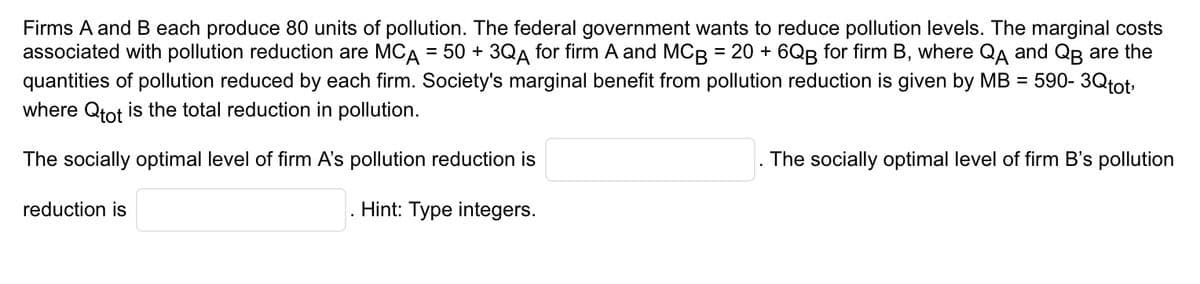

Firms A and B each produce 80 units of pollution. The federal government wants to reduce pollution levels. The marginal costs associated with pollution reduction are MCA = 50 + 3QA for firm A and MCB = 20 + 6QB for firm B, where QA and QB are the quantities of pollution reduced by each firm. Society's marginal benefit from pollution reduction is given by MB = 590-3Qtot' where Qtot is the total reduction in pollution. The socially optimal level of firm A's pollution reduction is . Hint: Type integers. reduction is . The socially optimal level of firm B's pollution

Firms A and B each produce 80 units of pollution. The federal government wants to reduce pollution levels. The marginal costs associated with pollution reduction are MCA = 50 + 3QA for firm A and MCB = 20 + 6QB for firm B, where QA and QB are the quantities of pollution reduced by each firm. Society's marginal benefit from pollution reduction is given by MB = 590-3Qtot' where Qtot is the total reduction in pollution. The socially optimal level of firm A's pollution reduction is . Hint: Type integers. reduction is . The socially optimal level of firm B's pollution

Chapter14: Environmental Economics

Section: Chapter Questions

Problem 3SQ: From an economic viewpoint, the optimal amount of pollution a. is zero because all pollution imposes...

Related questions

Question

Transcribed Image Text:Firms A and B each produce 80 units of pollution. The federal government wants to reduce pollution levels. The marginal costs

associated with pollution reduction are MCA = 50 + 3QA for firm A and MCB = 20 + 6QB for firm B, where QA and QB are the

quantities of pollution reduced by each firm. Society's marginal benefit from pollution reduction is given by MB = 590- 3Qtot,

where Qtot is the total reduction in pollution.

The socially optimal level of firm A's pollution reduction is

Hint: Type integers.

reduction is

The socially optimal level of firm B's pollution

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning