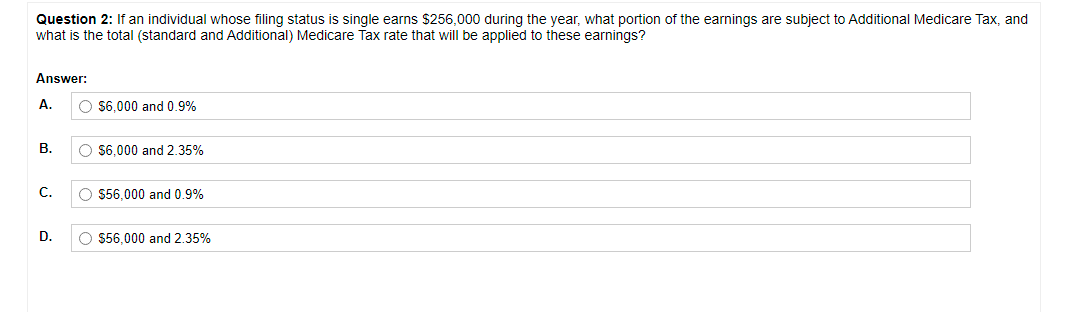

Question 2: If an individual whose filing status is single earns $256,000 during the year, what portion of the earnings are subject to Additional Medicare Tax, and what is the total (standard and Additional) Medicare Tax rate that will be applied to these earnings? Answer: A. O $6,000 and 0.9% В. O $6,000 and 2.35% С. O 556,000 and 0.9% D. $56,000 and 2.35%

Question 2: If an individual whose filing status is single earns $256,000 during the year, what portion of the earnings are subject to Additional Medicare Tax, and what is the total (standard and Additional) Medicare Tax rate that will be applied to these earnings? Answer: A. O $6,000 and 0.9% В. O $6,000 and 2.35% С. O 556,000 and 0.9% D. $56,000 and 2.35%

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter3: Preparing Your Taxes

Section: Chapter Questions

Problem 2FPE: ESTIMATING TAXABLE INCOME, TAX LIABILITY, AND POTENTIAL REFUND. Hannah Owens is 24 years old and...

Related questions

Question

Transcribed Image Text:Question 2: If an individual whose filing status is single earns $256,000 during the year, what portion of the earnings are subject to Additional Medicare Tax, and

what is the total (standard and Additional) Medicare Tax rate that will be applied to these earnings?

Answer:

A.

O $6.000 and0.9%

В.

O $6.000 and 2.35%

C.

O 556,000 and 0.9%

D.

O 556.000 and 2.35%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT