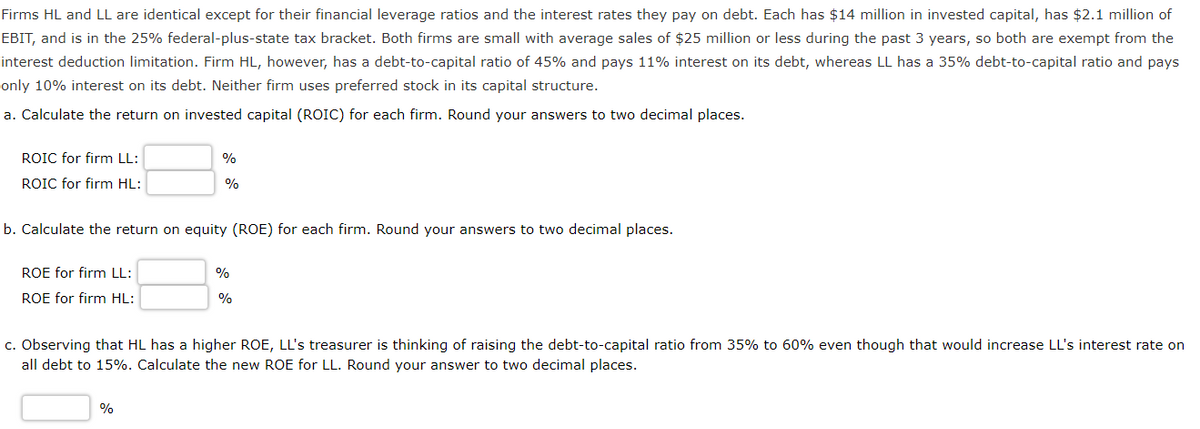

Firms HL and LL are identical except for their financial leverage ratios and the interest rates they pay on debt. Each has $14 million in invested capital, has $2.1 million of EBIT, and is in the 25% federal-plus-state tax bracket. Both firms are small with average sales of $25 million or less during the past 3 years, so both are exempt from the interest deduction limitation. Firm HL, however, has a debt-to-capital ratio of 45% and pays 11% interest on its debt, whereas LL has a 35% debt-to-capital ratio and pays only 10% interest on its debt. Neither firm uses preferred stock in its capital structure. a. Calculate the return on invested capital (ROIC) for each firm. Round your answers to two decimal places. ROIC for firm LL: ROIC for firm HL: % % b. Calculate the return on equity (ROE) for each firm. Round your answers to two decimal places. ROE for firm LL: ROE for firm HL: % % c. Observing that HL has a higher ROE, LL's treasurer is thinking of raising the debt-to-capital ratio from 35% to 60% even though that would increase LL's interest rate on all debt to 15%. Calculate the new ROE for LL. Round your answer to two decimal places. %

Firms HL and LL are identical except for their financial leverage ratios and the interest rates they pay on debt. Each has $14 million in invested capital, has $2.1 million of EBIT, and is in the 25% federal-plus-state tax bracket. Both firms are small with average sales of $25 million or less during the past 3 years, so both are exempt from the interest deduction limitation. Firm HL, however, has a debt-to-capital ratio of 45% and pays 11% interest on its debt, whereas LL has a 35% debt-to-capital ratio and pays only 10% interest on its debt. Neither firm uses preferred stock in its capital structure. a. Calculate the return on invested capital (ROIC) for each firm. Round your answers to two decimal places. ROIC for firm LL: ROIC for firm HL: % % b. Calculate the return on equity (ROE) for each firm. Round your answers to two decimal places. ROE for firm LL: ROE for firm HL: % % c. Observing that HL has a higher ROE, LL's treasurer is thinking of raising the debt-to-capital ratio from 35% to 60% even though that would increase LL's interest rate on all debt to 15%. Calculate the new ROE for LL. Round your answer to two decimal places. %

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter17: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:Firms HL and LL are identical except for their financial leverage ratios and the interest rates they pay on debt. Each has $14 million in invested capital, has $2.1 million of

EBIT, and is in the 25% federal-plus-state tax bracket. Both firms are small with average sales of $25 million or less during the past 3 years, so both are exempt from the

interest deduction limitation. Firm HL, however, has a debt-to-capital ratio of 45% and pays 11% interest on its debt, whereas LL has a 35% debt-to-capital ratio and pays

only 10% interest on its debt. Neither firm uses preferred stock in its capital structure.

a. Calculate the return on invested capital (ROIC) for each firm. Round your answers to two decimal places.

ROIC for firm LL:

ROIC for firm HL:

%

%

b. Calculate the return on equity (ROE) for each firm. Round your answers to two decimal places.

ROE for firm LL:

ROE for firm HL:

%

%

c. Observing that HL has a higher ROE, LL's treasurer is thinking of raising the debt-to-capital ratio from 35% to 60% even though that would increase LL's interest rate on

all debt to 15%. Calculate the new ROE for LL. Round your answer to two decimal places.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning