Calculate the expected return and standard deviation for S and T. (i) Calculate the covariance and the correlation coefficient between (ii) the returns on S and the returns on T. (iii) Determine a portfolio expected return and standard deviation if two-thirds of the portfolio is invested in S and one third in T.

Calculate the expected return and standard deviation for S and T. (i) Calculate the covariance and the correlation coefficient between (ii) the returns on S and the returns on T. (iii) Determine a portfolio expected return and standard deviation if two-thirds of the portfolio is invested in S and one third in T.

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 7TCL

Related questions

Question

Could you please show me the solution.

Transcribed Image Text:Question 4

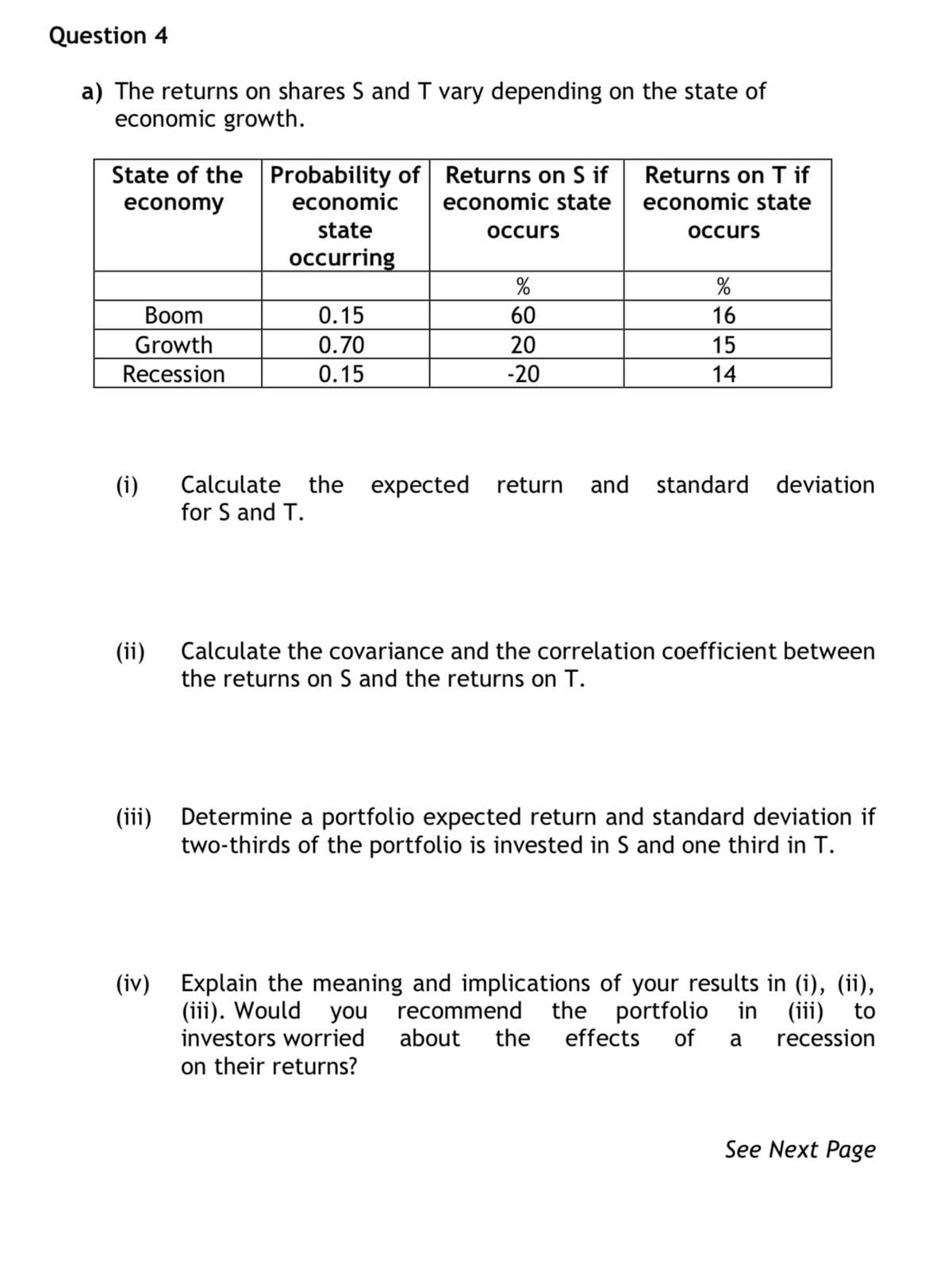

a) The returns on shares S and T vary depending on the state of

economic growth.

State of the Probability of Returns on S if

economic

Returns on T if

economic state

economy

economic state

state

Occurs

Оccurs

occurring

%

Вoom

0.15

60

16

Growth

0.70

20

15

Recession

0.15

-20

14

Calculate the expected return

for S and T.

(i)

and standard deviation

(ii)

Calculate the covariance and the correlation coefficient between

the returns on S and the returns on T.

(iii) Determine a portfolio expected return and standard deviation if

two-thirds of the portfolio is invested in S and one third in T.

(iv) Explain the meaning and implications of your results in (i), (ii),

(iii). Would you

investors worried

recommend the portfolio in (iii) to

about

the

effects

of

a

recession

on their returns?

See Next Page

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT