Q: Using the following data: Scenario Probability return K1 return K2 0.2 -10% 5% W2 0.4 0% 30% W3 0.4…

A: Excel Spreadsheet: Excel Workings:

Q: d) What is the reward-to-volatility ratio of the best feasible CAL? e) You require that your…

A: Sharpe ratio is refer as reward to volatility ratio which used to determine the performance of an…

Q: A portfolio consists of 70% of investment A and 30% of investment B. The expected return on…

A: The Expected portfolio or overall rate of return of the portfolio is the total return that is…

Q: Assuming that the CAPM approach is appropriate, compute the required rate of return for each of the…

A: As per CAPM, Expected Return = Risk free Rate + (beta * market risk premium) Where market risk…

Q: If the risk free rate is 6 %, the expected return on the market portfolio is 12% and the beta of…

A: The Capital Asset Pricing Model (CAPM) is the model which shows the relationship between the…

Q: You observe the following: ABC Inc. has 1.8 Beta and .2 Expected return XYZ Inc has 1.6 Beta and .19…

A: The required rate of return for a firm depends on the risk free rate, beta and market premium. Beta…

Q: How do I calculate portfolio return and risk for an equally weighted portfolio using expected…

A: The portfolio return is defined as the gain/loss that is realized through an investment portfolio,…

Q: The return, standard deviation, market risk premium and Beta (β) of A, B, C, D and the Market…

A: The performance of the portfolios can be measured using Sharpe ratio, Treynor ratio and Jensen's…

Q: Consider a portfolio consisting of the following three stocks: . The volatility of the market…

A: portfolio weight volatility correlation with market beta expected return HEC CORP 0.23 11% 0.33…

Q: Assuming that the CAPM approach is appropriate, compute the required rate of return for each of the…

A: Given: Risk free rate = 0.07 Market rate = 0.13 Different betas:

Q: A portfolio has an average return of 14.4 percent, a standard deviation of 18.5 percent, and a beta…

A: The Sharpe ratio: The Sharpe ratio is one of the most commonly used measures to assess the…

Q: Suppose that the risk-free rate ry = 0.03, the expected market return µM = 0.11, and the market…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Your portfolio has a beta of 1.24, a standard deviation of 14.3 percent, and an expected return of…

A: Portfolio beta = 1.24 Standard deviation = 14.3% Expected return = 12.50% Market return = 10.7% Risk…

Q: Based on the following information, calculate the expected return and standard deviation for each of…

A: Expected return refers to the amount of returns on estimated or probability basis for the future…

Q: Use the following table to answer the questions a-c below. Standard deviation of risky portfolio 3.5…

A: Note: We’ll answer the first question, including sub-parts since the exact one wasn’t specified.…

Q: a. Based on the following information, calculate the expected return and standard deviation for each…

A: expected return = ∑Probability × Return State Probability J's Return K's Return Expected…

Q: If the market portfolio has a required return of 0.12 and a standard deviation of 0.40, and the…

A: Security market line (SML): The security market line (SML) is the graphic depiction of the Capital…

Q: Assume the market portfolio's and risk-free rate's projected returns are 13% and 3%, respectively.…

A: There are various portfolio performance measures and one such measure is Treynors' ratio. This ratio…

Q: Consider a portfolio exhibiting an expected return of 6% in an economy where the riskless interest…

A: Given, Expected return = 6% Risk less interest rate = 1% Expected return on market portfolio = 10%…

Q: Adam wants to determine the required return on a stock portfolio with a beta coefficient of 0.5.…

A: Required rate of return = risk free rate + beta * (market return - risk free rate)

Q: Consider an investment portfolio that consists of three different stocks, with the amount invested…

A: Given The risk free rate is 2.5% The market risk premium is 6%

Q: Suppose the expected return for the market portfolio and risk-free rate are 13 percent and 3 percent…

A: Treynor ratio = (Expected return - Risk free rate) / BetaTreynor ratio of the market = (Expected…

Q: A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7…

A: An expected return is defined as the profit / loss, where an investors used to anticipate on their…

Q: Find the tangency portfolio mathematically (or mean-variance efficient portfolio). Follow the next…

A: This question has four subparts. The first two subparts have been answered here.

Q: What is the Sharpe ratio (S) of your risky portfolio and your client’s overall portfolio? , assume…

A: Sharpe Ratio = (Return on portfolio - Risk free Rate ) / (Standard Deviation of portfolio)

Q: Using the return data on portfolios A and B provided in the accompanying spreadsheet, compute the…

A: Standard deviation is a measure of Volatility, so, In this question we need to find out Standard…

Q: Use the following table to answer the questions a-c below. Expected return on risky portfolio…

A: The provided table is: Risk Portfolio Expected return on risky portfolio Standard deviation of…

Q: What is the standard deviation of this portfolio?

A: Information Provided: Correlation = -0.10 Standard Deviation of Stock A = 3.0 Standard Deviation of…

Q: Show that the (percent) return of the portfolio satisfies Tp = WATA + WBTB, i.e. the portfolio…

A: The portfolio refers to a combination of different financial securities. Return on the portfolio is…

Q: The risk-free rate is 2%, the market risk premium is 8.00%, and portfolio A has a beta of 2. What is…

A: Given: Risk free rate = 2% Market risk premium = 8% Beta of portfolio = 2 Computation of required…

Q: Consider two types of assets: market portfolio (M) and stock A. The expected return is 8% and…

A: Given: Market rate = 8% Risk free rate = 2% Standard deviation of market portfolio = 15% Standard…

Q: You are evaluating various investment opportunities currently available and you have calculated…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: The following portfolios are being considered for investment. During the period under consideration,…

A: Given:

Q: Consider a portfolio consisting of the following three stocks: . The volatility of the market…

A: given, rf=3%rm=8%σm=10% portfolio weights volatility correlation HEC 0.23 11% 0.33 Green…

Q: The following expected return and the standard deviation of current returns are known: Security…

A: The standard deviation is a measure of the consistency of returns of an investment. The standard…

Q: A particular firm’s portfolio is composed of two assets, which we will call" A" and "B." Let X…

A: " Hi, Since you asked multiple sub-parts questions, we will answer the first three sub-parts for you…

Q: When the return on the market portfolio goes up by 5%, the return on Stock A goes up on average by…

A: A portfolio is defined as a group or a collection of various financial assets or commodities that…

Q: Calculate the expected return and standard deviation for S and T. (i) Calculate the covariance and…

A: Hai there, thank you for the question. As per company guidelines expert can answer only one question…

Q: The following portfolios are being considered for investment. During the period under consideration,…

A: Portfolios are the combination or group of various investments of an investor pooled together in one…

Q: A portfolio manager summarises the input from forecasts in the following table: Average Financial…

A: Capital Asset Pricing Model gives you the relation between Expected Return of an Asset and…

Q: Mean returns for portfolios are calculated by taking the weighted average of the mean returns for…

A: The return on a particular portfolio is calculated by dividing the portfolio's net loss or profit by…

Q: Compute: a) The expected rate of return. b) The standard deviation of the expected return. c) The…

A: Expected Return The minimum risk expected by an investor for the risk undertaken in the process of…

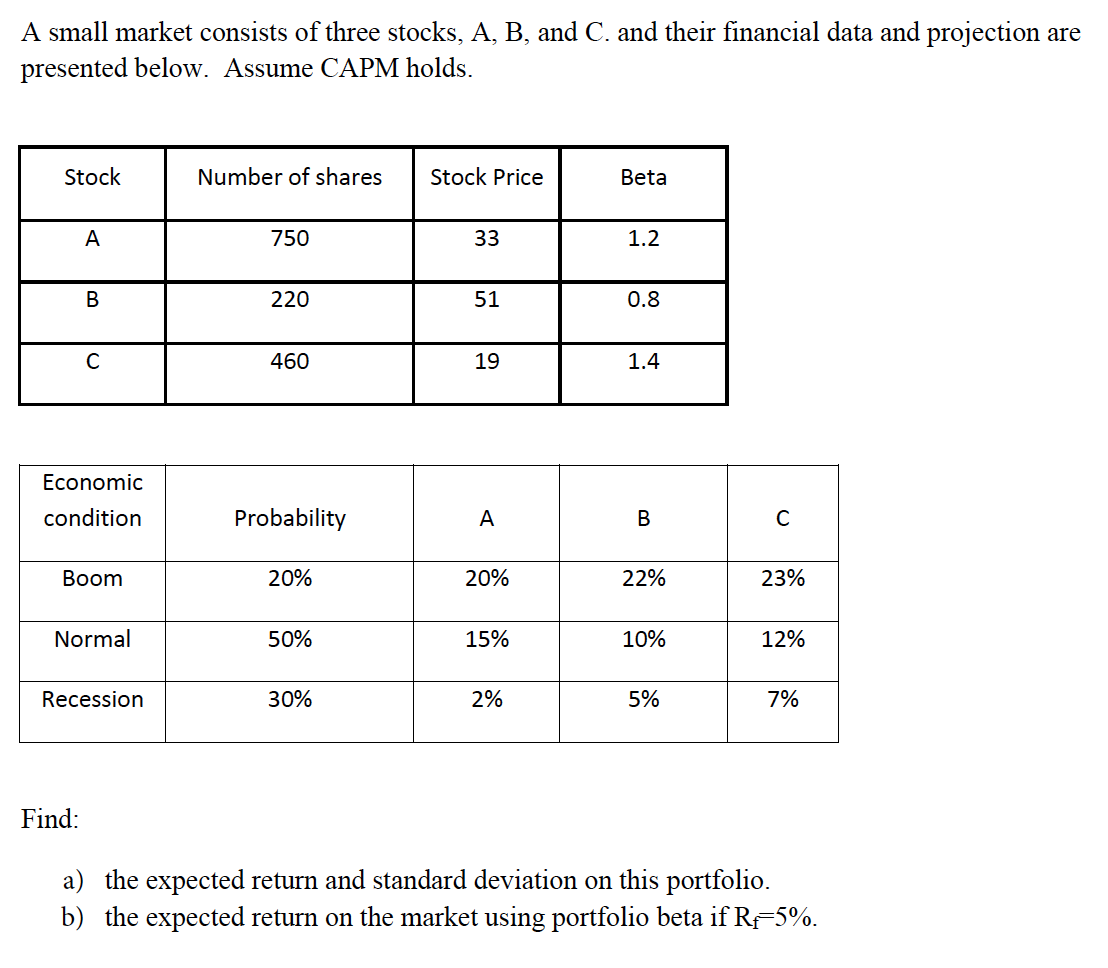

Q: According the picture, Find: a) the expected return and standard deviation on this portfolio. b)…

A: Calculation of Expected Return, Standard Deviation and Expected Return using Portfolio Beta: Excel…

NO2.6

Step by step

Solved in 3 steps with 5 images

- Given the following information concerning three stocks, Stock Price Shares Outstanding A $10 1,000,000 B $14 3,000,000 C $21 10,000,000 a. Construct a simple average, a value-weighted average, and a geometric average. b. What are averages if each price rises to $11, $17, and $35, respectively? c. What is the percentage increase in each average?Here are data on two stocks, both of which have discount rates of 14%: Stock A Stock B Return on equity 14 % 10 % Earnings per share $ 1.50 $ 1.40 Dividends per share $ 1.20 $ 1.20 a. What are the dividend payout ratios for each firm? (Enter your answers as a percent rounded to 2 decimal places.) b. What are the expected dividend growth rates for each stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) c. What is the proper stock price for each firm?Use the data below to construct the advance/decline line and Arms ratio for the market. Volume is in thousands of shares. (Input all amounts as positive values. Do not round intermediate calculations. Round your "Arms Ratio" answers to 3 decimal places.) StocksAdvancing AdvancingVolume StocksDeclining DecliningVolume Monday 1,936 876,951 333 126,645 Tuesday 2,641 509,531 809 217,135 Wednesday 1,340 519,132 1,188 499,845 Thursday 2,159 942,526 840 314,846 Friday 2,033 596,483 1,205 381,953

- Here are data on two stocks, both of which have discount rates of 15%: Stock A Stock B Return on equity 15 % 10 % Earnings per share $ 2.00 $ 1.50 Dividends per share $ 1.00 $ 1.00 a. What are the dividend payout ratios for each firm? (Enter your answers as a percent rounded to 2 decimal places.) b. What are the expected dividend growth rates for each stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) c. What is the proper stock price for each firm? (Do not round intermediate calculations. Round your answers to 2 decimal places.)Consider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. P0 Q0 P1 Q1 P2 Q2 A 87 100 92 100 92 100 B 47 200 42 200 42 200 C 94 200 104 200 52 400 Required: a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t = 1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What will be the divisor for the price-weighted index in year 2? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Calculate the rate of return of the price-weighted index for the second period (t = 1 to t = 2).What equation was used to get this? Common Stock Share price 65 Dividends 2.53 Growth rate 9% Riskfree Rate 7% Market Risk Premium 5.50% Beta 1.2 Cost of common stock(using DGM) 13.24% Cost of common stock(using CAPM) 13.60% Cost of common Equity 13.42%

- On a particular date, FedEx has a stock price of $88.24 and an EPS of $7.36. Its competitor, UPS, had an EPS of $0.30. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? Question content area bottom Part 1 A.$5.40 B. $7.19 C.$8.00 D.$3.60Consider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two for one in the last period. P0 Q0 P1 Q1 P2 Q2 A 110 500 115 500 115 500 B 90 600 85 600 85 600 C 80 600 100 600 50 1,200 a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t = 1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Calculate the new divisor for the price-weighted index in year 2. (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Calculate the rate of return for the second period (t = 1 to t = 2).Using the stock table for Dell Technologies below, calculate the earnings per share. Round your answer to the nearest cent.Do not include the $ in your answer.Dell TechnologiesDVMT$66.26$66.40-$66.96$42.02-568.25NameSymbolCloseDay Range52-Week RangeVolumeP/EDividendDividend YieldEPS895,028103.53$0.000%?

- 1.You are given the following information regarding prices for a sample of stocks. PRICE STOCK NUMBER OF SHARES T T +1 A 1,000,000 60 80 B 10,000,000 20 35 C 30,000,000 18 25 a.Construct a price-weighted index for these three stocks, and compute the percentage change in the index for the period from T to T + 1. b.Construct a value-weighted index for these three stocks, and compute the percentage change in the index for the period from T to T + 1 c.Briefly discuss the difference in the results for the two indexes.Consider the three stocks in the following table. P, represents price at time t, and Q, represents shares outstanding at time t. Stock C splits two-for-one in the last period. (LO 2-2) A B C Po 90 50 100 Qo 100 200 200 P₁ 95 45 110 Q₁ 100 200 200 P₂ 95 45 55 a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t = 1). b. What must happen to the divisor for the price-weighted index in year 2? c. Calculate the rate of return of the price-weighted index for the second period (t = 1 to t=2). Q₂ 100 200 400You are given the following information regarding prices for stocks of the followingfirms: PRICE Stock Number of Shares T T+ 1 ScotBank Ltd. 1,000,000 60 80 Jetvan Ltd 10,000,000 20 35 PriceLife Ltd. 30,000,000 18 25 i. Construct a price-weighted index for these three stocks and compute the percentagechange in the series for the period from T to T +1. ii. Construct a market-value-weighted index for these three stocks and compute thepercentage change in the series for the period from T to T +1. iii. Based on your answer above, which of these indexes BEST illustrate the movementon the stock market.