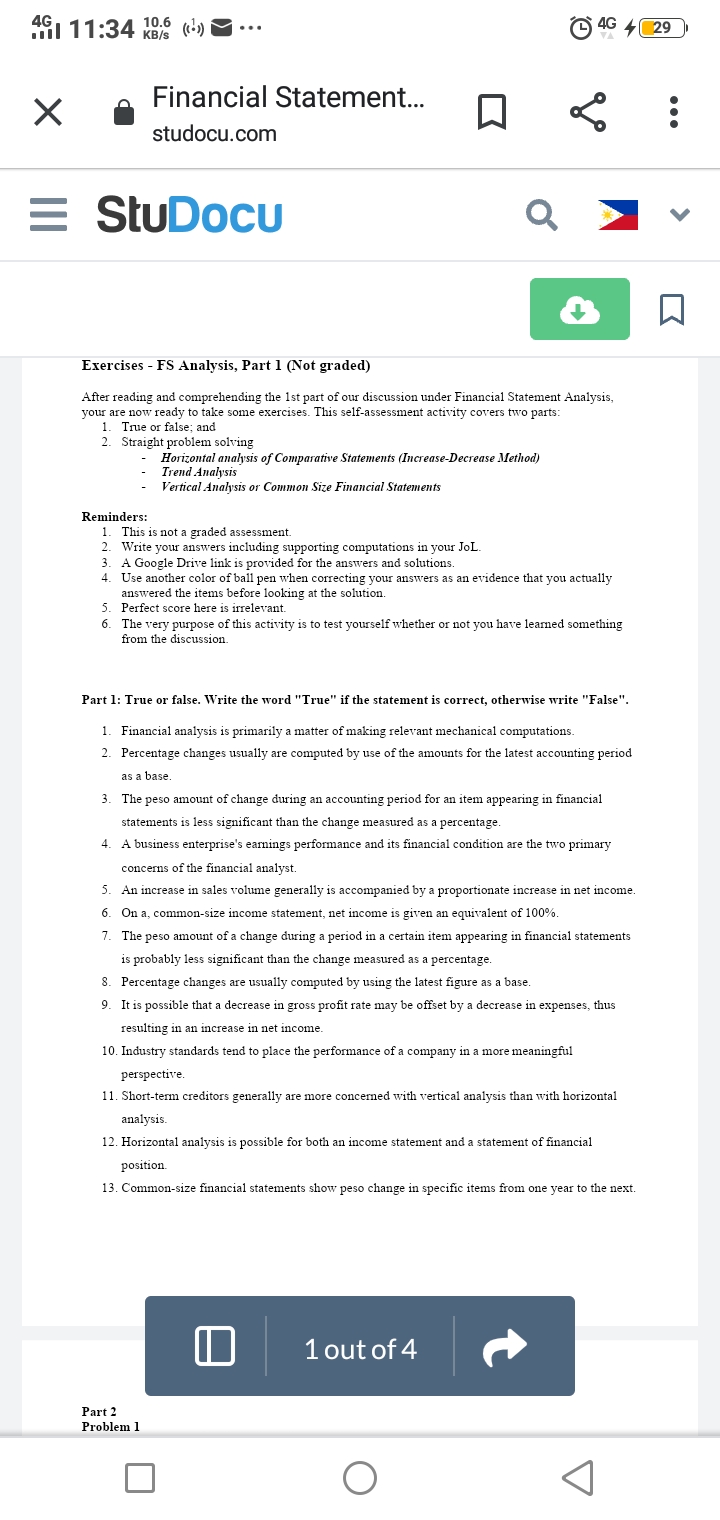

Exercises - FS Analysis, Part 1 (Not graded)

After reading and comprehending the 1st part of our discussion under Financial Statement Analysis,

your are now ready to take some exercises. This self-assessment activity covers two parts:

1. True or false; and

2. Straight problem solving

Horizontal analysis of Comparative Statements (Increase-Decrease Method)

Trend Analysis

Vertical Analysis or Common Size Financial Statements

Reminders:

1. This is not a graded assessment.

2. Write your answers including supporting computations in your JoL.

3. A Google Drive link is provided for the answers and solutions.

4. Use another color of ball pen when correcting your answers as an evidence that you actually

answered the items before looking at the solution.

5. Perfect score here is irrelevant.

6. The very purpose of this activity is to test yourself whether or not you have leaned something

from the discussion.

Part 1: True or false. Write the word "True" if the statement is correct, otherwise write "False".

1. Financial analysis is primarily a matter of making relevant mechanical computations.

2. Percentage changes usually are computed by use of the amounts for the latest accounting period

as a base

3. The peso amount of change during an accounting period for an item appearing in financial

statements is less significant than the change measured as a percentage.

A business enterprise's earnings performance and its financial condition are the two primary

concerns of the financial analyst.

5. An increase in sales volume generally is accompanied by a proportionate increase in net income

6. On a, common-size income statement, net income is given an equivalent of 100%.

7. The peso amount of a change during a period in a certain item appearing in financial statements

is probably less significant than the change measured as a percentage.

8. Percentage changes are usually computed by using the latest figure as a base.

9. It is possible that a decrease in gross profit rate may be offset by a decrease in expenses, thus

resulting in an increase in net income.

10. Industry standards tend to place the performance of a company in a more meaningful

perspective.

11. Short-term creditors generally are more concerned with vertical analysis than with horizontal

analysis.

12. Horizontal analysis is possible for both an income statement and a statement of financial

position.

13. Common-size financial statements show peso change in specific items from one year to the next.

1 out of 4

Part 2

Problem 1

...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning