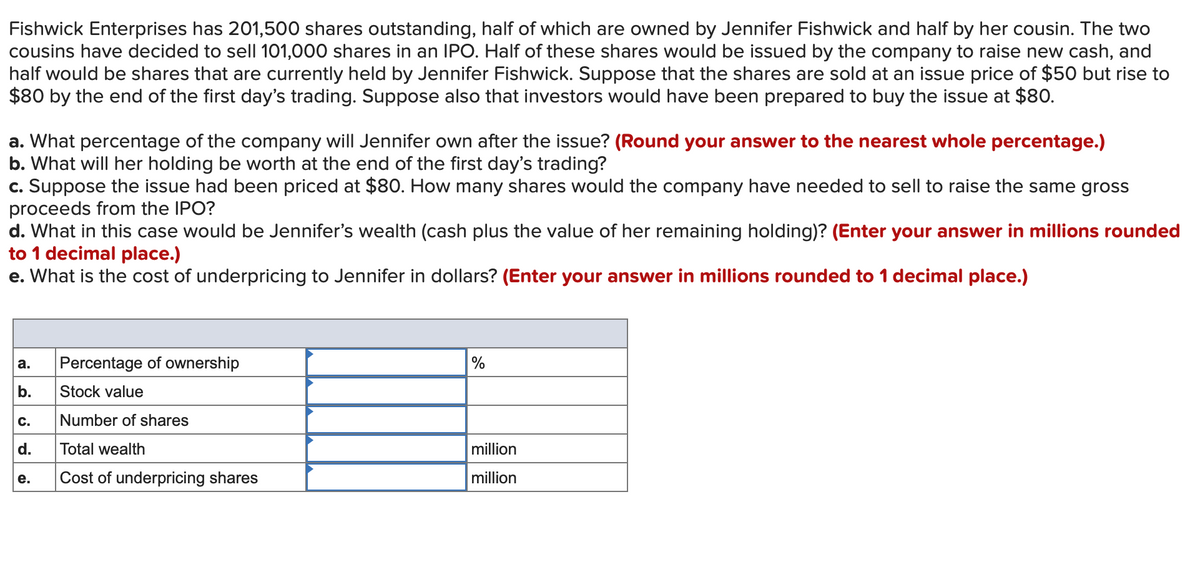

Fishwick Enterprises has 201,500 shares outstanding, half of which are owned by Jennifer Fishwick and half by her cousin. The two cousins have decided to sell 101,000 shares in an IPO. Half of these shares would be issued by the company to raise new cash, and half would be shares that are currently held by Jennifer Fishwick. Suppose that the shares are sold at an issue price of $50 but rise to $80 by the end of the first day's trading. Suppose also that investors would have been prepared to buy the issue at $80. a. What percentage of the company will Jennifer own after the issue? (Round your answer to the nearest whole percentage.) b. What will her holding be worth at the end of the first day's trading? c. Suppose the issue had been priced at $80. How many shares would the company have needed to sell to raise the same gross proceeds from the IPO? d. What in this case would be Jennifer's wealth (cash plus the value of her remaining holding)? (Enter your answer in millions rounded to 1 decimal place.) e. What is the cost of underpricing to Jennifer in dollars? (Enter your answer in millions rounded to 1 decimal place.) a. Percentage of ownership % b. Stock value C. Number of shares d. Total wealth million Cost of underpricing shares million е.

Fishwick Enterprises has 201,500 shares outstanding, half of which are owned by Jennifer Fishwick and half by her cousin. The two cousins have decided to sell 101,000 shares in an IPO. Half of these shares would be issued by the company to raise new cash, and half would be shares that are currently held by Jennifer Fishwick. Suppose that the shares are sold at an issue price of $50 but rise to $80 by the end of the first day's trading. Suppose also that investors would have been prepared to buy the issue at $80. a. What percentage of the company will Jennifer own after the issue? (Round your answer to the nearest whole percentage.) b. What will her holding be worth at the end of the first day's trading? c. Suppose the issue had been priced at $80. How many shares would the company have needed to sell to raise the same gross proceeds from the IPO? d. What in this case would be Jennifer's wealth (cash plus the value of her remaining holding)? (Enter your answer in millions rounded to 1 decimal place.) e. What is the cost of underpricing to Jennifer in dollars? (Enter your answer in millions rounded to 1 decimal place.) a. Percentage of ownership % b. Stock value C. Number of shares d. Total wealth million Cost of underpricing shares million е.

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:Fishwick Enterprises has 201,500 shares outstanding, half of which are owned by Jennifer Fishwick and half by her cousin. The two

cousins have decided to sell 101,000 shares in an IPO. Half of these shares would be issued by the company to raise new cash, and

half would be shares that are currently held by Jennifer Fishwick. Suppose that the shares are sold at an issue price of $50 but rise to

$80 by the end of the first day's trading. Suppose also that investors would have been prepared to buy the issue at $80.

a. What percentage of the company will Jennifer own after the issue? (Round your answer to the nearest whole percentage.)

b. What will her holding be worth at the end of the first day's trading?

c. Suppose the issue had been priced at $80. How many shares would the company have needed to sell to raise the same gross

proceeds from the IPO?

d. What in this case would be Jennifer's wealth (cash plus the value of her remaining holding)? (Enter your answer in millions rounded

to 1 decimal place.)

e. What is the cost of underpricing to Jennifer in dollars? (Enter your answer in millions rounded to 1 decimal place.)

а.

Percentage of ownership

%

b.

Stock value

C.

Number of shares

d.

Total wealth

million

Cost of underpricing shares

million

е.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning